Sustainable investment grows down under

New Zealand, Australia and Japan were the only countries where sustainable investment grew as a proportion of total managed assets in 2022, a new report says.

Friday, December 1st 2023, 4:00PM

by Andrea Malcolm

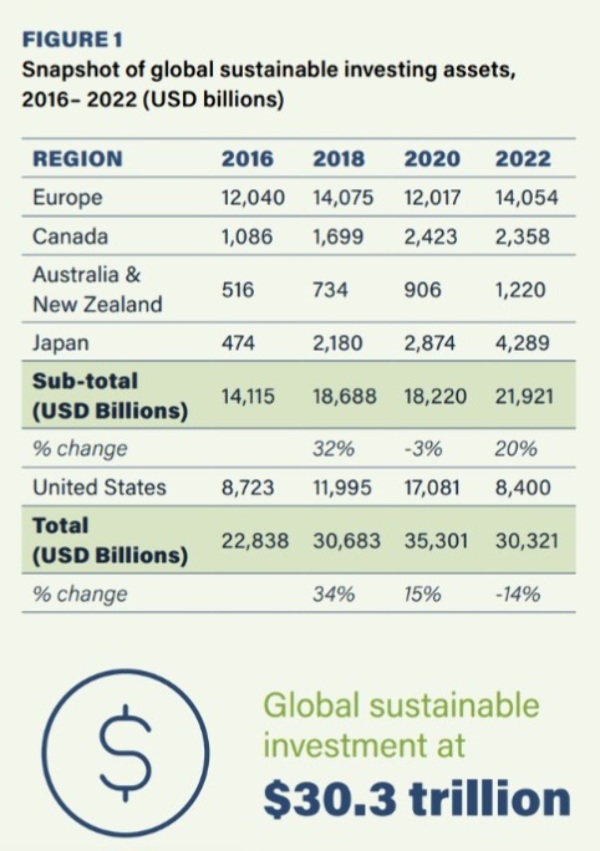

The latest biennial Global Sustainable Investment Report says sustainable AUM across Australia and New Zealand in 2022 was US$1.2 trillion, up from US$906 billion in 2020. This reflects a steady increase since the report started in 2016.

The report by the Global Sustainable Investment Alliance, including the RIAA (Responsible Investment Association of Australasia), looked at the state of sustainable investments worldwide.

Globally, sustainable investment AUM declined 14% from US$35.3t in 2020 to US$30.3 trillion in 2022. According to PWC the global market overall was US$115.1t.

In non-US markets – Canada, Europe, Japan, Australia and New Zealand — sustainable investment AUM increased 20% from 2020.

Tighter definitions affect data

The report said a maturing of the market is leading to clearer definitions – the EU’s Sustainable Financial Disclosures Regulation (SFDR), the UK’s SDR and in the US the SEC’s proposed Climate Disclosure Rule – of what can be described as a ‘sustainable’ fund.

These new standards have been a direct response to growing concerns around ‘greenwashing’.

As a result of these evolving standards, the US Sustainable Impact Forum changed its measurement methodology, recording $8.4t in AUM in 2022 compared to $17t in 2020.

The report said in Europe, the long-term trend suggested the share of assets defined as ‘sustainable’ had been shrinking by around 5% per year with creased disclosure regulations and tighter definitions around sustainable investing possible contributing factors in the decline. In some instances, this had led to a reticence to disclose practices, aka ‘greenhushing’.

The tightening of regulatory frameworks and industry standards, in response to a rise in greenwashing concerns, was a theme across all regions.

As well as better labelling, continued maturity was also shown in greater use of corporate engagement and shareholder action to drive corporate change and reduce sustainability-related investment risks, said the report.

Call to the new NZ govt

The report anticipated the widespread adoption of responsible investment approaches (ESG integration, corporate engagement, and negative screening) across the entire managed fund industries of Australia and New Zealand.

“Consumer demand for responsible investments is on the rise, with a majority of Kiwis expecting their investments to be managed in a manner that is both responsible and ethical”, it said.

RIAA chief executive Simon O’Connor said, “This timely report shows clearly the pace of sustainable investment developments across global markets and underscores the need for the newly announced NZ government to ensure it does not slow down the pace of policy progress to support sustainable finance in New Zealand.”

Proposals to COP28

The report was launched in time to inform discussions at COP28 in Dubai this week and recommended setting up a sustainable finance regulatory convergence task force aimed at greater alignment of regulations worldwide.

The report also called for a global baseline for strengthened corporate sustainability disclosures as well as for ESG ratings and benchmarks and urged the global adoption of the disclosure recommendations prepared by the Taskforce on Nature-related

Financial Disclosures (TNFD) and the incorporation of TNFD reporting for corporations into the International Sustainability Standards Board (ISSB) framework.

| « RIAA becomes twin-headed organisation | Mostly passive AMP Wealth gets active with climate impact fund » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |