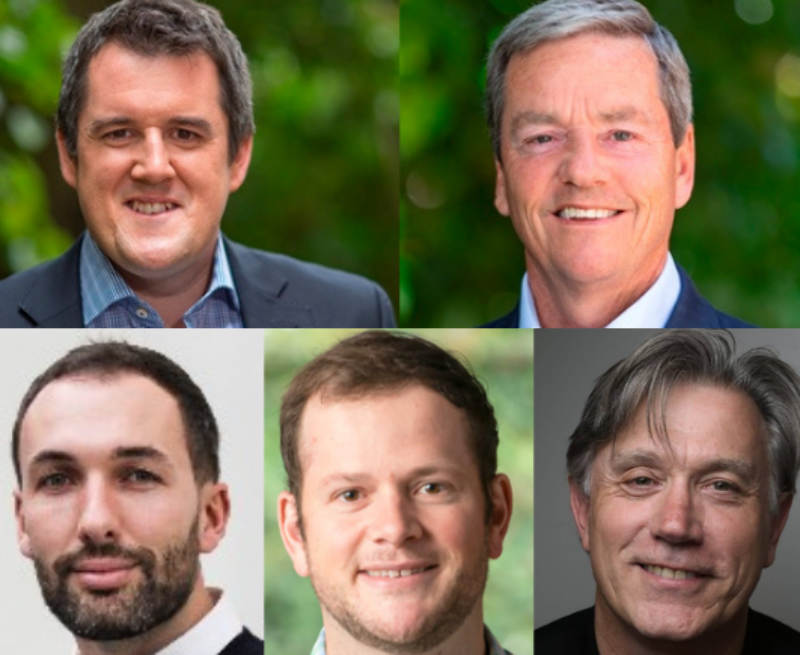

Bayly, fund managers on KiwiSaver for tenancy bonds

KiwiSaver fund managers are mulling over the implications of the National Party’s announcement that it will let under-30-year-olds use KiwiSaver for tenancy bonds.

Tuesday, July 18th 2023, 6:12AM

by Andrea Malcolm

The party’s housing spokesperson, MP Chris Bishop announced the intention to students at the University of Auckland. Under the policy students would be able to transfer money from their KiwiSaver to Tenancy Services and return it to their savings when the tenancy ended. They would also be able to transfer the bond to a new tenancy.

National’s finance and commerce spokesperson Andrew Bayly, says he did not know if KiwiSaver Scheme managers had been consulted as the initiative was led by Bishop.

“The demand came from younger people, and particularly our young Nationals who said that for a lot of people, coming up with a bond is really difficult. And so it was a demand driven policy.”

He says National was concerned that people do not withdraw money and not return it to KiwiSaver.

“That's why we're going to take that discretion out of the hands of the individual wanting to access it. The money goes straight to the Tenancy Tribunal and gets paid straight back into the KiwiSaver. No doubt it will have some administration costs for KiwiSaver providers, but they're used to withdrawing money out of KiwiSaver. It's not something that they’re not used to doing.

Asked if he thought the policy erodes the originally intended purpose of KiwiSaver as a retirement scheme, he says that would be the case if the money could be withdrawn and not paid back.

“It can only be used this way once and it will be taken out for short periods of time.”

Kernel CEO Dean Anderson says he wasn’t aware of providers being asked about the policy.

He says he hasn’t seen the full details to make a fully formed judgment but continual changes to non-critical KiwiSaver settings risk undermining the confidence in the scheme as a whole.

“It makes people question what rules changes may come next, therefore they distrust it - it only takes two minutes reading social media comments to see this.

Sharesies CEO Leighton Roberts acknowledges the difficulty of scraping together a tenancy bond.

“Rent bonds are definitely an affordability problem - but the proposed policy to let under-30s access their KiwiSaver for tenancy bonds isn’t the right solution for New Zealanders.

“KiwiSaver is a scheme to help people save for their future and by relaxing how to access this money will inevitably lead to a lower balance for retirement or buying a house.

“It’s important to note that paying for tenancy bonds isn’t ring fenced to just those under 30s, it’s impacting Kiwis of all ages.”

Simplicity CEO Sam Stubbs says it's a political decision and he doesn’t have a view whether it’s a good or bad idea.

“Clearly the youth wing of the party has said it is and the party is accommodating it. I’ll leave it up to the politicians to decide whether it would be sufficiently attractive to enough people.

“There are people who will say it’s a slippery slope. It’s one of many policies that seek to tap into KiwiSaver to make life easier. We’ve had hardships and first home withdrawals. KiwiSaver was designed as a retirement account. The more it becomes like a general saver account, the more it is deviating from its original purpose. But people shouldn’t confuse it with policies that take money out forever. It’s temporary so it’s more like a savings suspension.”

ANZ did not have any comment to make.

National would have to amend the KiwiSaver Act 2006 which currently allows early withdrawal for five reasons; first home ownership, significant financial hardship, serious illness, life shortening congenital conditions and permanent emigration.

Anderson says he would like to know when politicians will start discussing policy settings that drive engagement and contributions into KiwiSaver.

“We need to be talking about increasing contributions and getting the policy settings in place that leverages the now $100b of capital into driving better outcomes for New Zealand and all Kiwis - not building a mindset of KiwiSaver being a transactions account.”

Bayly says KiwiSaver in general needs to be “looked at”.

“We've got to look at KiwiSaver in general, because the average balance in KiwiSaver is about $28,000. And that means many New Zealanders are not saving sufficiently for retirement. And if you look at the current estimates, it used to say that [for retirement] we needed anywhere between $400 to $800,000. Since then, we've had massive inflation and now it’s more between $500,000 and $1 million.

“For a lot of its education and encouraging people to do it. A lot of people don't pay KiwiSaver for different reasons and we need to make sure that many people are taking advantage of KiwiSaver.”

| « National MP Andrew Bayly’s to-do list of four | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |