Extreme measures for extreme circumstances – why the RBNZ should cut the OCR by 0.75% when it meets this week

Around six weeks ago we made the case for a 0.75% cut at each of the two final RBNZ meetings of the year. This was a non-consensus call. In the end, the central bank cut rates by 0.50% last month, but expectations following October’s CPI number started to shift in terms of what will happen at this week’s meeting.

Tuesday, November 26th 2024, 12:57PM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

The rate implied by markets is now ~4.2%. In other words, while a 0.50% cut is favoured, there is also a possibility of a 0.75% cut. Within a relatively short space of time, this scenario has gone from what was seen as an outlier “extreme” call to one that is entirely “plausible.”

A general comment by “huddling” dissenters to a cut of such magnitude is that such large reductions are generally reserved for “extreme” circumstances. It is not too difficult to argue that we are in such circumstances now.

But even before that, it is worth remembering that the Reserve Bank’s mandate was changed at the end of last year to a single operational objective of “…future annual inflation between 1 and 3 percent over the medium term, with a focus on keeping future inflation near the 2 percent mid-point”. Maximum sustainable employment is no longer an operational objective in the RBNZ’s remit. However, as a secondary objective they “Seek to avoid unnecessary instability in output, employment and interest rates, and the exchange rate”.

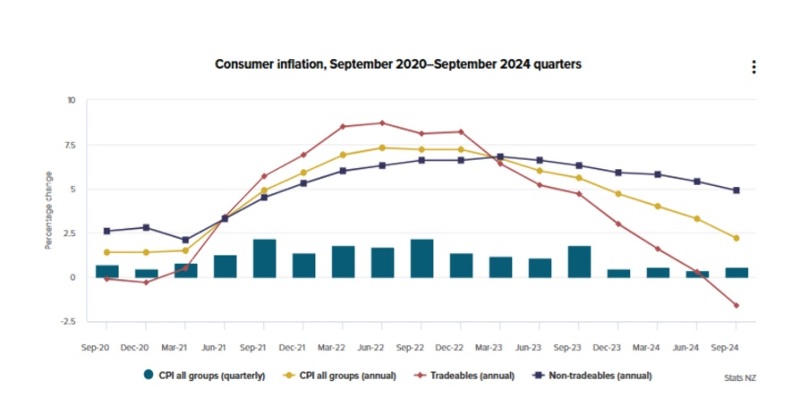

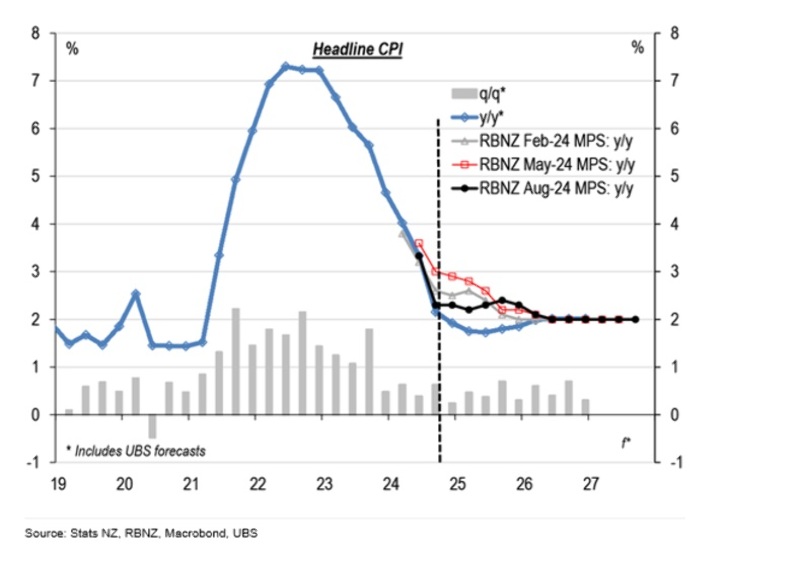

The September quarter CPI release showed that annual inflation is running at 2.2%, down from 3.3% at the June quarter. Expectations were for a print of around 2.2%-2.3%, and for a change the miss to the bottom side was courtesy of lower non-tradeable (domestically driven) inflation, which is the lowest in three years, despite a surge in property rates.

There was the mitigating factor of a 22.8% fall in early childhood education fees (a result of the government FamilyBoost rebate), but there’s no escaping the observation that inflation pressures are moderating. It is also worth highlighting that domestic inflation typically lags the labour market by ~6 months. Unemployment is rising, so inflation here might fall much faster yet. Meanwhile, annual tradable inflation is now at -1.6%, with falling fuel prices a factor.

On a quarterly basis, CPI inflation was just 0.6%, at the lower end of expectations, and just 0.2% on a seasonally adjusted basis (the lowest since the lockdown impacted June quarter of 2020). On an annualised basis, seasonally adjusted inflation is just 1.2%. Core inflation measures like the 30% trimmed mean and the weighted median, on a quarterly basis, slowed to the lowest level since 2020.

For the first time since March 2021, annual headline inflation is within the RBNZ’s target band of 1% to 3%. Inflation could now go through the bottom of the band due to the recession. Having landed on a 0.50% reduction last month, should the RBNZ now look to play catch up and go with a 0.75% cut this month?

Inflation has fallen to within the bank’s target band at pace, and given the current downturn, it could undershoot the 2.0% midpoint and go right to the bottom of the band at 1%. It is therefore not hard to argue that we should be at, or below, the RBNZ’s “neutral” rate (neither boosting nor restricting growth) of 3.75% (some estimates of this are much lower) right now.

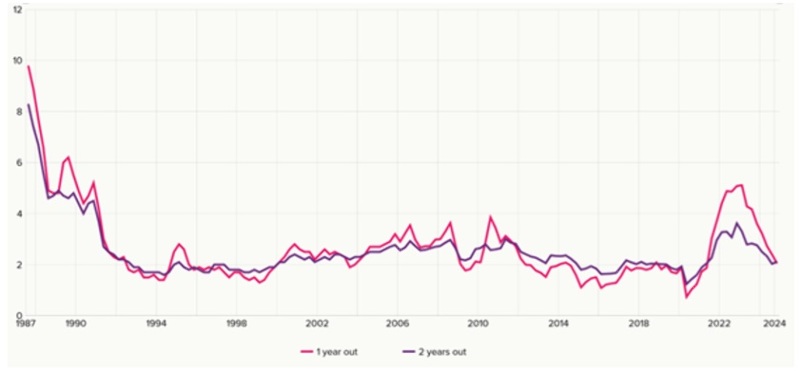

We have had more good news on the inflation front since the quarterly CPI. Monthly food prices fell 0.9% in October compared with September. Food price inflation in the 12 months to October was 1.2% against expectations for a 1.5% lift. Rents, a sticky area of price inflation, are also moderating. On a “flow” basis these rose just 0.1% for the month and 0.7% for the year. Petrol prices have deflated 14% in the year to October. International airfares have descended 2.8%. The RBNZ itself also released its quarterly survey of business inflation expectations. One year ahead views have fallen, and there was only a small rise in 2-year ahead inflation expectations (to 2.1%).

Source: RBNZ

Expectations for the unemployment rate remained relatively stable (5.2% on a 1-year view). Expectations for wage growth declined one year ahead but increased two years ahead.

Regardless of expectations, unemployment is rising. In the September 2024 quarter the unemployment rate was 4.8%, up from 4.6% in the previous quarter. Annually, the number of unemployed people increased by 24.2% to 144,900 (not seasonally adjusted). There were annual increases in the number of people who had been unemployed for three to six months (up 47.2% to 29,500), over six months to one year (up 53.2% to 32,500) and over one year (up 55.5% to 16,900).

More people are remaining unemployed for longer periods while the employment rate is declining, as wage growth slows. Annual wage inflation was 3.8% versus 4.3% in the June quarter. The labour force participation rate was 71.2%, down 0.5 percentage points over the quarter and 0.8 percentage points over the year. Over the year, the number of people who were not in the labour force grew by 57,000. A slowing employment situation and rising unemployment will clearly be a poignant part of the data set for the RBNZ.

It is interesting on where businesses now see the OCR. More than half of RBNZ survey respondents see a 50 basis points cut to 4.25% by the end of the year. The mean expectation for the OCR was 4.20%, so some are also in the 75bps cut camp in November.

The risk of undershooting inflation on the downside is particularly possible in economies such as ours which are facing numerous challenges and are effectively deflating. As noted last month, our economic data is generally dire (with the dairy industry -auction and forecast farmgate milk prices have been rising, and parts of the agricultural sector – kiwifruit exports are booming, notable exceptions), and the RBNZ should probably be pushing the panic button.

The economy is in recession, and unemployment is on the rise. Various measures of confidence may be picking up, but from depressed levels, and are on the back of rate cuts which take time to filter through the economy.

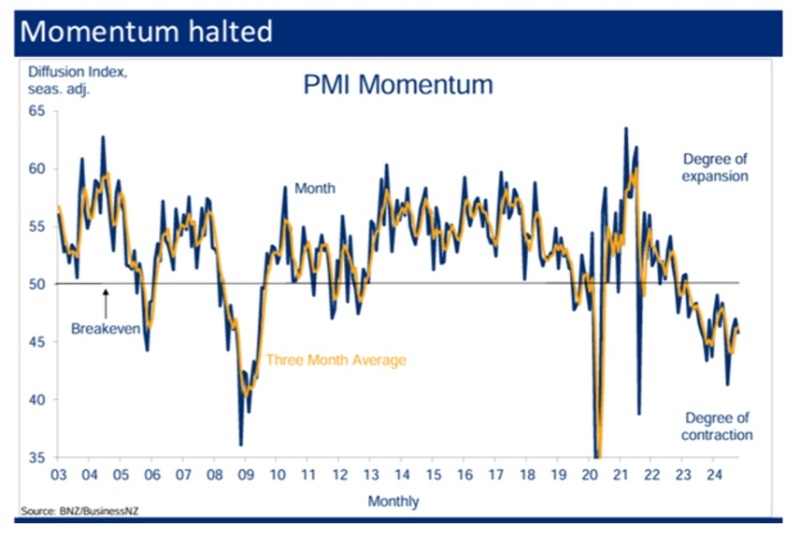

We have had further evidence of the challenges that NZ is facing. The recent BNZ Business NZ Performance of Manufacturing Index showed that New Zealand’s manufacturing sector contracted at a faster rate during October. The report was appropriately titled “Lost Momentum.”

The seasonally adjusted PMI for last month was 45.8, down from 47.0 in September, and the lowest level of activity since July 2024. The sector has now been in contraction (<50) for 20 consecutive months. There was some hope that recent improvement would be sustainable, but we now appear to be heading the other way and this is a big reality check.

Sub-index results for Production and Deliveries dropped along with employment – people are still losing their jobs in the manufacturing sector (over 14,000 in the last quarter according to another report). There was a little bit of brightness though with new orders nudging up to its highest level since May 2023, albeit still in contraction territory.

There is some optimism about the future, but the “here and now” is still tough. The proportion of negative comments from respondents has also eased a bit to 53.5%. So, half the manufacturing sector is gloomy it would seem, compared to three quarters in June before interest rates started being cut. We might need a few more (and bigger) rate cuts to get our manufacturing sector into more positive spirits.

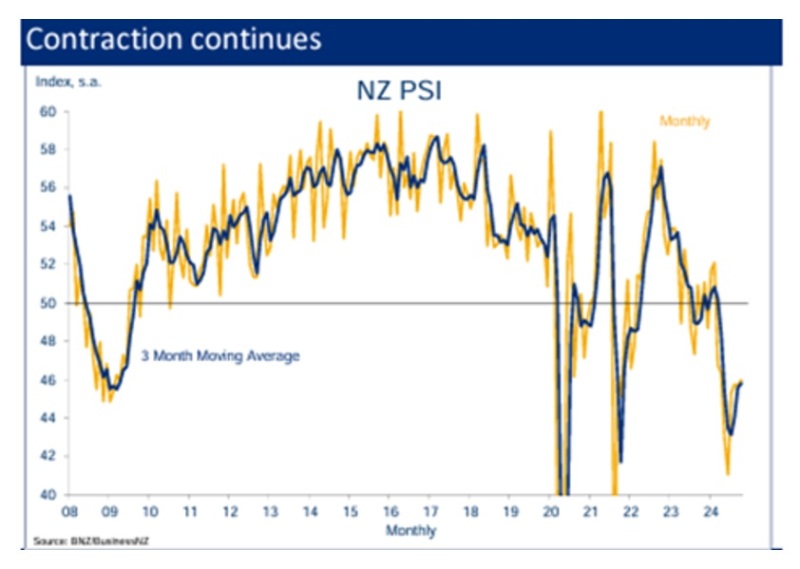

The services sector isn’t doing much better, although appears to be heading in the right direction at least. The BNZ – Business NZ Performance of Services Index (PSI) nudged up slightly from 45.7 to 46.0 in October. The long-term average is 53.1.

The recent PSI report was titled “Stuck in a Rut” and showed that the services sector is still firmly in reverse, although it is contracting at a much slower pace than it was in June (when the PSI was 41.1). BNZ noted that the activity outlook for the sector has improved in recent business surveys, but the “here and now” remains extremely challenging. New orders at 48.1 were the highest level since February (but still below 50). The employment Index recovered some ground after a big fall in September but is still only 46.4. The proportion of negative comments is getting better. Concerns over the cost of living and general economic climate dominate responses.

New Zealand is still an outlier and underperformer compared to international services indexes – the JP Morgan Global Index stands at 53.1.

The PSI retail trade index improved to 50.3 but remains well below its historical average of 54.0 for October. Retail activity tends to improve in the lead-up to summer and Christmas, but it is coming off a very weak base. With the PMI and PSI both stuck firmly in contraction there is a clear case for more significant monetary policy easing (the market is pricing in 132bps of cuts over the next 12 months currently). The Composite (manufacturing + services) index at 46.1 is tracking below levels from a year earlier. This still suggests downside risks for GDP.

Things are still tough on the retail front. Stats NZ reported this week that the total value of nominal retail sales fell 0.7% from the June quarter to $30b. Volumes were down 0.1%. This is the ninth consecutive quarterly drop. Fifteen of the 16 regions had lower seasonally adjusted sales values in the September 2024 quarter compared with the June 2024 quarter. Most industries are doing it tough – ten out of 15 had lower seasonally adjusted sales volumes in the September 2024 quarter compared with the June 2024 quarter.

Annually, the total value of actual retail sales was down 2.8%. Households have been winding back their spending (and will only get relief as mortgage rates drop). Some are saying that the September quarter might be the low point for retail sales, as tax cuts and lower interest rates feed through. The data suggests however that DDP growth is likely to remain challenged – although we will have to wait till just before Xmas to get the GDP print for the September quarter (and too late for the RBNZ meet).

Meanwhile there are some flashing red lights on other fronts. The growth outlook for China, our largest customer, remains uncertain. Officials in China have announced stimulus initiatives recently, but there remain question marks (as also noted by the RBNZ) about their effectiveness, which poses downside risks to New Zealand’s real export growth, as well as export and import prices.

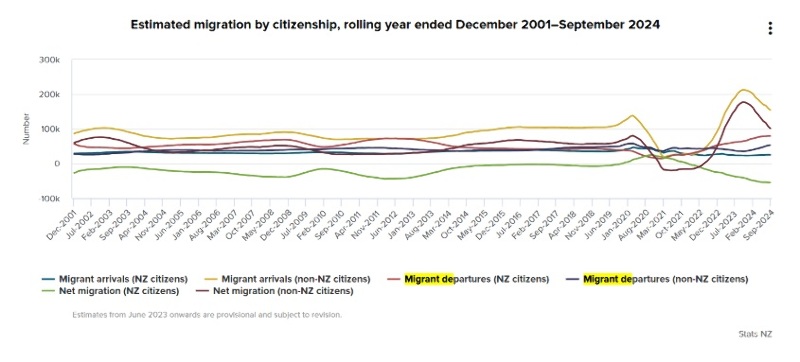

Some other previous tailwinds are dissipating. The migration boom appears to be petering out with fewer inbound arrivals, while the brain drain of kiwis appears now to be running at a record pace (54,700 annually on a net basis). The annual net migration gain in the year to September 2024 was 44,900, massively down on the 136,300 peak seen in the year to October 2023.

Overall, migrant departures of 133,000 for the year are the highest on record. On a monthly basis September saw a 23% decrease in migrant arrivals and a 35% increase in migrant departures on a year ago. We’ve got more kiwis leaving in droves, and the number of non-NZ’ers coming is falling. These numbers reflect an economy which is in a tough spot, and unattractive compared to alternatives.

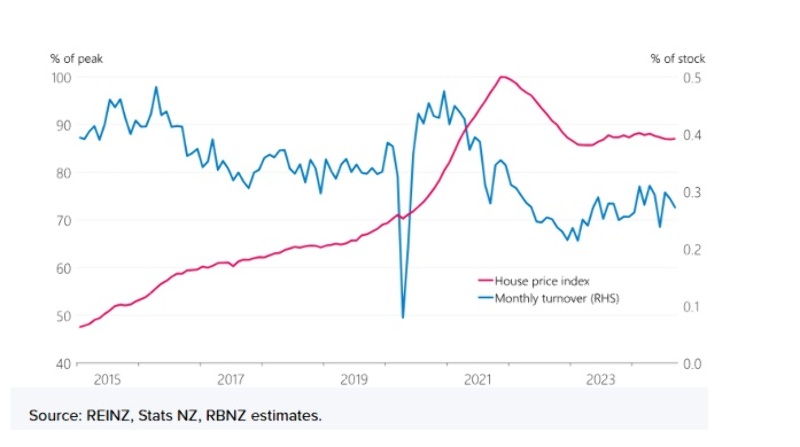

The slow-down in net migration (in addition to high interest rates of course) is also dampening housing demand. This was highlighted in the RBNZ’s semi-annual Financial Stability Report. The central bank has highlighted how important housing is to the economy, accounting for most of household wealth, while homes loans make up 60% of bank lending. The RBNZ noted that housing market activity remains “subdued.” This was confirmed by the REINZ October report which had NZ house prices are down 1.1% on an annual basis.

Prices have fallen 14% since their late 2021 peak nationally, but with significant regional variations – prices in Auckland are down 20% while those in Wellington are down 23%. Inventories of homes available for sale have built up and days to sell remains elevated. There is a glut of townhouses, particularly in Auckland.

The bank sees house prices as still stretched for prospective buyers and around the top of their estimated sustainable levels. Tax policy changes (interest deductibility going to 100% from April 2025 and the recent reduction of the brightline test to two years) may see investor activity pick up from weak levels. The bank said that financial stresses amongst developers were “normal” for this point in the development cycle.

The bank did note that while debt servicing stresses are elevated, several factors have mitigated the impact of the “boom-bust” cycle including a resilient labour market, high inflation (eroding real debt values), the fact that house prices were at their peak for only a brief period and strong business lending standards which have meant borrowers have built up financial buffers. The bank estimates that less than 2% of the current stock of lending is to borrowers in negative equity.

The RBNZ said that its recently activated limits on high debt to income mortgage lending will act as “guardrails.” That said, is it possible to contend that many parts of the economy are already “off the rails.”

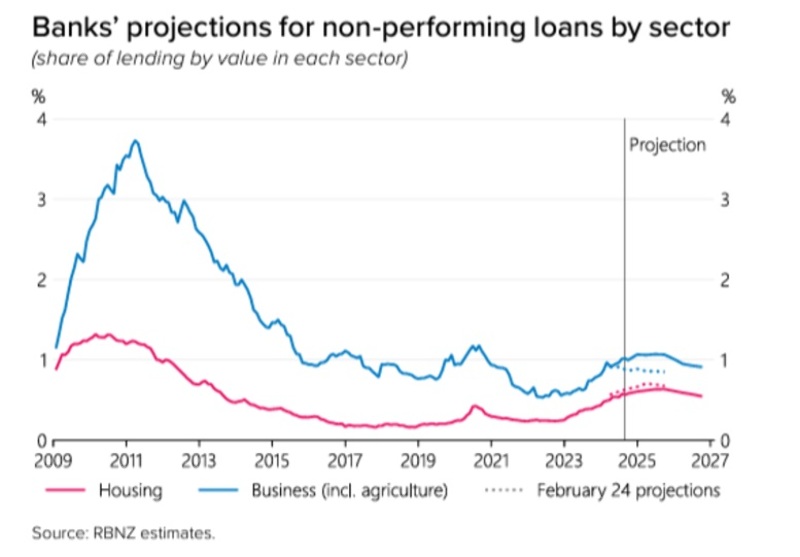

The RBNZ noted that debt servicing costs are nearing their peak and beginning to decline, and the shift will make mortgage costs more “manageable” for households. However the RBNZ admitted that domestic economic challenges remain. Many households and businesses are feeling financial pressure and rising unemployment is posing challenges for some borrowers. The RBNZ noted that banks anticipate a slight increase in non-performing loans, albeit still below levels seen in previous recessions.

Does all this mean that officials should be forced into action stations now with a bigger rate cut?

Some good news is that a larger rate cut now will take less time to filter through to the economy than it did previously. Last month members of the Devon investment team attended a speech on the transmission of monetary policy given by the Assistant Bank Governor Karen Silk, who noted that around 75% of new home loan flows currently carry interest periods of one-year or less, and circa 70% of existing home loans will be repriced within the next nine months.

There is though something of an imperative with the central bank meeting this week in that officials do not have their next meeting until February 19, 2025. That’s nearly three months during which quite a lot can happen to our growth profile and not necessarily in a good way.

In addition to very large companies, we meet and talk with a lot of smaller businesses, and it is clear that many are struggling, and some are even at the brink of failure. A larger rate cut this side of Christmas might make all the difference.

There are those that contend a large rate cut is not warranted, considering the Fed in the US has stepped down to a 0.25% rate cut as this month’s meeting. However, there are some additional points of relevance to note. The US economy is growing at 3% while New Zealand’s is contracting, and the Fed also holds meetings in December and January.

With this backdrop, will last month’s inflation figure be the straw that the breaks the camel’s back and drives the RBNZ to cut rates by a thoroughly plausible 0.75%?

Or will the much-needed real jumbo cut be avoided altogether, to save an admission that the NZ economy is lagging many others, and that rates were pushed up too high too fast and kept there for too long? Time will tell.

As a side note, the RBNZ also recently said that the strength of NZ’s financial system means we are able to “weather economic uncertainties and challenges, including increased geopolitical tensions.” However, the outcome of the US election could be very relevant to New Zealand given Donald Trump’s plans to ramp up protectionism, particularly towards China. RBNZ Deputy Governor Christian Hawkesby also told a Parliamentary committee. that Donald Trump’s policies would be inflationary “at the margin” but manageable. If this is the view, there seems little to hold the RBNZ to take rates towards neutral at this week’s meeting.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Power Plays: Navigating New Zealand’s Electricity Market | Animal spirits » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |