No plain sailing around Castle Point

Castlepoint turnaround taking longer than expected.

Monday, November 18th 2024, 7:36AM  1 Comment

1 Comment

The three founders of Castle Point Funds management have all left and new owner, Perpetual Guardian says it has not been plain sailing turning the funds around.

The last of the three founders to leave was Richard Stubbs who has taken up a role at Forsyth Barr as Director, Institutional Wealth Management. In this role he will be helping Forsyth Barr's wholesale clients "get the most of out the quality resources and people available" at the firm.

He will be working with a team that specializes in philanthropy and ESG, and the wealth research team.

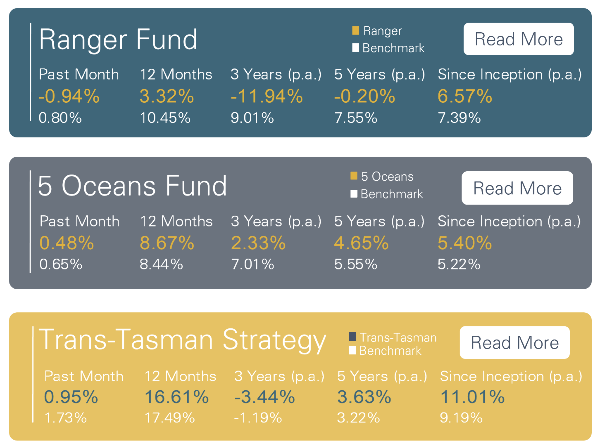

Perpetual Guardian says in a note to clients that in the first five months of ownership it has made some change in the underlying investments, including exiting some investments, introducing others and reducing cash.

"As I mentioned at the onset, improving the funds returns would be and remains the priority however, it has not been plain sailing. Some of the simple changes have already been made with minimal disruption to prices however the reorganisation is not finished, but we remain steadfast in our goal to provide an investment portfolio that separates us from past mistakes and focuses on the future.

"Whilst I am pleased with progress to date, the refocus is taking longer than originally anticipated and remains work in progress. During the month, for Ranger, we have lowered the weighting in nine investments and increased our weighting to one of our new inclusions."

"Whilst investments we have bought do not yet show in the top 10, we are actively increasing our exposures with one representing a little over 3%. The new companies span different industries which includes steel and electrical. Whilst the top 10 may appear static, it is not because we are not acting and where we see improved liquidity, we shall step up the pace of change."

Historically cash levels have been kept high, sitting at approximately 30% in June, but we do not see this as an appropriate level for this fund. The cash and fixed interested weighting continue to be elevated however it has fallen by approximately 10% through portfolio changes and we remain committed to becoming fully invested.

Whilst change may be slower than preferred, buying new and rebalancing or exiting other investments preferred by prior management, especially where there is somewhat limited liquidity, is done with a keen focus on the portfolio mix and its impacts.

Thank you for your ongoing patience and support during this time of transition. We have made some good progress but have also had some knocks along the way, but we remain optimistic at some of the optionality embedded in the portfolio and will continue to introduce new ideas to refresh and renew elsewhere.

In the 5 Oceans fund Castle Point has added the Schroders Global Value Fund and is looking at adding the Daintree Core Income Trust.

Of the latter it says, "We continue to like their strategy and risk mitigation as well as their access to markets not well served elsewhere."

| « Failure to plan for data-hungry AI will have consequences | Value of index tracking seen in the numbers, says Kernel » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |