No shift on KiwiSaver balance gender gap

New KiwiSaver analysis for 2023 shows the 25% gap between men and women’s balances did not improve over the year.

Friday, May 24th 2024, 6:02AM  2 Comments

2 Comments

by Andrea Malcolm

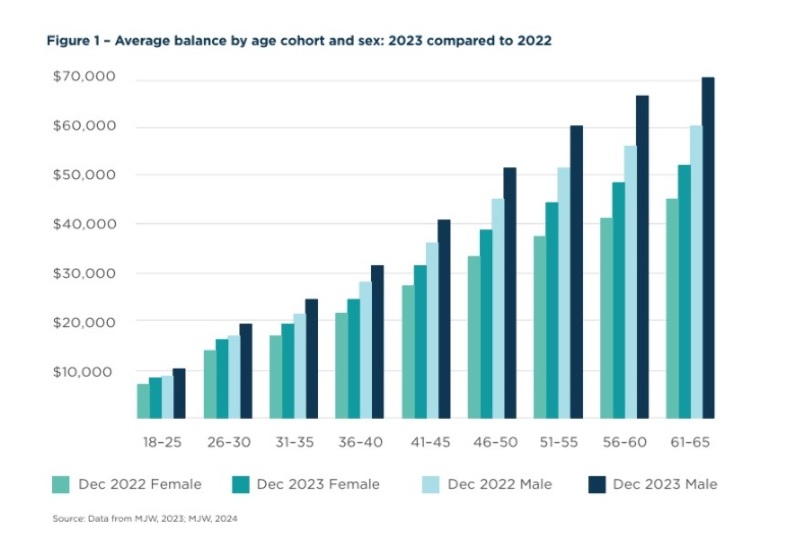

The average KiwiSaver balance at Dec 31 2023 was $31,823, an increase of 16.2% ($4,444) from the previous year, shows research by Melville Jessup Weaver (MJW) for Te Ara Ahunga Ora Retirement. The increase reflects the strong recovery the financial markets experienced over 2023.

The average balance for men grew 16.2% (by $5,109) and 16.6% (by $14,147) for women. However, the gap between the average balances of men ($36,605) and women ($29,291) remained at 25% ($7,314).

Te Ara Ahunga Ora policy lead Dr Michelle Reyers says the results are disappointing and highlights the importance of closing gender pay gaps and the impact they have for KiwiSaver balances and retirement. She says it's good to see the gap didn’t widen as it did in 2022 from 20% to 25%.

Men and women in their 40s and 50s continued to display the widest breach. On average, women in their 40s had approximately 32% ($11,000) less KiwiSaver than men, while women in their 50s had about 36% ($17,000) less.

This likely reflects the combined impact of the gender pay gap, time out of paid work, and the higher percentage of women than men that work part-time, says the report.

Overall less than 10% of KiwiSaver members had balances over $80,000 and there were more males than females in this category across almost all age brackets. Only 17% of women aged 51-65 had more than $80,000 compared to 26% of men.

Many members continued to have low KiwiSaver balances, with 38% having less than $10,000 compared to 41% in 2022.

“We know that the cost-of-living pressures many are facing will be contributing to this. However, lower KiwiSaver balances have a significant impact, particularly on women who need to fund their retirement for longer,” says Reyers.

This latest analysis follows research released by Te Ara Ahunga Ora and Auckland University of Technology in April, which also highlighted how the gender pay gap affected KiwiSaver contributions.

Despite men and women both contributing at the same average rate of 3.7%, the gender pay gap resulted in large differences between the average dollar amounts contributed by both employee and employer.

Reyers says its data collection and analysis is used to shape future policy decisions. In June, Retirement Commissioner Jane Wrightson will release a paper outlining policy options for the government to explore to improve the scheme.

The MWJ report covers 98% or more than three million KiwiSaver members with funds under management of $104.21 billion as at December 2023.

| « National Capital: Women should back themselves on investment | KiwiSaver not hot on Kiwi markets » |

Special Offers

Comments from our readers

What was the hypothesis that was meant to be tested, or, was it, here are a bunch of numbers, look at this.

Can someone once an for all define and demonstrate this gender gap in pay. We know more women have babies than men still but as for women being paid less for a role because of gender, prove, demonstrate.

I can write you an article explaining everyone that drinks water dies.

Or I can propose that because the cock crows the sun rises.

I think more rigorous thought needs to be given to any funding given to any academic who wants to wander down any old cul-de-sac.

Sign In to add your comment

| Printable version | Email to a friend |

With females now making up the majority of university places it will be interesting to see how relative incomes change. Already in 25 cities in USA females under 30 earn more than males.