Lessons from a silent housing crash

It certainly has been a rollercoaster ride for the economy and markets over the past four years.

Friday, June 14th 2024, 6:42AM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

Initial angst over the pandemic was replaced with relief as central bankers and governments pulled out the punch bowl, stimulating a Covid-stricken economy with a raft of measures which included taking interest rates towards zero. Spending thrived and economic activity soared as a result. The property market also ballooned – the narrative for the latter was that it was “a good time to buy a house” because it was cheap to borrow. Any notion of value, long term affordability, and what the future might bring, was put aside as a thought for another day.

After any big party there are usually a few hangovers, and our economy has been left with a sore head in the form of a recession. Free lunches often come with a catch, and soaring inflation has seen “easy money” taken away, with interest rates rising rapidly. Cost of living pressures have reverberated through the economy, with a collapse in property prices rubbing salt and financial pain in the wounds for anyone that entered or moved up the housing ladder in 2021.

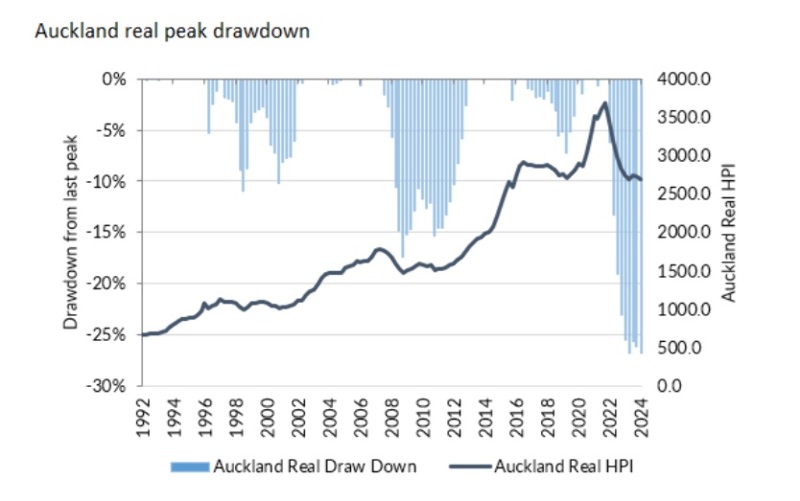

The NZ housing market has crashed since the peak in late 2021, with the house price index falling 19% in nominal terms, and some 29% in real terms when allowing for inflation. In Auckland the numbers are 21% and 31% respectively.

Source: Devon

The housing market crash doesn’t get a lot of attention - contrast this with periods of volatility in the stock market, whose card is still scarred by some by large historic moves. The stock market is still seen by many as a “risky” proposition, with many still taking about the 1987 stock market crash, in addition to the more recent GFC, and the steep, but brief, ‘Covid correction’ in 2020.

Why do Kiwis have a love affair with bricks and mortar? Home ownership is important, and tangibility is a clear aspect, but the attraction of leverage (through mortgage lending) associated with property means that gains can be amplified when prices are running higher (but so too can losses).

Is our fixation with property part of our Achilles heel and an unhealthy obsession from an economic perspective?

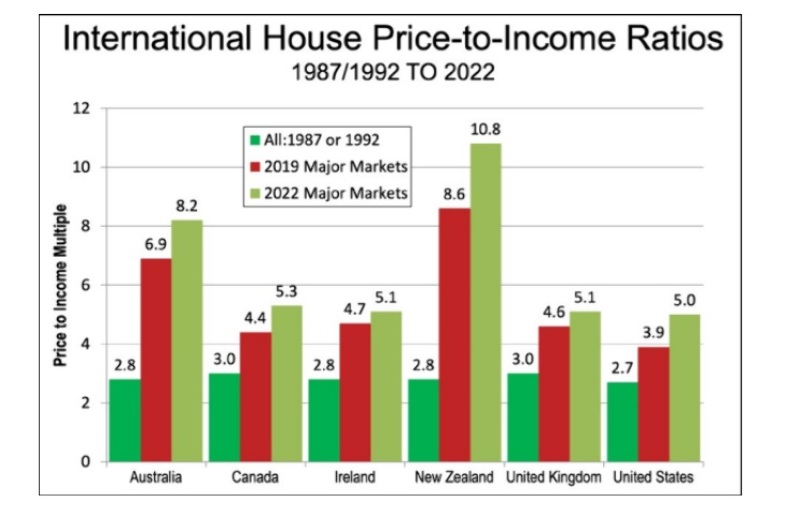

There would certainly appear to be a vested interest in looking for green shoots – prices have picked up slightly of late, as have sales volumes. Strong levels of migration and the shortfall of new homes (~50,000 a year), along with the prospect of a recovering economy and lower interest rates, arguably provide a case for an ongoing turnaround. On the other side, despite the decline in house prices over the past 2½ years, we still have one of the most expensive housing markets in the world - rated “severely unaffordable” in a 2023 report by Demographia, with a median house price to household income ratio of close to 11 times.

Source: RBA, Demographia

Demand drivers could underpin support going forward, but the supply of existing housing stock may pick up given a third of mortgage holders are refixing from low pandemic fixed loans to much higher rates of interest (for context, the ratio of mortgage payments to household income is already running at close to 50%). Meanwhile, caps on debt-to-income ratios loom in the coming months.

The RBNZ meanwhile indicated recently that the OCR will not fall until late 2025. The hawkish tone appears to centre around the persistence of inflation in areas (rents, insurance, and council rates) which seem less sensitive to the OCR, which suggests there must be other drivers at work. The reality may though prove very different, with then RBNZ potentially set to join others globally in cutting rates should the economy soften further.

But still, with property prices remaining extended in terms of various valuation and affordability metrics, it is not a stretch to conceive of a scenario where New Zealand has a decade of no real increases in house prices. History can repeat, and possibly the most extreme example of a property market taking decades to recover is Japan - in 1989 the bubble got to a point where the Japanese Imperial Palace was worth more than the State of California.

This is an extreme suggestion perhaps, but against this backdrop, if there a case for much greater, and somewhat more urgent diversification by Kiwi investors?

The launch of KiwiSaver in 2007 has provided welcome impetus for retirement savings, but NZ still lags behind much of the developed world in stock market participation. This also means we lack the same economic buffers that exist in the likes of Australia, where the current compulsory super rate is 11%, versus (an optional) 3% in New Zealand.

Reasons to diversify beyond property also exist beyond the notion of avoiding “putting all your investment eggs in one basket.”

The stock market stands out as a clear option. The pandemic provided a boost to share market awareness, with many investors caught up in the frenzy around Covid beneficiaries and technology names, and more recently in AI darlings such as Nvidia.

But investment portfolios built on fads (e,g. the Dot Com Boom) typically do not endure. Building a long-term investment portfolio around “high quality” names can come with distinct advantages, and particularly when compared to property.

Stocks by their nature are more liquid, and publicly traded shares can be bought and sold quickly. Price certainty is also a huge attraction, with market determined prices readily available in a highly regulated environment, as opposed to property where there is far less certainty or transparency. “Getting on the investment ladder” is also much more feasible, with fairly minimal amounts required to start a share portfolio thanks to the notion of fractional ownership.

Diversification can also be extended within a share portfolio, as investors can buy shares in a wide range of industries, sectors, and companies. An added appeal of the stock market is that it is forward looking, with pricing determined based not just on the here and now, but the future growth prospects of companies, sectors, and indeed the economy. The latter will turn upwards at some point, and stock markets will price this in ahead of time.

There is also the notion that investment in companies provides more qualitative benefits and is effectively providing growth capital for “New Zealand Inc.” Market dynamics also mean that well governed companies do better and are rewarded for doing so over time. They also potentially deliver more positive environmental and social outcomes. Many companies also pay dividends (indeed our stock market is known for its dividend attributes), which can provide investors with an income stream, in addition to any capital appreciation.

It’s important to also recognise that there are potential tax advantages from investing in stocks, depending on how portfolios are structured. Recent tax changes have boosted the appeal for trusts to invest in PIEs (Portfolio Investment Entities) which now carry a maximum tax rate of 28%.

While nothing is guaranteed, and past performance is not a certain guide to the future, from a return perspective, studies have shown that stock markets have outperformed property over the longer term. Over the past 60 years the S&P500 has returned around 10% per annum while long term returns for global property are ~8%. The case for stocks versus property does not have to be a “one or t’other” proposition, but there is certainly enough cause for property centric investors to consider adding another string to their bow.

The information in this article is provided for information only, is intended to be general in nature, and does not take into account your financial situation, objectives, goals, or risk tolerance.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Financial markets: Calm seas never made a skilled a sailor | US Equities – simply momentum or something more fundamental » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |