ESG KiwiSaver outperforms non-ESG on some profiles over five years

More than one million KiwiSaver members (39%) are invested in environmental, social, governance (ESG) funds, says a new report.

Wednesday, September 4th 2024, 5:04AM  4 Comments

4 Comments

by Andrea Malcolm

The second quarter KiwiSaver Value for Money report by financial advisers National Capital analysed 110 KiwiSaver funds (around 95% of the total value of KiwiSaver).

Just under half (51) were classified as ESG funds with a projected total value at retirement of around $244 billion.

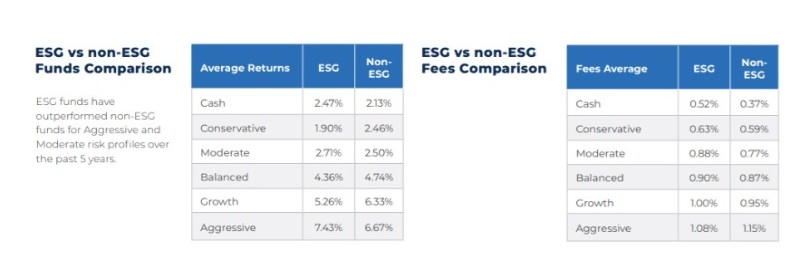

Financial Markets Authority (FMA) disclosures showed that ESG outperformed non-ESG funds for aggressive and moderate risk profiles in the past five years to March.

The report scores KiwiSaver funds out of 10 on performance after fees, value for fees, fund management capability, provider stability, portfolio composition and processes, and ethical investing.

A benchmark was set with funds scoring in the top 50% categorised as ESG and those below are non-ESG funds. Fernandez says the report disregarded ESG labelling by the providers themselves.

National Capital director and co-founder Clive Fernandes says the results reaffirmed research National Capital has done in the past that on performance, ESG beat non-ESG in certain categories.

“There are two schools of thought. One is that you have to sacrifice performance for ethical investing and that doesn’t seem to be true. But we don’t have conclusive evidence because for growth and balance it was the other way around.”

What the result means for National Capital is that if performance is a client’s top consideration, it doesn’t rule out ESG funds.

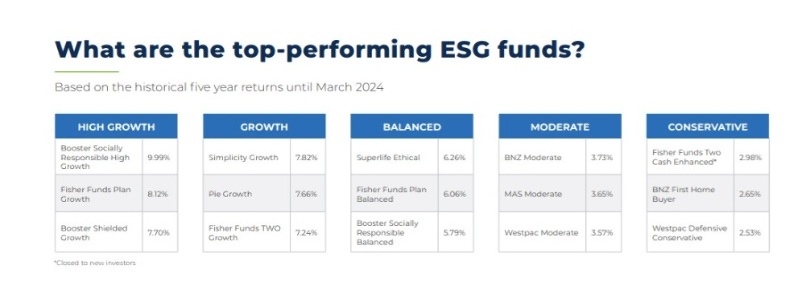

Top returning ESG funds

The Booster KiwiSaver Socially Responsible High Growth fund was the top performer among ESG funds with a 5-year return of 9.99%. Growth was Simplicity with 7.82%, Balanced was Superlife Ethical with 6.26%, Moderate was BNZ Moderate with 3.73% and Conservative was Fisher Funds Two Cash Enhanced with 2.98%.

“We want the client to make the final decision because ESG is a very complex topic and it depends very much on their personal preferences. Once we know what they want we can run some numbers and find funds that suit,” says Fernandez.

Scores for being ethical

The report uses the terms ethical and ESG interchangeably. To calculate ethical scores out of 10, National Capital analysed data from the Morningstar Sustainability Report, on the individual holdings in each fund, and used My Fiduciary for ESG policies such as exclusion, stewardship and impact investing.

Amongst the funds, 27% were rated A for ethical scoring, 15% were B-rated, 26% were rated C and 32% were rated D.

Pathfinder Growth and ASB Positive Impact overtook Booster for the high scores for Growth and Balance. MAS Conservative Fund scored the highest for in the Conservative category.

Overall, fund managers improved their ethical investment practices, with an average score of 6.67/10 compared to 6.11/10 for the first quarter of this year, the report says. A score of 6.67 indicates having ‘some exclusions’, so overall managers seem to be paying attention to ethical investing, the report says.

| « Embracing GenAI: A Roadmap for NZ Financial Services Companies - Part 3 | IRD wants to make fund management fees exempt GST » |

Special Offers

Comments from our readers

I'm also concerned at the plethora of various industry accolades and awards, whereby the consumer is potentially misled into believing (and potentially acting upon) either a small industry sample that is portrayed to represent 'all that is available' or is the consumer is simply the victim of bad research.

Sign In to add your comment

| Printable version | Email to a friend |