What does the rest of 2024 have in store?

Equity markets are through the first month of 2024 and have largely started off the year where they finished 2023 – on the front foot. How will the rest of the year play out? We outline our projections for the remaining 11 months ahead.

Wednesday, January 31st 2024, 12:23PM

by Devon Funds

by Greg Smith, Head of Retail at Devon Funds

By way of a quick recap. It certainly wasn’t smooth sailing last year, with investors fretting for much of the year over high-interest rates and a possible recession, notions that were put to one side as inflation prints, economic data and central bank meetings playing out favourably. A regional banking crisis in the US, the collapse of one of Europe’s biggest banks, and another war, this time in the Middle East, were also dismissed quickly by markets. The technology sector, driven by the “Magnificent 7”, dominated proceedings, with the blue-sky potential of AI a common thread.

Several members of the “M7” have continued to make their presence felt in the early throes of 2024. Microsoft, Meta and Nvidia have hit record highs. It’s not all about super-tech though - older-fashioned names such as Caterpillar, MasterCard and Visa (as well as Uber) have all seen their share prices hit record levels.

Meanwhile, economic data continues to point to the resilience of the economy. US job openings rose last month as did consumer confidence, while home prices have also pushed higher. Strength in the world’s largest economy was also central to the IMF upgrading its forecast for global economic growth this year to 3.1%.

The US economy, and indeed much of the world, has continued to defy the gravity-pulling impact of interest rates which have soared from levels around zero during the pandemic in a bit to curtail inflation. The latter has tracked a steady path down from last year’s peak levels, allowing for the prospect of rate cuts to now start offering a tailwind to economies that have largely been able to maintain reasonable altitude over the past 12 months.

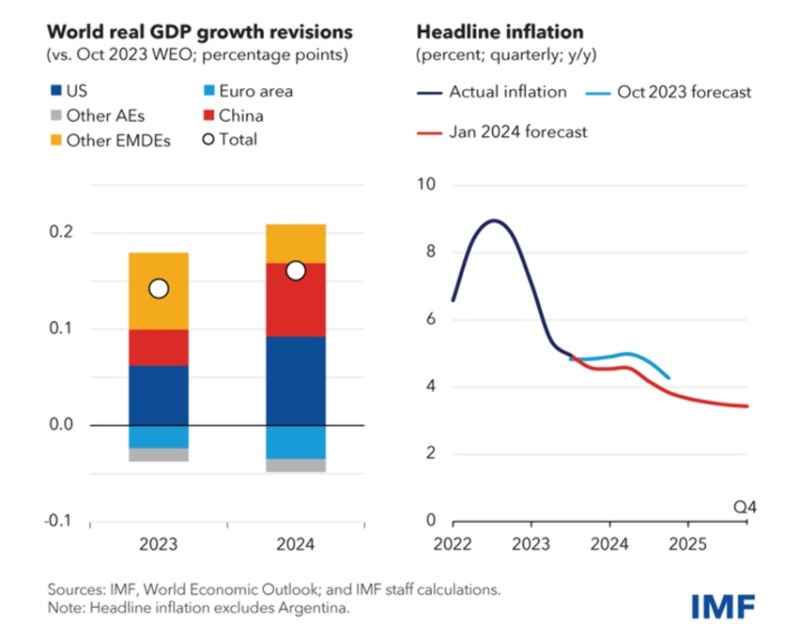

This has been recognised by the International Monetary Fund which has raised its forecast for global economic growth this year to 3.1%, an increase of 0.2 percentage points from its October projection. The fund kept its 2025 forecast unchanged at 3.2%. Officials cite unexpectedly strong US growth as a key driver.

Significantly, IMF officials noted that “the global economy continues to display remarkable resilience, and we are now in the final descent toward a soft landing.” China’s growth forecast was also a driver of the upgrade on better-than-expected growth and the boost provided by ongoing stimulus. India meanwhile is expected to remain a growth juggernaut, with a 6.5% expansion pegged for 2024.

The IMF also emphasised that inflation has cooled more than projected, but that there were upside risks, in the form of potential commodity-price spikes caused by geopolitical shocks and global supply disruptions (particularly in the Middle East).

The body though expects “the deceleration to continue through 2025,” bringing global inflation down to 4.4% from 6.8%. Good news.

So a good start on a number of fronts. In any event, below is a list of how the ‘Top Ten’ may play out in terms of big themes this year.

1. The global soft economic landing plays out, but in an uneven fashion, making for a volatile market. The US Federal Reserve puts through four rate cuts

The US indices led the way on the upside in 2023, particularly in the latter stages of the year as confidence grew that it was the end of the central bank rate-hiking journey, and the timeline for cutting rates became the focus for investors. This was also reflected in the bond market, where the US 10-year peaked at 5% in October and is now back around 4%.

Inflation has declined by around two-thirds since its peak last year in the US, and it is a similar case elsewhere. Falling oil prices are also helping. Inflation has largely fallen quicker than expected, and we see this trend continuing in 2024 as the global economy continues to cool. This has not been without some pain (particularly for consumers and borrowers), but the thematic of falling inflation is likely to see the Fed cut rates four times in 2024 (an election year also providing a nudge here), with a similar magnitude of easing by other big central banks, including the ECB.

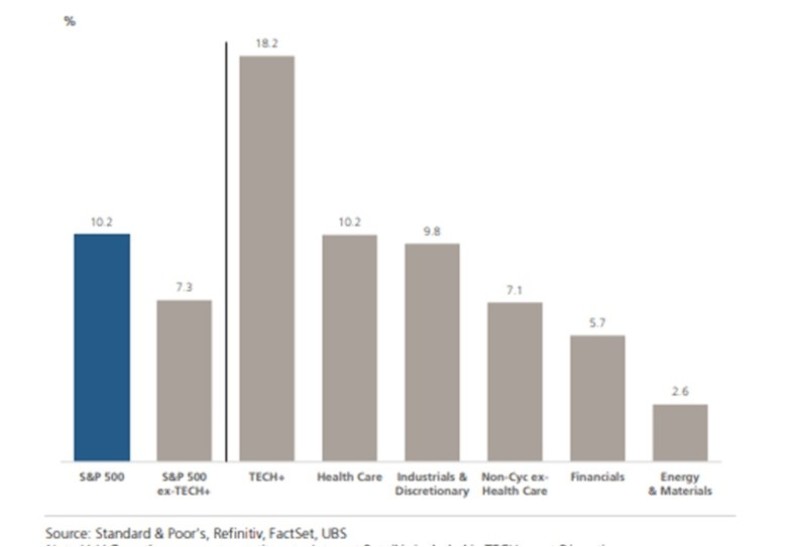

Falling interest rates, which provide much-needed support to a global economy that is still weak in places (particularly in manufacturing), are adding to the notion that the world economy can have a “soft landing” this year. The state of the corporate sector, with falling interest rates set to provide a further boost to activity, reinforces this outlook. Forecast earnings growth for the constituents of the S&P500 is robust. The tech sector (where earnings are estimated to grow ~18%) is a big part of the story, but strength across other sectors is encouraging as well. The fourth quarter earnings season has meanwhile begun well.

Forecast 2024 earnings per share growth for the S&P500

All that said, nothing is linear, and as we were reminded in 2023, there will always be a “wall of worry” for markets to climb. 2024 is likely to prove no different, with geopolitical tensions (the Middle East is a “developing” story) always offering a potential wild card along with other crises from “left-field”. Markets therefore could still be volatile once again, providing positive conditions for astute active investors.

2. Domestic interest rates fall quickly as inflation surprises on the downside. RBNZ cuts rates earlier than anticipated

The Kiwi market, while seeing a strong rally from November, didn't enjoy the same performance as other markets (although we were not alone – the FTSE100 in the UK posted a gain of a similar margin). Part of the reason here is that our inflation rate has been somewhat "stickier." The current inflation rate of 5.6% has fallen from its peak (7.3%), but less so than in other economies.

The current inflation rate is also well ahead of the RBNZ’s target of 2-3%. Given our central bank has been one of the more "hawkish" around, expectations are growing that the Reserve Bank may not cut rates until 2025.

This scenario may however not play out. The RBNZ appears worried about the inflationary impact of migration (which is at record levels), but this could slow with a softening jobs market, and also with any new government policies to stem the flow. Central banks also do have to look at both sides of the equation. NZ’s GDP growth has been weak. Our economy is technically in a recession, definitively on a per capita basis (with a growing population), and even more so when looking at things in real terms. We suspect it may be a challenge for the RBNZ to justify keeping rates elevated should the economy stutter further, especially when many other global central banks are on a rate-cutting expedition.

3. The kiwi housing market has a positive year

As suggested in our predictions, 2023 was a year of correction for the kiwi property market, from the giddy highs of the pandemic era, and as interest rates pushed quickly higher from unsustainably low levels. FOMO amongst buyers evaporated as higher interest rates and tighter credit saw a great reset on expectations for property prices.

We expect 2024 to be a positive year for the property market as interest rates top out and start to decline. Several banks have already cut their 2 and 3-year rates. We do not see it being a boomer year, but elevated (but possibly slowing) levels of migration should also help on the demand side. Green shoots which are already appearing in Auckland could well spring further and spread to the rest of the country.

4. Discretionary spending under pressure as borrowers move onto higher mortgage rates

An improving housing market, while boosting the spirits of homeowners, will not be enough to offset the pressure on discretionary spending, which is likely to increase as the year wears on. Kiwi households built up significant cash buffers during the pandemic, but these have been called upon, and then some, due to cost-of-living pressures and higher borrowing rates.

While we see interest rates topping out this year, the fact remains that around half of Kiwi mortgages are set to refix in 2024, and many borrowers will be moving onto higher rates compared to those secured during the pandemic. This will likely add further discretionary spending pressures. Retail card spending has been soft despite high levels of migration. Consumer sentiment remains at a low ebb. The levels of spending over key shopping periods such as Black Friday and Cyber Monday have also been weak relative to other countries, most notably the US, where consumers are insulated from higher mortgage rates (most borrowers are on 30-year deals).

5. The Chinese economy confounds the bears, with further property market support and other stimulus forthcoming from officials to maintain growth at target levels

There could be some good news for New Zealand, however, from our largest customer. The post-Covid reopening in China failed to live up to expectations in 2023, amidst a stuttering property market, and as officials provided further stimulus initiatives, but not the “bazooka” that some were anticipating. However, there is cause for optimism. China’s economy was recently announced that its economy grew at a better-than-expected 5.2% in 2023.

A sentiment headwind for China has been an aging demographic, but there are signs that birth rates may be set to turn higher if a leading indicator is anything to go by. Marriage rates in China, which plummeted in the Covid era, are estimated to be up nearly 20% over the course of 2023. A nearer-term source of optimism is iron ore prices, which are around 2-year highs – China is a huge consumer of the steel-making ingredient, and strong prices here suggest activity is set to pick up in China’s industrial sector.

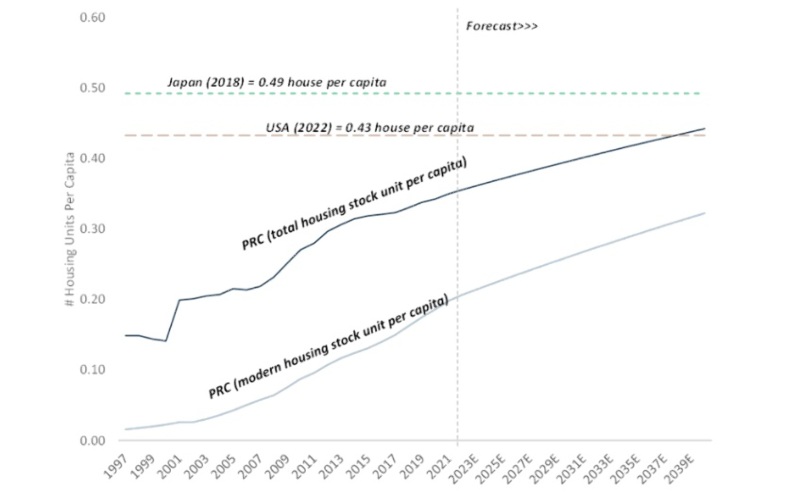

With respect to the property sector, officials in China have indicated they want to support it, and certainly not let it fail. While the prospective liquidation of property developer Evergrande is making headlines currently, any stability in the property market will be a tonic for consumers in the country. The idea that China has a massive problem with overbuilding is also at least partially misplaced. China’s urban housing stock per capita is not expected to reach US/Japan’s levels until 2040. In any event, China could well be the surprise package in 2024, and make a meaningful contribution to global growth.

Total Housing stock per capita

Source: Wellington Management

6. Australia’s economy does well as commodity prices rally

What is good for China is also good for our closest trading partner. China consumes vast quantities of Australia’s iron ore, as well as a host of other commodities. Signs that trade relations are normalizing after a frosty period (Anthony Albanese was recently the first Australian PM to visit China since 2016) will also be helpful to demand here.

Prices for metals, ores, energy, and the like will also likely receive another tailwind from falls in the unit of currency in which they are priced – the US dollar. The latter will be driven by the Federal Reserve, who have recently articulated a dovish shift in their positioning. While some are concerned about an impending recession in Australia, the reality could again be very different for "the lucky country." Falling rates of inflation are likely to help the Reserve Bank of Australia abandon any idea of more rate hikes and instead join the debate about when to ease rates.

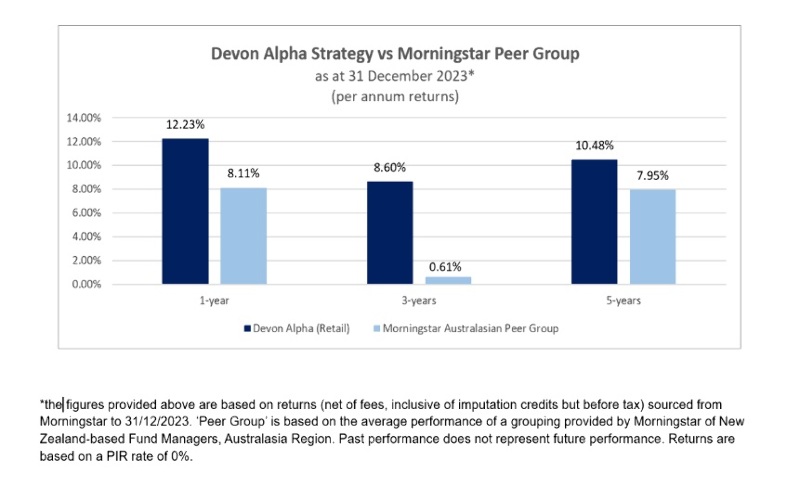

The initial stages of the year have seen the Australian market push towards the all-time highs of August 2021. Some sectors (and stocks) have done better than others. Healthcare has been robust with names such as CSL and ResMed outperforming. This (along with stock additions such as A2 Milk) have further boosted the performance of a number of Devon Funds, including Devon Alpha which is performing strongly on both short and longer-term horizons versus peers, as the below graphic highlights.

7. Trump wins the election – pressure for Biden to step aside, but stands in any event

It may be a close-run thing once again, and while early days, it appears Donald Trump could well be President once again. The path back to the White House may not be a smooth one, with various legal actions and challenges - Colorado and Maine have already banned the former Commander in Chief from the ballot due to his actions leading up to the Capitol riot in 2021. However, dissatisfaction over the economy may prove to be too weighty a cross for President Biden to bear and may see pressure from some Democrats to step aside. It stands to be a fascinating election battle once again, although missing from the sideshow will be Rudy Giuliani and (most likely) a press conference at Four Seasons Total Landscaping.

8. M7 fails to deliver on AI hype

The “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) were like something out of a Marvel movie as far as the stock market was concerned last year. The collective helped power the Nasdaq to a 43% gain in 2023, the best showing in two decades. A common thread among the performance has been the excitement around AI (named “word of the year” by Collins Dictionary) and the growth prospects that are to come from a technological innovation that is proving dynamic in its potential applications, even if the exact manner in which it will be employed is uncertain.

Generative AI has already driven huge growth in the chip sector and data centre industries, with the promise of more to come. Every week it seems another big tech name has unveiled its latest chatbot to challenge ChatGPT.

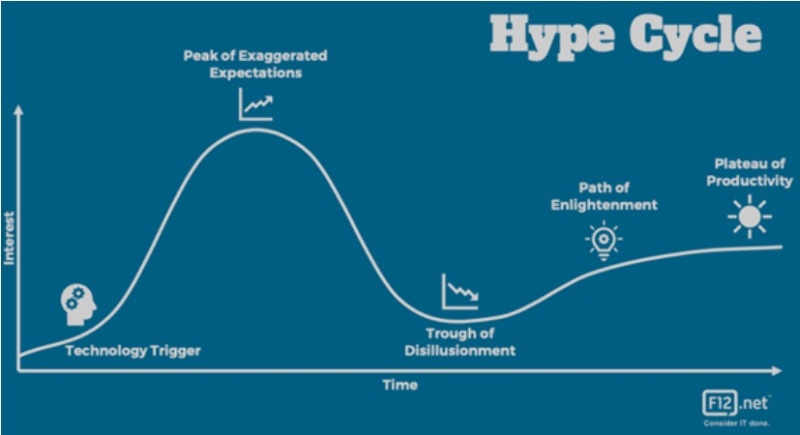

Will AI live up to its promise in 2024? Certainly, there is a lot of expectation baked in. A slight stutter would not be unusual. Major technological innovations historically tend to have their impact overestimated in the short term (3-5 years) but understated over a 10-year period. Are we at the peak of exaggerated expectations for AI? Time will tell, but if so, the next stage is “the trough of disillusionment.”

9. Tiwai stays in 2024, good for Greater Southland and the electricity sector

Our prediction that a deal on Tiwai would be done in 2023 didn’t transpire, but the case for the New Zealand Aluminum Smelter to stay put remains as compelling as ever. Aluminum prices remain well above US$2,000, making Tiwai highly profitable and one of the most environmentally friendly smelters globally. Tiwai averages around two tonnes of CO2 per tonne of carbon produced, versus an average of over six times that for the sector globally.

The smelter remains highly important to the South Island economy, and the new government acknowledged this during the campaign trail. The smelter accounts for around 12% of New Zealand’s electricity demand. “Horse trading” has continued behind the scenes, and part of this will be around agreements on the clean-up bill, assurances around emissions, better waste management, power “co-operation” during peak periods, and a pledge to invest in and support new renewable generation projects. But ultimately, a deal will get settled, allowing the local economy and the electricity sector in general to move on to a more certain footing.

10. Uranium gains in importance as part of the global energy transition – more reactors planned in the West

On the subject of energy, the transition to cleaner energy was a persistent theme throughout 2023. This culminated with government ministers from nearly 200 countries approving the COP28 deal, unanimously agreeing to move away from fossil fuels for the first time in nearly three decades. Although there is agreement on “the need”, however “the how” to get there remains far from clear.

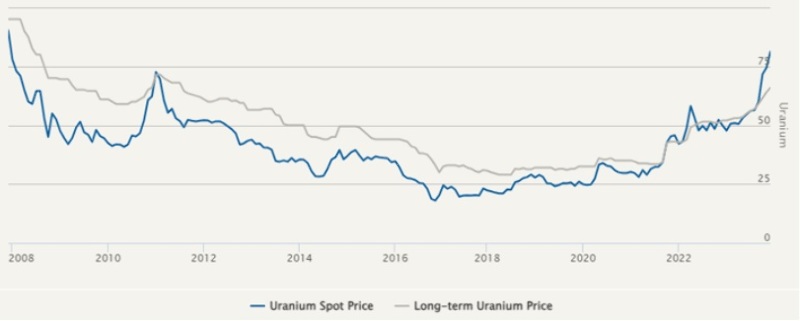

One commodity that may have an increasing part to play is uranium, prices for which have reached the highest level since 2008. Optimism is growing that “yellowcake” may be called upon by governments as a means to realistically deliver the energy transition.

Uranium was shunned in the aftermath of the Fukushima disaster in 2011, but with safety measures having been tightened, it is now expected to be a big part of the world’s energy solution. A report from the World Nuclear Association forecasts nuclear capacity growing nearly 80%, and demand for uranium roughly doubling by 2040. There were 436 operable reactors globally as at the end of November, with 62 more under construction and around 113 planned. Much of this growth is in China and India, but discussions of building new plants or extending the lifespan of existing ones have also ramped up in advanced economies.

Source: Cameco

11. NZ has a great year on the sporting front, with the second most successful Olympics ever in terms of medal haul and with Team NZ retaining the America’s Cup

It will be a hard act to follow for our Olympians after Tokyo, but NZ posts a better-than-expected showing across a variety of disciplines, including a gold for Ryan Fox in the golf. The Black Caps make it as far as another semi-final in the T20 World Cup, while Peter Burling skippers a far superior boat to keep kiwi hands on the Auld Mug.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Gaming still bigger than Ben Hur | [OPINION] Alphabet and Microsoft: Searching for AI Monetisation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |