Conduct and the design of policy documents and product brochures

Many insurers are updating their policy documents and product brochures in an effort to meet a number of conflicting objectives, which could be summarised as: simplicity, accuracy and ease of operation.

Thursday, August 3rd 2023, 1:51PM

by Russell Hutchinson

Some changes, I think, are excellent – such as electronic delivery of documents, and showing the definitions of defined terms on the page they are used, either on a click or on mouse-over. Others, I felt were not so good – such as including all benefits in one document.

But documentation is always a trade-off and resolving challenges of legal correctness, use of medical terms, simplicity and ease of navigation are not easy.

A few months ago, Pinnacle Life released a guide “Five big life insurance questions” which was brought to our attention. It is a really simple guide for clients.

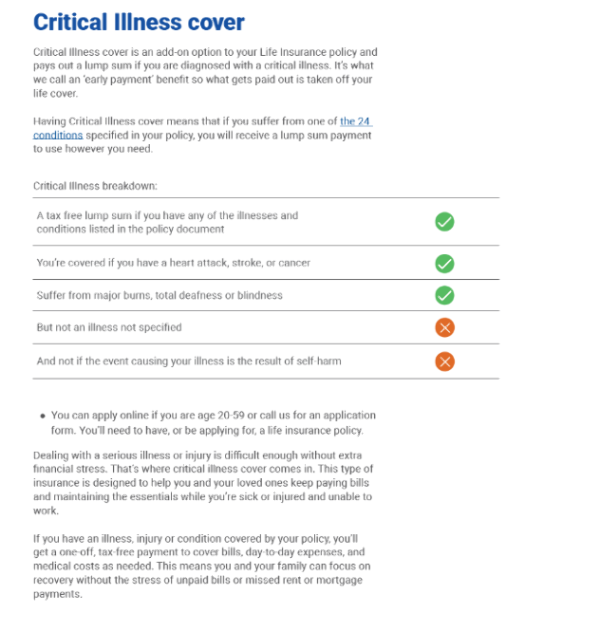

One of the features I like best is that there is a straightforward description of the common limitations on application and common claims exclusions shown in the guide

Exclusions are highlighted with clear ticks or crosses in a colour coded dot to make it easy to see what is covered and what is not. A sample page from the guide – this time covering critical illness – is shown here.

But Pinnacle have had to make sacrifices to achieve the concise, clean page: the list of 24 covered conditions is not given but is linked to…which is a shame. Also, there will be no adviser there to help the client understand.

On the other hand, Medical Assurance Society, has opted for the omnibus document approach.

At least you can say that they have given the client everything.

The omnibus document, which has benefits not selected by the specific policyholder, and requires them to check their schedule to see if it’s included or not, may lead to confusion and makes for a very, very long document.

Some customers get overwhelmed by the volume of information and trying to figure out what is applicable to their chosen cover.

Both approaches probably underline the importance of an adviser’s presence in the process.

A few years back I was shocked to hear that a partner in a law firm who deals a lot with insurers state “I didn’t read the document”. I am sure few advisers will be surprised. The clients simply leave that up to you.

| « Fish hooks in Insurance contract law review | Tech stack stuff » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |