Harris or Trump? It doesn’t matter for investors

Whether the Democrat’s Kamala Harris (from the blue team) or the Republican’s Donald Trump (from the red team) becomes the next President of the United States, will likely have little or no impact on longer term investment returns, according to Insync Funds Management (Insync).

Thursday, October 10th 2024, 5:47PM

by Insync

By Grant Pearson & Monik Kotecha

‘As it draws closer to the big day, media and financial commentators will go into overdrive tempting investors to pre-position their investments for a red or a blue team win,’ said Insync’s Head of Strategy and Distribution, Grant Pearson. ‘Politicians themselves will likely use fear and temptation to try to influence perceptions of how their actions, or those of their nemesis, might impact investment markets.’

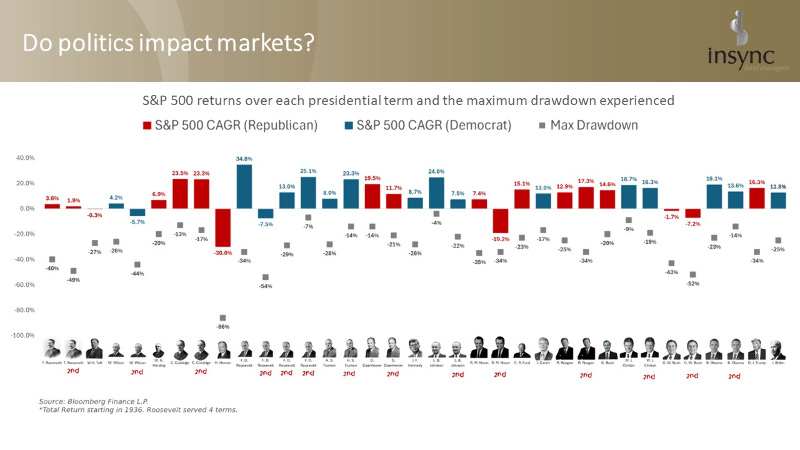

But the evidence, as captured below, suggests investment returns will be similar when looking beyond immediate market reactions, regardless of the outcome of the election.

‘If we look at every US election result since President Roosevelt, and how markets actually behaved across each term, we can see that who wins and who loses the presidential race makes little difference to returns at all,’ Mr Pearson said.

Across the last 35 presidencies, Republicans presided over the most negative and most damaging investment return periods. They had 4 negative return rates, compared to 2 for the Democrats.

‘These six presidential terms, however, total a mere 17% of all government terms since before World War II,’ Mr Pearson said.

Positive terms amounted to about the same in number and magnitude, no matter which party won, and so too were the worst falls.

Insync’s Chief Investment Officer, Monik Kotecha, said there are times where a particular sector of the market may be favoured, or not, by a certain presidency.

‘We last witnessed that with Trump in 2016. Aspects of the healthcare industry, for example, were negatively impacted for a short time by Trump’s unsuccessful attempt to repeal the Affordable Care Act,’ Mr Kotecha said. ‘While overall, politics don’t dictate broad market outcomes, the 2024 election does present the widest range of policy and investment outcomes I've seen in my 33 years of market observation.’

Mr Kotecha said this election will likely have more pronounced effects at specific industry and stock levels.

‘This is due to stark differences between the parties on key issues such as trade policy and its influence on the pace of de-globalization, energy policy impacting the oil and gas and renewables sector, and regulatory approaches across industries from financial services to technology.’

The key takeaway for investors, however, is that while US elections can create short-term volatility and impact specific sectors or stocks in election years, they rarely change the long-term trajectory of the overall market.

Mr Pearson said, ‘Traders beware. As for investors, they are best advised to focus on business fundamentals, have exposure across multiple sectors, and maintain a long-term view rather than letting election outcomes drive their investment decisions.’

About Insync Funds Management

Established in July 2009, Insync Funds Management Pty Ltd (Insync) is a core global equities manager based in Sydney with Equity Trustees as its RE. A high conviction, bottom-up, quality style manager, Insync employs a valuation-based approach, selecting stocks from a concentrated group of global large cap companies. These stocks must meet Insync’s rigorous filters, benchmarks and hurdles, and be beneficiaries of one or more of 16 global megatrends that Insync has identified are key predictors of growth. They must also consistently allocate capital efficiently, and have a high Return on Investment Capital (ROIC).

Established in July 2009 by Monik Kotecha and Garry Wyatt, Insync Funds Management Pty Ltd (Insync) is a core global equities manager based in Sydney with Equity Trustees as its RE. A high conviction, bottom-up, quality style manager, Insync employs a valuation-based approach, selecting stocks from a concentrated group of global large cap companies. These stocks must meet Insync’s rigorous filters, benchmarks and hurdles, and be beneficiaries of one or more of 16 global megatrends that Insync has identified are key predictors of growth. They must also consistently allocate capital efficiently, and have a high Return on Investment Capital (ROIC). For more info see https://www.insyncfm.com.au/

| « Strategic versus Tactical Allocation | Why the Reserve Bank should cut interest rates by a further 1% before Christmas » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |