Don’t bet on house prices rising faster than incomes

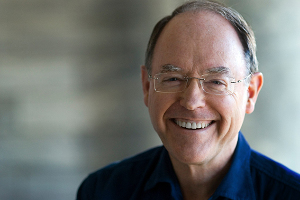

Former Reserve Bank Governor and National Party leader Don Brash says there are grounds for believing that house prices may finally have ended the three-decade period when they rose significantly faster than incomes.

Wednesday, January 15th 2025, 6:00AM  3 Comments

3 Comments

by Sally Lindsay

Former Reserve Bank Governor and National Party leader Don Brash says there are grounds for believing that house prices may finally have ended the three-decade period when they rose significantly faster than incomes.

He says the far-reaching policy changes the coalition government is undertaking have the clear intention of preventing further house price escalation.

These changes include obliging local authorities to zone housing sufficient housing land for the estimated need over the next three decades; removing the restriction on building small “granny flats”; allowing for greater intensification around transport nodes; freeing up the rules and regulations arising from the Resource Management Act; and reducing some of the rules and regulations which currently make house-building such a constipated process.

“If the Government is serious about these policy changes – and Chris Bishop, Chris Penk and Simon Court certainly seem to be – it would be unwise to make a substantial bet on house prices continuing to rise faster than incomes, as they have done over the past 30 years,” Brash says.

“And if these policy changes actually produce a gradual decline in house prices over, say, the next decade, the effect on our society will be profound.”

“Relative to household incomes, house prices in major urban centres are absurdly over-valued, largely because of the deliberate policies of local governments, which have pushed section prices to ridiculous levels, as the Productivity Commission and others have shown.”

Brash says it is precisely the strong house price growth of the past several decades which lies at the root of most of the country’s social and economic problems.

“Relative to household incomes, house prices in major urban centres are absurdly over-valued, largely because of the deliberate policies of local governments, which have pushed section prices to ridiculous levels, as the Productivity Commission and others have shown.”

As for recent claims describing house prices of $500,000 as well within the reach of budget-conscious first home buyers, they just show how out of touch with the reality they are, Brash says.

A young couple starting a family, and perhaps working 60 hours a week between them at, say, $26 per hour – some 10% above what the minimum wage will be by 1 April this year – will have a pre-tax household income of $81,000 per annum.

This means that a house priced at $500,000 is already more than six times this family’s household income – whereas a multiple of three times is generally regarded as being “affordable”.

“It’s no surprise that New Zealand’s balance of payments deficit is currently the highest in the developed world.”

And of course in Auckland, where the median house price is roughly double that $500,000 figure (which applied to the West Coast of the South Island), house prices are still ridiculously out of reach for the average wage earner, Brash says.

“The consequences of these still-elevated house prices in terms of social distress are all around us. Solve that problem, and many other social problems melt away.”

He says the fact Kiwis have come to expect house prices to keep rising faster than incomes is a significant contributor to New Zealand’s lousy household saving rate – why save when homeowners are convinced their wealth keeps rising without any saving required? – and to a persistent need to borrow from overseas.

“It’s no surprise that New Zealand’s balance of payments deficit is currently the highest in the developed world.”

| « Similar Price Growth |

Special Offers

Comments from our readers

The future prices and rents. The market has long spells of bad news and no growth then sudden bursts of growth just when you not expecting it.

Instead of relying heavily on councils, new developments could shift to a model with minimal council dependency by adopting larger land parcels (such as quarter-acre lots) where each property manages its own water tank and septic system. This approach would alleviate council infrastructure constraints, streamline rezoning processes, and provide a practical solution for everyone—a win-win-win.

Sign In to add your comment

| Printable version | Email to a friend |