The bulls are back

Globally, most stock markets have made a strong start to the year, Leading the way has been the US indices, with the S&P500 rallying 3.3% in January, making new record highs, as did the Dow Jones which went through 38,000 for the first time ever.

Thursday, February 22nd 2024, 5:21AM

by Devon Funds

Strong economic data from the world’s largest economy has dispelled recessionary fears, while falling rates of inflation have investors prepped for a year of rate cuts, even if many central bankers have pushed back on the notion of them being imminent. The US earnings season has also been very strong, with the technology sector (and any mention of AI) continuing to capture much attention.

The performance of the New Zealand and Australian markets was also positive in January, even if a little more sedate than markets in the US. The NZX50 rose 0.9% last month, while the ASX200 gained 1.2%, hitting a record high in the process. Better expected inflation prints on both sides of the Tasman, along with some softness in the economy, is pushing the case for the RBNZ and RBA to cut rates in the coming months, despite ongoing hawkish comments from officials.

The question of rate cuts this year does appear to be very much a question of “when” rather than “if.” This was a scenario being factored in by markets in the final quarter of last year, and encouragement is now being taken from any data (macro or corporate) which indicates that inflation is falling whilst also suggesting the world economy will avert a material downturn.

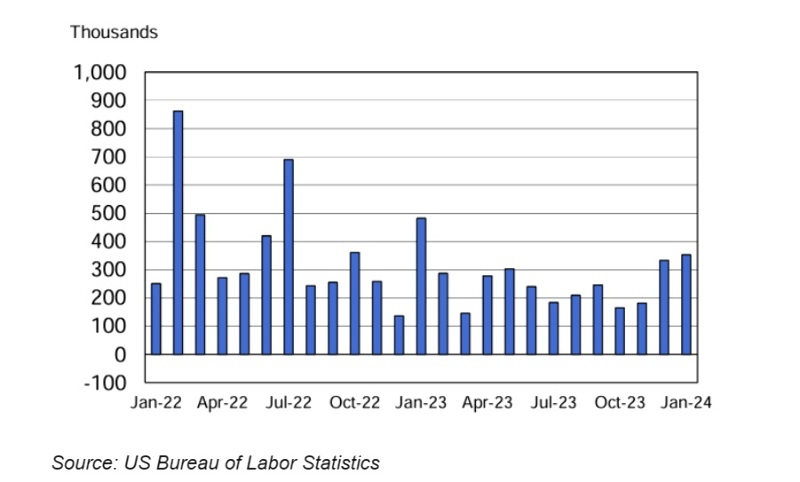

Strength in the US economy (we have had strong consumer confidence, retail sales, and house price data in recent weeks) has meanwhile been further underlined by the recent Non-farm Payrolls report which showed that job creation in the world’s largest economy Is roaring ahead. The US added 353,000 jobs in January which trounced estimates for around 185,000. The unemployment rate held at 3.7%, against forecasts for 3.8%. Job growth was widespread and prior months’ jobs gains were upwardly revised. Wage growth was strong (double estimates) at 0.6% for the month, but also came as Americans worked slightly less hours.

The numbers further dismantle any idea that the US is on the cusp of a major downturn, with hiring robust across a broad cross-section of the economy. It may however raise further questions about the proximity of Fed rate cuts this year. At the January meeting, Fed Chair Jerome Powell pushed back on the idea that a rate cut may be coming in March, saying this was not the base case. Nonetheless, (outside of wage numbers) recent data is showing that inflation is moving in the right direction (and is down ~two thirds from its peak). So strong economic growth is being achieved, but in a non-inflationary way – a “nirvana” for the Fed and investors.

The earnings season meanwhile has further boosted confidence in the outlook. Around halfway through, around 80% of S&P500 constituents to report so far have beaten on earnings and revenue estimates.

The somewhat over-owned “Magnificent 7” have captured much attention again, although it is perhaps not surprising to see some disparity in the reaction to earnings announcements given the run up in stock prices.

Stellar announcements have been rewarded. Meta Platforms surged further into record-high territory after materially beating estimates and announcing its first dividend in its history. The 20% move on the day added US$197b to its market capitalisation, the biggest gain in a single session for any company in history. This is perhaps also fitting as Meta has the record for the biggest market cap “wipeout,” back in early 2022. What a comeback! Speaking of comebacks, numbers from Netflix (not an M7 member) were also impressive. Netflix has been cracking down on password sharing to convert ‘freeloaders’ to paying customers, and this is clearly working (as is bringing in an ad-supported tier).

Amazon’s results similarly added to evidence that the online ad market is continuing to rebound, which also saw its shares surge. The reaction to results from Apple was less convincing, with declining sales in China one area of concern. This year has seen Apple eclipsed by Microsoft as the world’s most valuable company. Microsoft, which is the top holding in the Devon Global Sustainability Fund, is trading at record highs, with a market cap above US$3 trillion.

Looking at other global markets, there were some highly disparate performances. The Nikkei in Japan soared 8.4% in the month. Unlike others, Japan has been trying to keep inflation moving higher – there has been some success with the CPI coming in at 3.1% in 2023, the highest level in 41 years. The Bank of Japan is holding firm on its current negative rate policy. The Bank of England and ECB also both held the line on rates during the month, but have slightly different issues to contend with. Inflation is bubbling away again in the UK, while growth is stagnating in Europe. The European indices were firm during the month, but the UK FTSE (-1.3%) lagged.

The Chinese stock market though has had a poor start to 2024 and fell 7% in January. Economic data has been reasonable (the 2023 growth rate of 5.2% was above official targets, and private manufacturing data has been encouraging, as evidenced by iron ore prices at around US$125). But there are clear concerns over the property sector (not helped by the prospect of Evergrande going into liquidation) and a tepid consumer. Premier Li Qiang has called for more measures to stabilize the stock market, and time will tell how they play out this time around.

In all, more than US$6 trillion had been wiped out from the market value of Chinese and Hong Kong stocks since the 2021 peak. Piecemeal stimulus efforts, concerns around the property market, and a crackdown on technology companies have been factors. Past intervention in the stock market, most notably in 2015, proved counterproductive.

Concerns over the Chinese economy do not at this stage appear to have held back the NZ market. Indeed, some China-facing companies have flourished.

Shares in A2 Mik have been a clear outperformer so far in 2024, soaring nearly 20%. A2’s biggest market is China, and part of the recent headwinds for the company have been that Chinese birth dates have been going down. There are however some signs that this might be turning around. After being impacted by Covid, marriage rates are picking up, and this is a leading indicator for birth rates, which tend to lift in the year following.

Some other good news for A2 is potentially in the US where it is looking to develop another market. They have recently launched their platinum brand, which is being sold on Amazon and will soon be available in retail stores. The company’s US business remains unprofitable, however A2 is moving towards their ambition of being break even by 2026 (despite being faced with tariffs of around 20%). A2 Milk is held in Devon Alpha, Devon Trans-Tasman, and a number of other Devon funds.

There was also other good news for much of the kiwi market (and potentially borrowers), with the release of the CPI for the December quarter. Inflation has fallen below 5% for the first time since September 2021. New Zealand’s CPI came in at 4.7% in the 12 months to December, down from 5.6% in the prior quarter. The print was in line with market expectations, but better than the 5% the RBNZ had pegged.

Within the economic data there were plenty of positives. Quarterly inflation fell sharply to 0.5% in December 2023 compared with 1.8% in September. Tradeable inflation (or inflation we effectively import) has fallen from 4.7% to 3.0% on an annual basis.

The not-so-positives are that non-tradeable, or domestically driven inflation, came in at 5.8% annually, and is proving very ‘sticky.’ This is something that the RBNZ will be conscious of, and was flagged by a somewhat hawkish presentation by RBNZ Chief Economist Paul Conway, who highlighted that “home-grown” inflation was persistent. Part of the issue is also surging immigration which is driving demand amid tight supply. The price of new housing has increased and the cost of building a new house is 41% higher than pre-pandemic. There was push-back on the idea of rate cuts. That could well change if the economy falters.

Dairy prices and immigration are strong, but the consumer could be an Achilles heel. While inflation is falling, cost of living pressures remain, and many are yet to come off low Covid-era mortgage rates. Weak retail sales highlight the challenges being faced by the retail sector. There is certainly a slowdown in many areas of the economy – building consents fell 25% over 2023, the biggest calendar fall on record, albeit from record levels. More data points will likely be needed to sway things – GDP numbers in late March could well show we are in a technical recession.

It will be interesting to see what the corporate sector makes of this all, with the earnings season about to get underway. One theme we may see emerge is those companies with offshore facing businesses coping a bit better and being relatively more optimistic about the outlook.

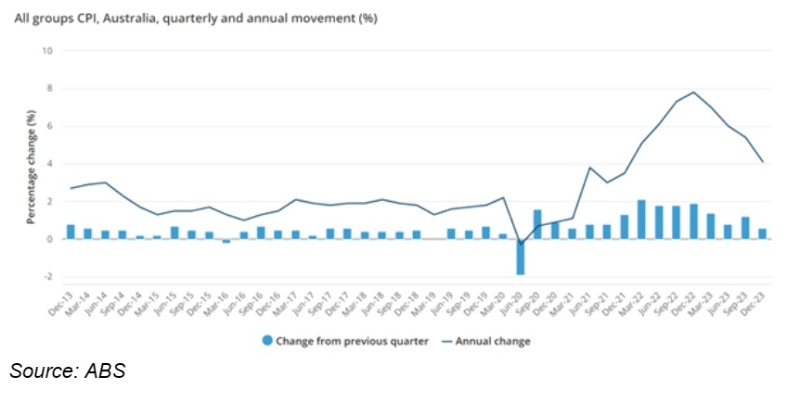

Across the Tasman, a sharp fall in inflation also helped the Australian market to a record high, exceeding levels last seen in August 2021. Annual inflation fell to 4.1% from 5.4% in the September quarter, below forecasts of 4.3%. Core inflation was 4.2% from 5.2% in the third quarter. Inflation has fallen for four straight quarters and is the lowest since December 2021. On a quarterly basis the CPI was up 0.6% versus 0.8% expected, and down from 1.2% in September.

The sharper than expected fall in inflation meanwhile suggests it is likely that rates have peaked in Australia. The RBA has gone on hold this week as expected, with evidence of softness in parts of the economy endorsing this narrative. Building approvals for December missed expectations by a wide margin, falling 9.5% in December, after a 0.3% rise in November. Officials have though played down the prospect of rate cuts in the near term, wanting to see further conviction that inflation is falling back towards targets.

A rising tide hasn’t however lifted all boats in Australia, reinforcing the importance of stock selection. Shares in pandemic beneficiary Domino’s Pizza Enterprises fell over 30% in one session, after an adverse trading update which erased more than A$1.5 billion in the company’s value. Domino’s is doing well in Australia and NZ but operations in Japan, Taiwan, Malaysia and France are doing it much tougher. It has been a big fall from grace for the pandemic darling of growth investors. During Covid people were eating pizza like it was going out of fashion. Their shares have since fallen 75% from their peak in 2021, and are back at pre-pandemic levels. Domino’s Pizza Enterprises is not held in any of the Devon funds.

The lower-than-expected Aussie CPI has been good news for interest-rate sensitive stocks, including Goodman Group, which is also benefitting from huge growth in data centres. The healthcare sector has also been very strong. ResMed is up around 15% year to date. Philips, ResMed’s key competitor, is to stop selling sleep apnoea machines in the US, under a tentative agreement with regulators following a product recall. Philips machines are perceived as a risk due to evidence that their internal foam can deteriorate over time, putting patients at the risk of breathing in particles and fumes while they sleep.

ResMed also beat expectations at the top and bottom lines with its own results. Quarterly revenues grew 12% to US$1.2 billion, while operating profit (non-GAAP) soared 20%. All products and services saw double-digit percentage growth. Investors were encouraged by better-than-expected gross margins, which appear to be back on track towards the company’s targets. ResMed has been putting up prices, and has taken market share, aided by the issues experienced by Philips. Costs are also abating, with lower rates of inflation and falling freight costs. ResMed is held across a number of the Devon funds.

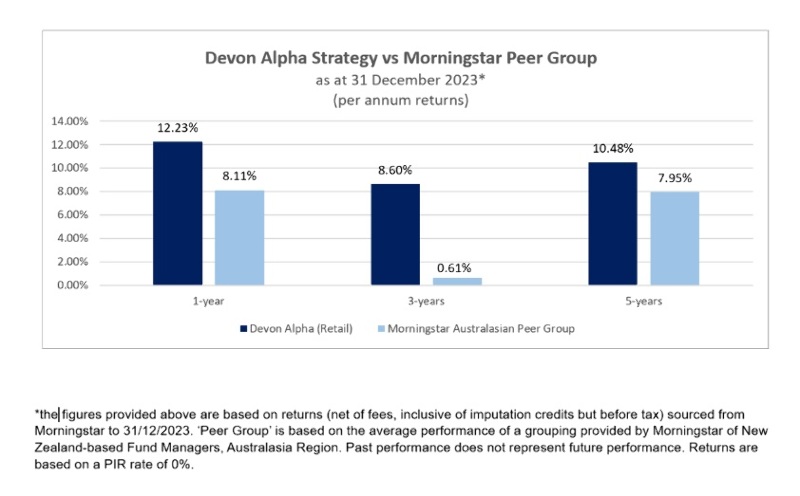

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « [OPINION] Alphabet and Microsoft: Searching for AI Monetisation | AI: The great acceleration » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |