Contrasting, but productive, times

The last few six weeks or so have been a contrasting period for markets with concerns over global economic growth, the persistence of inflation, and central bank tightening largely easing the more as time has worn on. The earnings season in the Northern Hemisphere finished up largely positive, while that down under was somewhat disparate.

Tuesday, September 19th 2023, 12:19PM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

While Australia saw some strong earnings beats, the results season in New Zealand was arguably less convincing, with more caution around the economic environment. While not everything went to script, this has largely been to the benefit of the Devon funds which currently have a tactical overweight position in Australia relative to New Zealand.

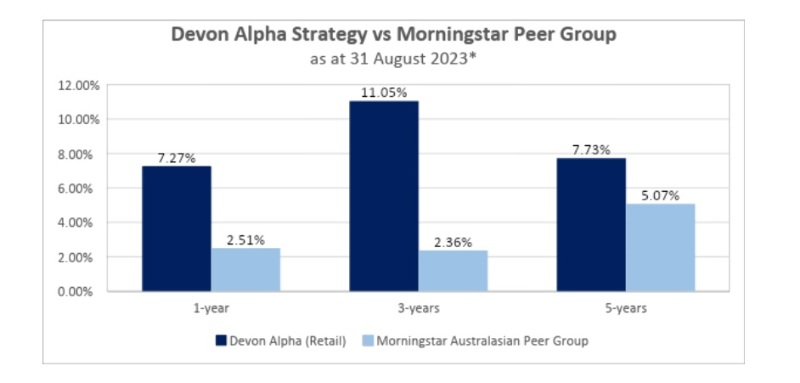

*the figures provided above are based on rolling 3-year returns (net of fees, inclusive of imputation credits but before tax) sourced from Morningstar to 31/8/2023. ‘Peer Group’ is based on the average performance of a grouping provided by Morningstar of New Zealand-based Fund Managers, Australasia Region. Past performance does not represent future performance. Returns are based on a PIR rate of 0%.

In the US, the technology sector has ebbed and flowed with AI being the acronym “du jour” for many investors. Nivida has come back from record highs of late but is still valued at more than US$1 trillion. Semi-conductor firm Arm Holdings has certainly dined out on its AI angle, with the biggest IPO in nearly 2 years oversubscribed by 10X and getting off to a strong start. Certainly, there is a lot hanging on AI which has also driven a concentrated area of the stock market (Nivida et al). The S&P500 is up around 16% year to date, but on an equal weight basis is up just 4% in 2023 – there is a lot of concentration in this year’s rally.

After a long drought of large IPOs, are the animal spirits back? We may soon know. Instacart, one of the largest online grocery delivery firms in the US, is due to list this week, and has upped its price range, with an implied valuation of up to US$10bn.

At the top end of the range, Instacart’s valuation will still be a quarter of that during a raise at the pandemic’s peak when food delivery was going gangbusters and everyone was at home.

Also waiting in the wings are software group Klaviyo and the more old-fashioned name Birkenstock, which is targeting a valuation of more than US$8 billion. The German sandal maker might have its timing right in some ways, with Margot Robbie having reinforced how cool they are by donning a pair in the Barbie movie. How well received the valuation will be is interesting, though, with the 250-year-old company being pitched at around 20 times earnings.

Investors might be aware that investing in megabrand shoe companies is not always a recipe for success. Dr. Marten’s shares have fallen 65% since their IPO during the pandemic. Shares in the somewhat divisive Crocs have not always been steady, with plenty of ups and downs since they listed in 2006, nearly collapsing in 2009, booming during the pandemic, then selling off this year.

Birkenstock also won’t be able to rely on AI as part of the investment proposition, and investors will have to take a view on whether they fall out of vogue at some point. In the nearer term, the reality is that 51 out of the 73 IPOs in the US (admittedly many are small) so far this year are currently below their IPO price.

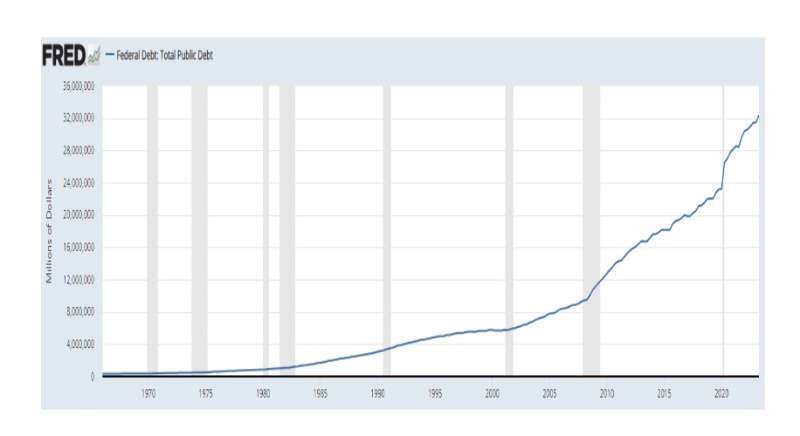

As usual there have been plenty of challenges for the market to be concerned about since the start of August. Rating agencies prodded the bear to a certain extent, with Fitch downgrading US debt (albeit from the highest rating possible).

There has been a steady deterioration in the US debt picture in recent years, with debt to GDP now around 113%, compared to less than 60% 15 years ago. At more than US$32 trillion, the US has the world’s highest debt and more than the next four most indebted countries (China, Japan, France and Italy) put together. Political standoffs around the debt limit have occurred with some regularity over the years and was something we saw earlier in the year. The talking point in respect of the Fitch call (and the later decision to downgrade a number of banks, as did Moody’s) was that none of the issues raised were particularly new.

Investors moved on and were more interested in the future, and how the world’s largest economy was looking, how inflation was tracking, and how the Fed was going to proceed. In the weeks that followed, economic data (such as retail sales, home sales, consumer confidence and US jobs numbers) have continued to point to an economy with resilience, but not excess strength.

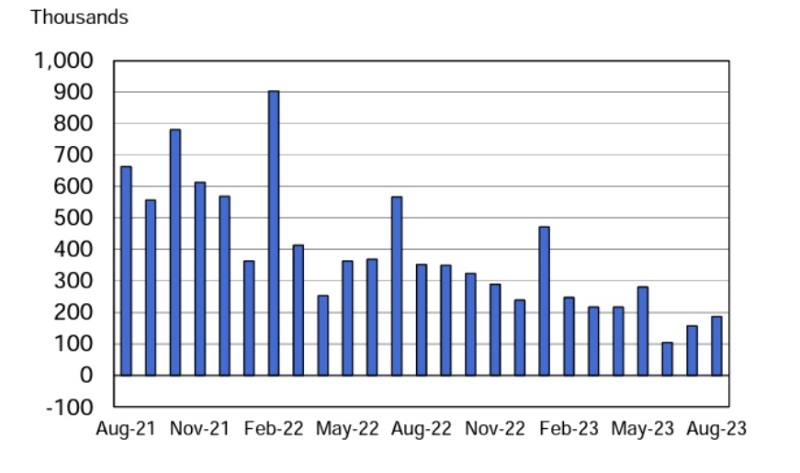

US job creation

Source: Bureau of Labor Statistics

The “no-thrills” speech from Jerome Powell at the annual meeting of central bankers at Jackson Hole was a big focal point. The Fed Chair suggested that rates may need to go higher, but importantly did not sound any alarms or spring any surprises. Investors latched onto comments that the US economy was proving more resilient than expected, and that there were risks of doing “too little” but also “too much” as it related to rate tightening.

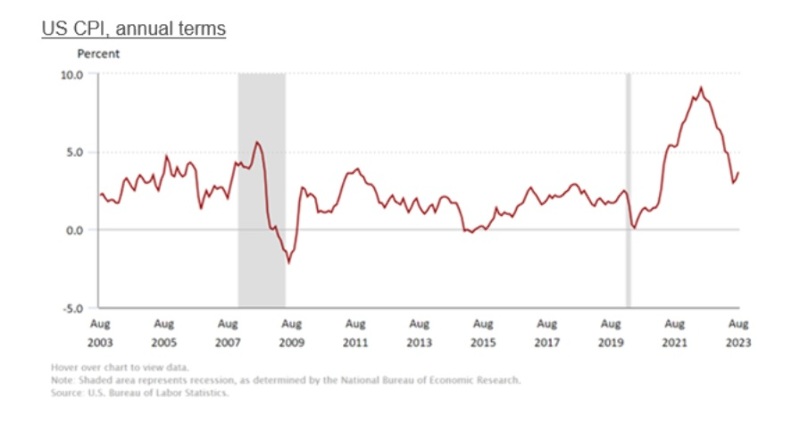

Last week’s consumer and producer price inflation prints have not disrupted the view that the Fed will pause interest rates this week. Inflation is being pressured at the headline level by rising energy costs, but the “core” levels of inflation, which is the Fed’s preferred gauge, appear to be under control. Meanwhile, the world’s largest economy has remained resilient but is not firing on all cylinders.

Meanwhile, longer-term bond yields continued to push higher, flattening out the yield curve, and indicating an increasing view that the US economy will avoid a recession. The yield on US 30-year bonds hit a 12-year high while the 10-year yield hit the highest level in 16-years. A soft economic landing, at the same time as bond yields are elevated, may give central bank officials the luxury of holding rates higher for longer as they look to stamp out inflation. A fly in the ointment was a push in oil prices to 9-month highs.

The US earnings season was strong, with around 80% of S&P500 constituents beat earnings forecasts. Apple exceeded expectations (with China a bright spot) while Amazon reported the biggest earnings beat since the fourth quarter of 2020. While ‘Barbenheimer’ was smashing records at the box office, Nvidia was doing likewise on the market boards, with results trouncing expectations amid booming demand for AI chips.

There were plenty of older fashioned bellwethers coming out with better-than-expected earnings, and outlooks as well, including heavy machinery maker Caterpillar, and tech names such as Dell and Cisco (which is held in the Devon Global Sustainability Fund, and rallied circa 10% during August). The world’s largest retailer Walmart was in a similar camp, amid signs that the consumer is coping with cost-of-living pressures, albeit they are having to modify their behaviours to do so.

Across the Atlantic, investors in Europe also became encouraged by the European Central Bank’s latest meeting, despite a 10th consecutive rate hike. On one side inflation is coming down but is still elevated, while on the other growth is stagnating. Europe’s historical growth engine Germany is spluttering and is forecast to be the only major European economy to contract this year. President Lagarde seemed to suggest this may be the last rate hike in the current cycle.

China was also a big focus for investors. Economic data from one of the world economy’s growth engines was somewhat mixed. Retail sales and industrial production have come in better than expected in August. A series of stimulus plans have been unveiled by authorities to spur confidence in the country’s property sector, wider economy, and stock market.

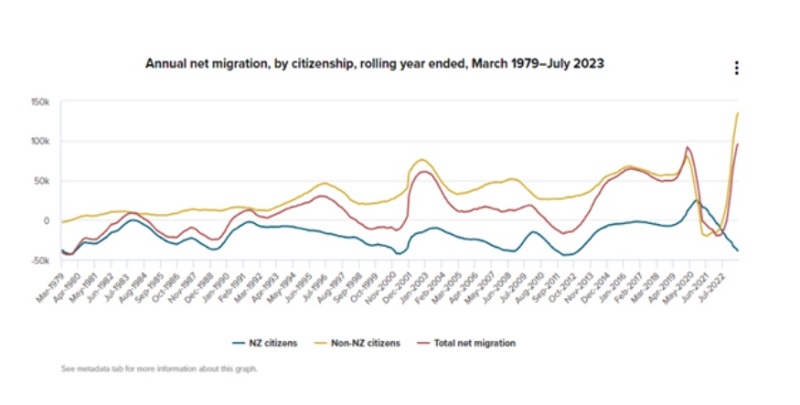

An uneven economic recovery in China was meanwhile one of the headwinds facing the kiwi economy. July’s trade deficit of $1.1 billion was bigger than expected, while weak quarterly retail sales volumes highlighted the challenges facing the consumer sector. The key dairy industry also felt the squeeze as milk prices continued to fall (these have though risen in the latest print). A tick up in net migration was a bright spot, as was 1% employment growth during the June quarter.

The RBNZ came through with a “hawkish hold”, indicating that policy would need to remain “restrictive” for some time. The prospect of a rate cut has been pushed into next year. The central bank appears confident that inflation will return to its target range, and also improved its forecasts slightly for some parts of the economy (underemployment and the housing market).

The earnings season in New Zealand saw some strong results, but this was not always met with a similar share price reaction, perhaps reflecting conservative outlook statements, and economic uncertainties. Companies had to go “above and beyond” to get investors excited.

The travel sector was in focus, amid the rebound in tourism, with both Air New Zealand and Auckland Airport reintroducing dividends after a hiatus since the pandemic. Auckland Airport saw its first profit in more than three years, more than doubling full-year revenues. The airport’s shares though has weakened as the Auckland Council sold down its stake.

Tourism Holdings was a standout performer on the upside. Investors warmed to the positive news around the integration and boost from the acquisition of Apollo across the Tasman. Revenues nearly doubled at the campervan operator, and the bottom line swung from a loss to a profit. Management were upbeat around the outlook. Tourism Holdings is held in a number of the Devon funds.

Dairy-related companies were out of favour. Full-year results from A2 Milk were in line with previous guidance, but the growth outlook, and an absence of a buyback or dividend, disappointed the market given the company’s $800m cash balance. There were solid results from the Gentailers although the share prices of Genesis Energy ,Mercury NZ and Meridian all finished the month lower.

Freightways proved one of the highlights with investors warmed by a 15% jump in full-year earnings. The company suggested that the operating environment in Australia was more favourable than New Zealand. Operating revenues in Australia surged 143% while those in New Zealand rose 6%. Freightways announced plans to (dual) list on the ASX, reflecting the changes to the makeup of the business following the acquisition of Allied Express. The company said it was looking for more complementary M&A opportunities in the years ahead.

There are still plenty of challenges around the kiwi economy, and this was evident in the Government’s pre-election Budget update. On the positive side, economic growth is better than expected, no recession is forecast, and a surplus is anticipated by 2027. The economy is expected to grow 2.6% over the next four years. The economy is slowing but this is being mitigated by high migration (forecast to peak at 100,000 in the year ending September, 33,000 more than forecast in May). This is helping spending and house prices where green shoots are also coming through (the NZ Housing Index was up 0.9% month on month). Net debt is expected to peak at 22.8% of GDP in 2027.

The not so good news is that the Government’s books have deteriorated since the Budget. Tax revenues have fallen and are $2.9b below forecasts. The return of the operating balance to surplus has been pushed out one year to 2026/7, Soft growth in the economy will see the unemployment rate is forecast to peak at 5.4% in early 2025 from the current 3.6%. Inflation is expected to stay higher for longer. Government bond issuance is ratcheting higher and the forecasts were underpinned by a number of assumptions, that do no lot leave much room for slippage. There are also potentially upside risks to forecasts for expenditure and inflation and from high net migration and natural population growth.

New Zealand GDP numbers are due this week, with the economy expected to emerge from technical recession, with growth of 0.5% in the June quarter and a 1.2% growth on an annual basis.

In Australia, economic data was also relatively more constructive. Retail sales rebounded more than expected in July, but jobs numbers fell more than forecast, before rebounding strongly at the last print. Trade frictions with China cooled further, with tariffs dropped on Aussie barley. The RBA left interest rates unchanged and adopted a “wait-and-see” approach to further rate hikes. Lower than-expected monthly headline inflation and core inflation numbers subsequently took further pressure off the central bank to follow through with a rate rise – the RBA duly obliged and stayed on hold in early September.

Source: ABS

Optimism over the economy was also mirrored in a number of blue-chip results. Consumer-facing companies Harvey Norman and Breville both came through with better-than-expected earnings. Low levels of borrower stress were also evident in results from Commonwealth Bank and Westpac. The earnings tailwinds of higher inflation were also on display in results from insurers IAG, QBE, and Suncorp with premium rates marching higher.

Another company displaying pricing power was building products supplier James Hardie, with investors marking the shares sharply higher following its results.

Carsales was another big gainer, with the shares hitting record highs as the online vehicle classified advertising group reported a 300% jump in full-year earnings. More than half of Carsales revenues now come from outside Australia. Carsales is held in the Devon Sustainability and Australian funds.

In Resources, BHP reported a 37% decline in full-year underlying profit amid weaker prices for iron ore, copper and coking coal. Iron ore sales have also declined. Sentiment towards the mining giant (11% of the ASX200) picked up recently amid Chinese stimulus measures and rebounding commodity prices.

Two excellent results during the earnings season were from property giant Goodman Group and transport & logistics group Brambles. Goodman reported a rise in operating profits ahead of guidance, with strong rent growth and occupancy while a trend of big asset write-downs seen at other property companies was absent. Shares in Brambles surged as full-year net profit after tax jumped by 19% and the dividend rose. The company has a pool of 360 million pallets and containers globally and has been successfully passing on rising input costs to customers. Goodman and Brambles are held across a number of the Devon funds.

One of the names which continued to feature through the month was Qantas. The airline delivered a record full-year underlying profit of A$2.47 billion, but came under increasing scrutiny around high airfares, flight cancellations, Covid flight credits , and was caught up in the issue around the government not allowing additional Qatar flights. The ACCC also launched a suit in the Federal Court alleging the carrier sold tickets to over 8,000 “ghost” flights that had already been cancelled. The shares fell over 10% during the month, pre-empting the early departure of retiring CEO Alan Joyce. The Devon funds do not hold Qantas but have done well on the name, selling the shares at higher prices earlier this year.

The last 6 weeks has certainly provided plenty for investors to digest. The coming weeks will be quieter in comparison results-wise, but there remain plenty of important considerations for investors, not least of which being the approaching election in NZ. Pervading levels of uncertainty continue to offer a productive environment for active stock pickers.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Harbour Investment Outlook: Past the winter solstice, but is it spring yet? | Acceleration of innovation now spells danger for investors » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |