Sharesies has biggest trading yet

Almost half a billion dollars ($488m) was traded on Sharesies retail investment platform in March, the highest in the company’s six-year history.

Tuesday, April 9th 2024, 11:59AM

by Andrea Malcolm

Sharesies attributed the surge to the US tech stock rally, plus new investors entering the market at higher rates than seen over the past 18 months, and previously hesitant investors increasing their activity.

The highest individual trading day on record, March 5, saw $35.7m traded, mostly driven by Nvidia and Super Micro Computer, the latter having recently joined the S&P500.

The popularity of tech stocks led Sharesies investors to focus on the US, with investing volumes in US markets increasing 58% in the quarter. US trading comprised 75% of trading volumes in March, compared with 17% and 9% for NZX and ASX, respectively.

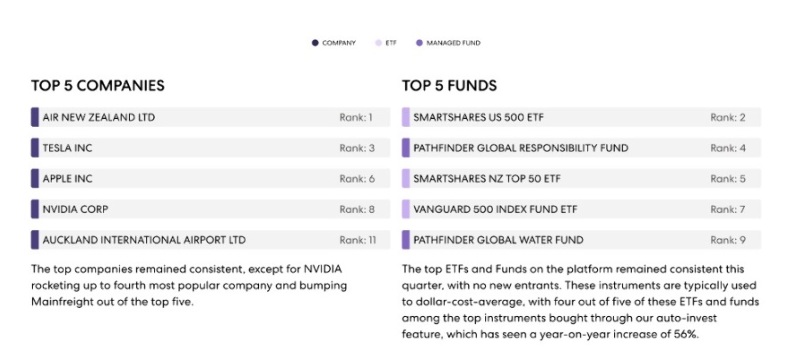

AI software and hardware manufacturer Nvidia was among Sharesies’ top movers, with total holdings increasing more than 165% from the end of Q3 to the end of Q4. Meanwhile, Advanced Micro Devices (AMD) attracted 30% more investors, with total holdings increasing by 82%.

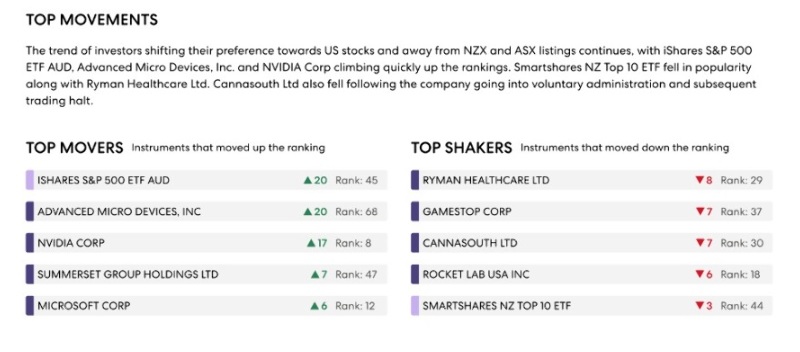

Nvidia pushed NZX-listed logistics company Mainfreight from its fourth-place ranking in Sharesies 50 most-owned instruments on the platform. Referred to as the Sharesies bundle it is updated quarterly and as some rise in ranking, others may decline in popularity. Several other NZX stocks, including Ryman Healthcare and Tourism Holdings, also fell in the rankings after rallying last quarter.

Retail investor sentiment was slightly up but behaviour continues to indicate a mood of caution, with the Sharesies Index remaining in the ‘cautious’ range throughout the quarter.

Sharesies co-founder and joint CEO Sonya Williams says the fact that investors were funding buying activity with existing funds was a sign of healthy investing behaviour among the platform’s 620,000-plus customers across New Zealand and Australia.

“The fact that investors are steadily contributing to their portfolios and making active decisions to profit take, despite a technical recession in New Zealand and ongoing inflationary pressures,

shows they understand the value of playing the long game,”she says.

Cautious

Sharesies noted a slight increase in investor confidence during Q4, although the mood remained cautious. The percentage of members who invested in individual companies as opposed to managed funds and ETFs hovered near 80% for the majority of the quarter.

The Sharesies Index also showed an increased Net Deposit Ratio (NDR), a measurement of the flow of funds into and out of Sharesies for its invest and save products. While the top ETFs and funds on the platform remained consistent for the quarter, iShares S&P 500 ETF AUD was the biggest mover for the three-month period, climbing 20 index points to rank 45th.

Williams says Sharesies’ most popular ETF tended to attract auto-investment from investors.

| « Version review of NZCFS Level 5 a structural tweak, skill standards still to come | Analysing AI’s Impact on Financial Advice, Part 3 » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |