The results are in

The deluge of results on both sides of the Tasman provided a host of contrasts, and highlighted the importance of being highly selective and discerning when it comes to active investing strategies.

Monday, September 9th 2024, 3:09PM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

August was anything but dull for markets. After the “panic attack” at the start of the month, global benchmarks rebounded, led by the US indices. The Dow Jones made a new record high. The S&P500 was down 6% for the month at one point (and 8.5% from its July highs), before ending the month up 2.4%. Fears over a hard landing were put on the back burner as economic data continued to largely be on the resilient side of the ledger. The US earnings season had some high-profile ‘misses’ but was largely positive, with around 80% of S&P constituents reporting better than expected earnings, while outlook statements were not too downbeat.

Lower than expected inflation prints, including for the Fed’s preferred inflation gauge, also effectively locked in the view that the central bank was ready to start easing rates at the September meeting, and paving the way for a soft economic landing for the world’s largest economy.

The RBNZ had already commenced down the easing path, and after a very strong performance in July, the kiwi market performed much more modestly in July. The NZX50 added 0.3% for the month. The slightly positive performance though was underpinned by a 10% lift in benchmark heavyweight Fisher & Paykel Healthcare after the company lifted guidance. At the other end, falls for a2 Milk (-23%) and Spark NZ (-17%) weighed, after missing the mark on earnings and guidance respectively in what was a relatively mixed reporting season.

The Australian sharemarket also rebounded strongly from the early month sell-off, pushing towards record highs. The ASX200 gained 0.5% during the month. Banks outperformed while resources drifted. Australia’s most valuable company, Commonwealth Bank of Australia, made new record highs. Results from the banking sector were generally well received. Numbers from retailers highlighted a somewhat resilient Australian consumer, despite the RBA appearing to be much further away from rate cuts compared to central bank peers. The technology sector also delivered some positive surprises in a relatively varied results season. That said, as with New Zealand, there were plenty of highlights, including from several of the names held across the Devon funds.

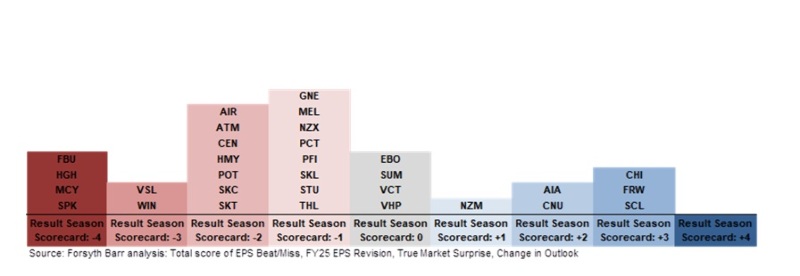

Turning to New Zealand, the misses outnumbered beats at both the top and bottom lines. More companies disappointed in terms of revenues, profitability (EBITDA) and earnings per share than those which impressed.

The below Reporting Scorecard from Forsyth Barr provides a quantitative assessment of the NZ reporting season, factoring in beats vs misses, EPS FY25 revisions, relative price reactions on results day and outlook statements. As is evident, the “red zone” of the Manhattan is somewhat more dominant.

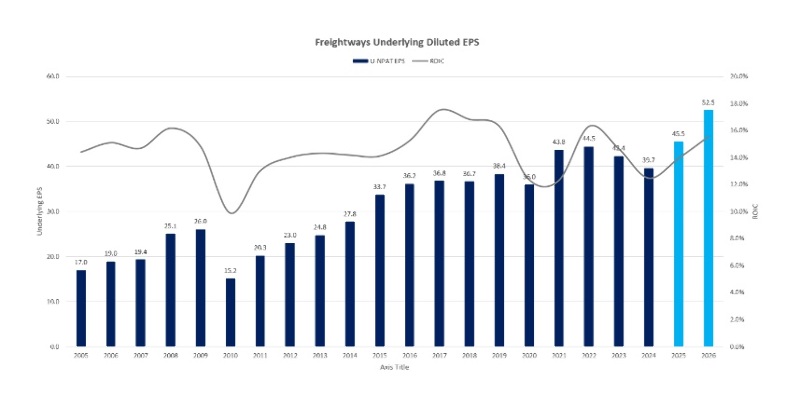

Amongst the clear highlights from the kiwi reporting season was Freightways, a name held across the Devon funds. Freightways delivered a resilient result given economic headwinds. Full year revenues were up 7.8% to $1.2b. Net profits fell 5.8% to $70.9m. Earnings (EBTIDA) in express packaging were up 7.1%. Volumes at Allied Express in Australia were up 11%. Same customer volumes in NZ were down 5%, but the company won market share of +4%, so net volumes were roughly flat in a tough environment.

Freightways is a cyclical business and doing well at this stage in the cycle is no mean feat, and also bodes well as the economy turns upwards. There was no hard guidance but management commented that they are hopeful of a recovery in the second half.

Freightways has expanded its business across the Tasman by acquisition and this appears to be going well. Back home the company’s main competitor is NZ Post, which is no longer being subsidised by the government, and has to behave in a much more rational and commercial manner. This is levelling the playing field, and also creating scope for price rises (it costs the same to courier a package across Auckland as it did 10 years ago). Freightways is generally putting through price increases of around ~5% in NZ. Stronger pricing power may facilitate a continuation of a robust earnings profile for the company over the past 20 years.

EBOS also came in with a solid result, albeit slightly short of estimates with record revenues of $13.2b, up 7.8%, and underlying earnings (EBITDA) growth of 7.3% to $624.3m. Healthcare and Animal Care performed well. The group is guiding for underlying earnings of between $575 million and $600 million in FY25. EBOS is another company which is benefitting from having a strong business across the Tasman.

Numbers from Auckland Airport reflected the ongoing rebound in tourism with total passenger numbers up 17% over the year to 18.5 million. American tourist numbers are strong, but China is well under pre-Covid levels. Revenue jumped 43% to $895.5 million and operating earnings leapt 55% to $614.0 million. The airport is though cautious about the outlook (also referencing Air New Zealand’s engine supply issues as a headwind) and has provided underlying FY25 earnings guidance of between $280 million and $320 million.

Results from the gentailers were characterised by a similar backdrop – dry weather means that the lakes are low andhydro inflows are below average, with the result that wholesale electricity prices are high and other sources of generation are being called upon. Companies are meanwhile pushing ahead on the renewables front, with a new 20-year deal at Tiwai providing the confidence to invest. Contact Energy’s results was in line with expectations, as underlying earnings rose 16%. Mercury’s results were the most disappointing in the sector - full year revenues rose 25.4% to $3.4b but the company reduced guidance.

A2 Milk also delivered a slight miss on guidance but a solid result. Full year revenues rose 5% to $1.68b and earnings (EBITDA) rose 6.9% to $234.3m. The company sees mid-single digit revenue growth in FY25 and margins to be similar to this year. a2 Milk has actually been doing really well to grab market share in China, given it is a tough market. However, the price reaction was a reflection of a weaker outlook given by management, who dampened expectations for accelerating growth due to supply chain constraints and continued decline in the overall Chinese market. The move also comes after A2 has been a top-performing stock in the kiwi market this year.

In the telcos, Chorus delivered a strong result, highlighting the defensive nature of its business. At the other end, Spark NZ has been feeling the effects of a slowing economy with a 1.2% decline in revenues in FY24 and a 2.5% decline in earnings to $1.16b. Private and public sector demand has been subdued in many areas, but reported comparatives were distorted by the TowerCo and Spark Sport transactions. Mobile was a bright spot, with mobile service revenue exceeding $1b for the first time. Revenues from data centres (+54%), and high tech (+21.5%) continue to grow strongly. Spark has guided for FY25 earnings of $1.165b-$1.22b but dividends are still being partially funded by debt.

There was a lot going on at Fletchers during the month. The full year result was underwhelming, and highlighted the challenges facing the company on a number of fronts. Full year revenues of $7.68b were flat and earnings fell 35% to $509m against the backdrop of a 25% fall in market volumes in NZ and a 15% fall in Australia. The company is guiding for FY25 market volumes in the materials and distribution businesses to be 10% to 15% lower year-on-year compared to FY24. Time will tell if a new CEO coincides with activity bottoming out. Further rate cuts by the RBNZ may also provide a welcome tonic for construction activity.

A number of results also underscored the impact of a soft economy – including those from Port of Tauranga and Vulcan Steel.

Away from reporting companies, there were however two very notable guidance upgrades from both the biggest company on the exchange and a company representing one of our most important industries. Fisher & Paykel Healthcare upgraded half year revenue guidance to a range of $940 million to $950 million, and net profit after tax in the range of $150 million to $160 million which would be growth of 18% and 44% respectively at the mid-points. The surprise upgrade was warmly received by investors and supported the market (FPH is ~15% of the index), while taking the healthcare giant’s share price back towards the record highs seen at the onset of the pandemic in 2020.

Dairy giant Fonterra also came through with an upgrade, lifting the FY25 forecast farmgate milk price by 50c to $8.50 per kgMS. Increasing balance sheet strength means that farmers will be paid 10% more of the FY25 forecast and earlier in the season.

FY24 earnings from continuing operations are expected to be at the top end of the forecast range of 60-70 cents per share. A lift in dairy prices is providing relief for dairy farmers, and a key part of our economy.

Further down the boards the recent result from Michael Hill highlighted the differing situations of the NZ and Australian economies with the latter currently more resilient in several aspects. Full year revenues rose 4.2%, with those in Australia up 10.3% and New Zealand down 11.8%. There appear to be similar trends at the start of the new financial year with same store sales in Australia up 5.0% but New Zealand down 6.2%.

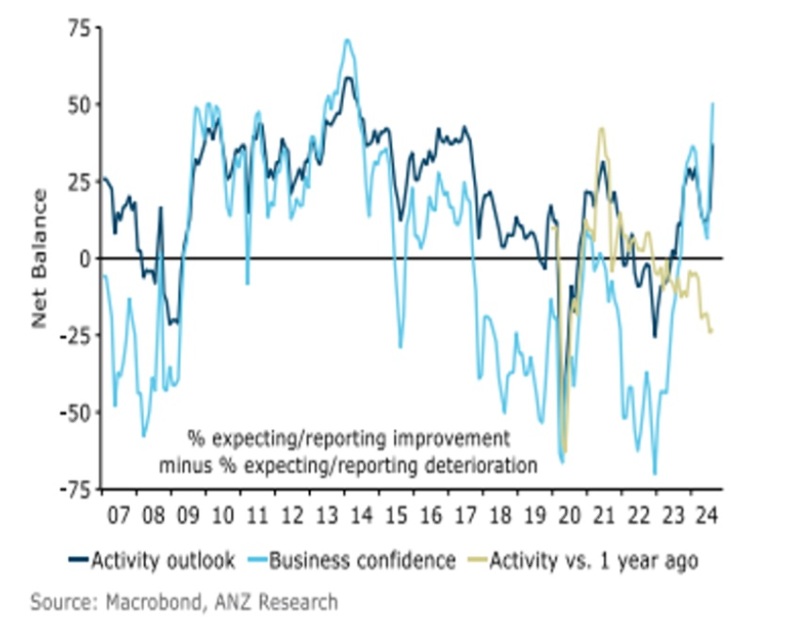

Time will tell if New Zealand plays a degree of catch up, with the RBNZ already on the rate cutting journey while the RBA could be stuck in the gates a while yet. The move by officials here looks to have already manifested in a pick-up in business confidence.

New Zealand business confidence

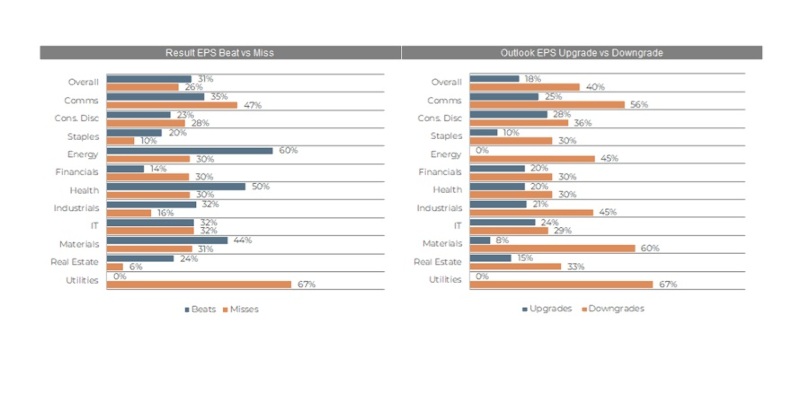

The Australian reporting season also reflected the above. In the “here and now” Australian companies appear to be doing better generally. Earnings beats outnumbered misses by a ratio of 1.2 to 1. The outlook is a slightly different story. During the reporting season 18% of ASX200 companies delivered upgrades in terms of what was expected, but 40% came through with downgrades.

Source: Barrenjoey

Expectations were fairly low going into the Aussie earnings season, and the retail sector arguably delivered a positive surprise overall. While numbers from Harvey Norman disappointed (FY24 sales fell 3.6% and profits fell 35%), the result from JB Hi-Fi boosted optimism around the sector. Results were better than expected and July has started off well with sales at JB Hi-Fi Australia up 5.2% in July, and the Good Guys 2.7% higher. JB Hi-Fi’s New Zealand division though lost A$2.3m during the year.

Same store sales for July in NZ were down by 4.9%. Overall, a surprise special dividend also boosted sentiment. Shareholders are to receive A$200m in distributions when including the final dividend. The shares soared to a record high.

Aussie supermarkets are still doing well. Coles reported a 7.3% lift in FY24 earnings to A$2.2 billion. Revenues were up 5.7% at A$43.6b. Aussies are though being more selective. Food sales are up 3.7% in the first eight weeks of the new financial year while those for liquor are down 1.4%. Australians may also be spending more on frozen pizza as opposed to eating out – Domino’s came in with a soft result and guidance, with same store sales down 1.3% in the opening weeks of FY25.

There is also a bit of disparity in vehicle sales (the second quarter of 2024 ended with the worst June for new vehicle registrations in 10 years in NZ) across the Tasman. Results from Car Group were strong. The company, which operates the Carsales site in Australia and has around 2.6 million vehicles online across its sites globally, reported a 41% increase in revenues to A$1.1 billion in FY24. Adjusted earnings soared 37% to $581 million. The company sees the 2025 financial year as being equally strong revenue and earnings wise.

In the financials, results from QBE and IAG highlighted that insurance premiums are still inflating. CBA, the largest bank in Australia, beat forecasts with a full-year cash profit of A$9.8 billion, down just 2% on the record result a year ago. Interest rate margins have been strong at around 2%. Even better news for shareholders was that the majority of the spoils are being shared now, with record dividends of some A$7.7 billion, equivalent to around 80 cents of every dollar of earnings being paid out. CBA also extended share buybacks. Bad debts have been relatively low, and Aussie borrowers are generally getting by.

CBA is also the most valuable company on the Aussie exchange with a market cap of $224b. It’s also a stock held by half the Australian population, either directly or via a superannuation fund. CBA also owns ASB which also put in a strong performance for the year. Annual profit was down 7% to $1.455 billion, but last year was a record. Loan impairments rose marginally. ASB said around 20% of customers are yet to roll off rates below 6%, but given what the RBNZ has done, many will be feeling a lot better about the prospect.

Australia’s second biggest company, BHP, posted a 2% rise in underlying net profit to US$13.7 billion for FY24, ahead of estimates. Revenues rose 3% on the back of higher realised prices for iron ore and copper, and record volumes for the steel-making ingredient while those for copper were up 9%. With iron ore prices now under US$100 a tonne, how the Chinese economy plays out remains pivotal as ever to BHP.

Results from the energy sector were marked by a fall in oil and gas prices, although shareholders were rewarded. First half core earnings at Santos fell 18% to US754m but the interim dividend was up 49% on a year ago to a record. The company has said that a number of multi-billion dollar projects are set to reach final investment decisions over the next year, and this would be weighed against the option of returning cash to investors. Free cash flows were US$1.1b in the first half and are forecast to rise to as much as US$4b by 2027.

Amongst the companies coming in with a strong result and outlook, as well as upping the dividend, was Brambles. The pallet maker reported that FY24 sales rose 8% to US$6.5 billion, while operating profit after tax leapt 19% to US$779.9 million. Pricing has been strong. The company sees 8-11% growth in underling profit in FY25. The shares have traded up to record highs as a result and are up over 30% year to date. Brambles is held across a number of the Devon funds.

Overall the deluge of results on both sides of the Tasman provided a host of contrasts and pointed to some differing views on the outlook, both at a micro and macro level. This, along with contrasting share price reactions, highlighted the importance of being highly selective and discerning when it comes to active investing strategies.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « A bit of volatility | New Zealand Equity Monthly August 2024 » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |