Bigger remit sees FMA numbers swell

An expanded remit has seen the Financial Markets Authority increase staff numbers 19% in the last two years.

Friday, January 5th 2024, 6:46AM

by Andrea Malcolm

In its annual report to June 2023, FMA counted 326 staff, up from 263 in 2021. This included 289 permanent staff, seven on fixed term employment, 28 contractors and two secondees.

The FMA said it implemented a new organisational structure to better align how it operates with its priorities, including a shift in focus from investors to consumers, and its expanded remit which included overseeing change in the form of the Conduct of

Financial Institutions (COFI) regime, the financial advice licensing regime, and the climate related disclosure (CRD) regime.

Chief executive Samantha Barrass earned between $610,000 and $620,000. More than half the staff, 197, were on salaries above $100,000. Cessation payments totalling $881, 236 were paid to seven staff.

Overall remuneration cost $46 million, $3 million less than projected in its budget but $7 million up on FY the year before.

The FMA reviewed its remuneration and reward framework, its benefits package and introduced new benefits during the year.

“The objective of our reward approach continues to be to attract and retain appropriately skilled people, and to recognise and reward performance and development that aligns with our strategic objectives, values and expected standards of behaviour,” it said in the report.

There was a voluntary turnover rate of 18.9%, slightly up on 17.5% for 2022 and average service length was 3.48 years. The voluntary turnover rate was a return to pre-Covid levels, driven by the country’s border reopening and a return to a competitive market, said the report.

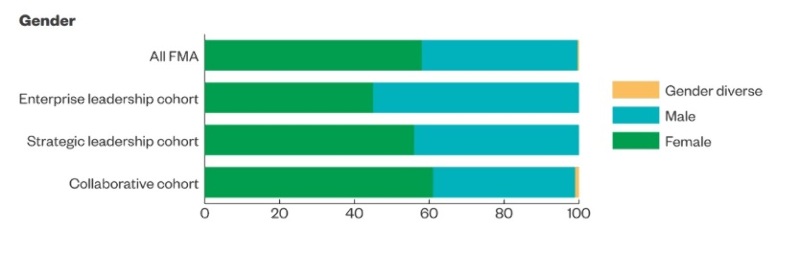

Gender pay gap

In March 2023 the FMA’s gender pay gap was 10% in favour of men with more men in senior roles and more women in lower salary bands.

The report said the FMA is committed to recruiting more women into senior roles. “As such our executive leadership team is comprised of three men and three women. Our pay equity, where we measure pay gaps between men and women doing similar roles, shows that we have good equity for roles of a similar size and scope of responsibility.”

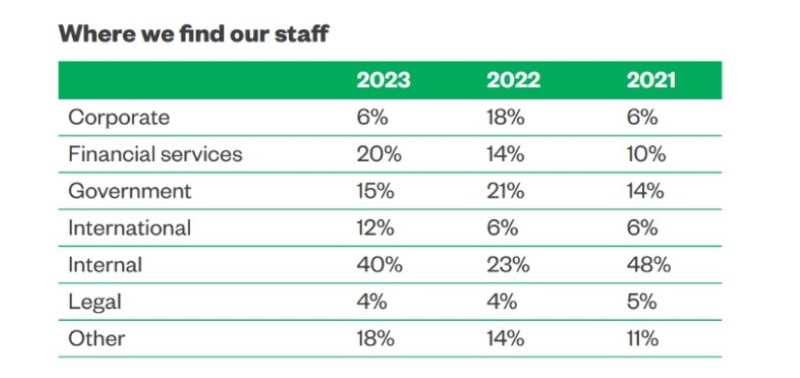

Recruitment

Its own ranks were the major source of new hires - 40% of recruitments were internal compared to 23% the year before. The next biggest sector the FMA recruited from was financial services at 20%.

Surplus

The regulatory watchdog ended FY22/23 with a surplus of $6 million, contrary to the initial deficit projected in its budget. It put this down to better-than-expected interest income (both interest rates and cash balances surpassing budget projections), unbudgeted cost recoveries from successful litigation cases and underspends due to the extended time needed to scale up operations and gradually staffing new positions established as part of its strategic change programme.

| « Will the 60/40 classic portfolio return to form in 2024? | Fisher Funds partners with NZX Wealth Technologies » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |