Back to the future

Many markets have enjoyed a very positive start to the year. The Dow surged 4.7% in January, while the S&P500 advanced 2.8% and the Nasdaq rose 1.6%. European indices rose nearly 7% to record highs and the UK’s FTSE100 surged over 6%...

Monday, February 17th 2025, 11:37AM

by Devon Funds

Many markets have enjoyed a very positive start to the year. The Dow surged 4.7% in January, while the S&P500 advanced 2.8% and the Nasdaq rose 1.6%. European indices rose nearly 7% to record highs and the UK’s FTSE100 surged over 6%. The MSCI World Index rose 3.6%. The Australian market has also enjoyed a strong start to the year, with a 4.6% rise. The NZX50 was something of an outlier with a 0.9% decline. This came ahead of an important month, with the earnings season upon us, and a rather important RBNZ decision due towards the end of February.

While optimism has been the prevailing mood in many markets, any air of complacency was shaken by political events in early February, as Donald Trump settles into his work at the Oval Office. The new administration announced blanket tariffs against Mexico, Canada and China, and signalled that Europe could be next. He has more recently proposed global tariffs on steel and aluminium imports. Investors at this stage however appear to be taking the view that an all-out trade war is not the most probable scenario, and like Trump’s first term, the current back and forth will ultimately end in negotiations and concessions. Though clearly this remains a great unknown.

Donald Trump initially signed an order imposing 25% blanket tariffs on Mexico and Canada (10% for Canadian energy imports), as well as a 10% duty on China. While Trump imposed tariffs during his last term, the latest measures are unprecedented. These tariffs have been imposed under emergency economic authority – this has never been used before for tariffs (Nixon used the precursor to the current law in 1971). There are no exemptions to the tariffs, and they were set to remain in place until the White House is satisfied that the “illicit fentanyl trafficking” into the US is under control and there is a dramatic reduction in migration and broader criminal activity at US borders.

Tariffs include a retaliation clause that will increase penalties if the trading partners impose tariffs on US imports. The measures in their current form would have significant impacts. Trade from Mexico in 2023 was US$475 billion, while that from Canada was ~US$420 billion (approximately 25% is energy related), and the tariffs are estimated now to affect approximately US$1.3-US$1.6 trillion of imports. There has been a one-month pause on their implementation granted to Mexico and Canada, but not for China.

The implications are that this will add to the cost of many household items for Americans. Trump though is prepared to take the economic risk on the view that this will simply be “short term disruption” and that tariffs will make America “very rich and very strong.”

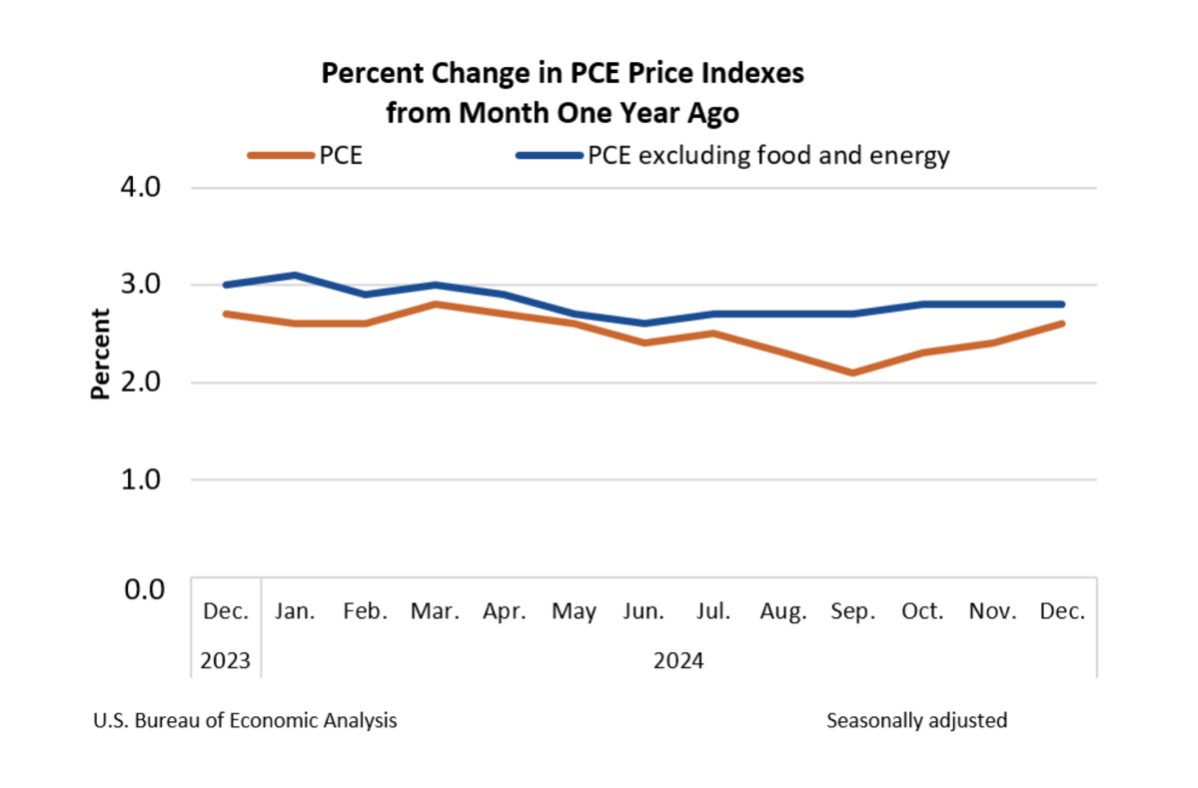

The impacts will be wide-ranging, and it is worth noting that current supply chains sometimes require parts to cross the border multiple times – thereby generating greater than 25% cost increases. Markets are therefore having to weigh up the balance of potentially lower growth against potentially higher inflation (with the Fed’s preferred inflation gauge already having accelerated to 2.6% on an annualised basis in December).

America’s trading partners did not take the action lying down. Mexico vowed to respond and Canadian Prime Minister Justin Trudeau announced retaliatory tariffs of 25% against US$155 billion of US goods.

The trade situation though looks to be a moving feast, with more twists and turns for investors. After the initial shock of the tariff announcement there was the news that Donald Trump granted Mexico a one-month reprieve after a “productive” conversation with the country’s President, who has agreed to station 10,000 Mexican soldiers at the border to clamp down on drug trafficking. This deal raised hopes that once again the bluster around protectionist measures is more of a negotiating tactic, for the self-anointed “master of deal-making.” After the Mexico concession Trump posted that every country is “dying” to make a deal.

What is happening currently is also a throwback to Trump’s first term, where the President effectively played bully, engaging in a game of “chicken run” in a show of strength and to ultimately secure concessions from trading partners.

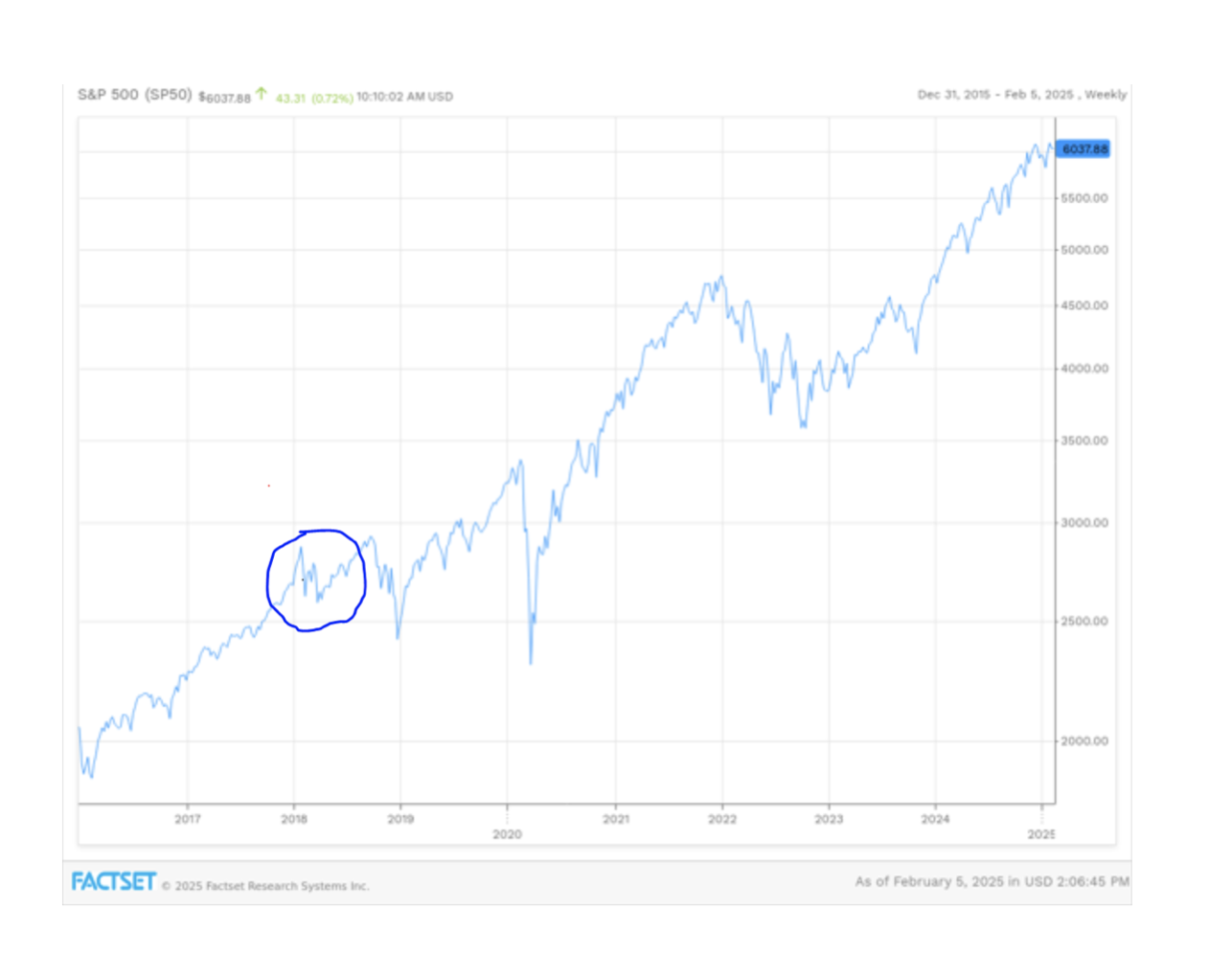

Events this time around have happened somewhat quicker and also appear more strategic. Trump imposed universal tariffs on steel and aluminium imports in March 2018 (over a year into his term), before moving to target the EU, Canada, and Mexico in June of that year. Markets were unsettled by these developments, but ultimately moved on.

S&P500

Trump has taken a more targeted, country-by-country, thematic approach initially this time around, and in doing so has already secured an early concession. The actions against the big three trading partners have been posited as a drug/fentanyl issue to some degree. Mexico has agreed to station a huge number of the National Guard at the border. Trump noted that talks would occur, and that the US had a “very good relationship” with Mexico. It is worth noting that it is also not a one-way one - Mexico for instance takes more than half of all gasoline exported by the US.

While Mexico appears to have “blinked first”, Canada (which Trump has also said should become the 51st state in the US) has also been relatively quick to make concessions. Trump has also granted a reprieve to Canada, on the top of that extended to Mexico. The 30-day pause comes as the two counties have agreed to take steps to prevent the illicit drug trafficking of fentanyl into the U.S (curiously Canada accounts for just 0.2% of fentanyl border seizures). President Trudeau said that Canada had made new commitments “to appoint a Fentanyl Czar” with a C$1.3 billion border plan, reinforcing the border with new choppers, technology and nearly 10,000 personnel.

Canada and Mexico appeared to have scored “brownie points” with Trump for their initial moves to increase border controls. For Trump it will be seen as an early moral, and very public, victory. It could also help minimise the level of damage that the American economy sustains. Currently, the US economy remains in strong shape, but the labour market is easing. A report showed job openings fell to 7.6 million in December, below estimates for 8 million. Layoffs totalled 1.77 million for the month. More positively, US factory activity has expanded for the first time in more than two years.

The situation with China remains less clearcut at this point.

China has retaliated with 15% tariffs on coal and LNG, along with 10% tariffs on a variety of other US imports, including crude oil, farm equipment, and certain cars and trucks, as well as enacting export controls on certain products related to critical minerals.

China has reiterated that the levies impost by the US “seriously violate” the rules of the World Trade Organization and “destructs the normal bilateral economic and trade activities.” China has also taken aim at a big US tech firm, saying that it is investigating Google for violating anti-monopoly laws. The move seems more a symbolic one given Google pulled its internet and search engine services in China in 2010.

Trump has meanwhile also asked for an audit of China’s compliance with the trade deal agreed in his first term. Things therefore could well heat up before they simmer down. China though will also be mindful that an “escalation” of tariffs could hinder the ability to hit economic growth targets (of ~5%) this year. The impacts to the US will though not be insignificant should the tariffs be implemented in their initially proposed form.

During this week’s testimony to lawmakers on Capitol Hill, Fed Chair Jerome Powell (who said the central bank was in no rush to cut rates) kept tariff talk to a minimum but Corporate America has been forthcoming with opinions. Coca-Cola has indicated it will pivot back towards plastic bottles as a result of duties on aluminium. Many other companies have also said they will have to put up prices.

Lots of US companies will be caught up in the crosshairs of US/China trade frictions, including the world’s biggest - Apple - which relies heavily in China for its manufacturing base. In theory the tech giant could shift some output to the likes of India (currently 13% of iPhone production), but this would be hugely disruptive. During Trump’s last term, Apple’s CEO Tim Cook secured a product exemption to avert matters. This could well be on the cards again.

Time will tell what happens when the one month pause passes, but certainly, one sector which would bear one of the biggest impacts is the automakers (including in Europe when Trump turns his attention there). Ford’s CEO has said the Trump Administration’s policy here was causing “chaos” within the auto industry.

Most automakers have factories in the US but also have at least one plant in Mexico. For an industry already facing profitability pressures, it does look likely that it will drive up the cost of vehicles materially. The duties will initially impact a quarter of the 16 million vehicles that are sold in the US each year, as well as the parts and components that go into them. One research firm has estimated that the price of an average car in the US may rise by ~US$3,000. US consumers could well be faced with a reignition of inflationary pressures.

Such is the globalisation of trade that the efforts to tilt more towards protectionism will have wide-ranging impacts, the extent of which are not known, but are being readied for.

This includes the Federal Reserve. Officials left rates on hold at their January meeting, but Chair Jerome Powell made several references to the uncertainty of outcomes from policy decisions by the Trump administration. This was as the central bank had already recognised that the “last mile” of inflation appeared to be getting stickier. It is understandable that officials are not looking to front-run the sequence of polices set to be rolled out under Trump. Tariffs, mass deportations, tax cuts, and increased fiscal spend come with inflationary risks, but the magnitude of these policies is unknown.

On the other side, de-regulation and cutting back on layers of bureaucracy in government could provide a deflationary offset. The outlook for the number of rate cuts in the US this year though is far from clear and (as we suggested in our Top 10 predictions for 2025), there may be less than many are expecting – a scenario of no more rate cuts this year is becoming a viable scenario. Effectively there are a lot of unknowns with respect to inflation. Meanwhile a strong economy and a stabilising jobs market afford the Fed the latitude to remain in data-dependent mode. Donald Trump’s immediate reaction to the Fed decision was notably dismissive – he posted on social media that the Fed had “created” inflation. Less than a week later he however said that the Fed made “the right call.”

Back to trade - while Mexico, Canada, and China have been the initial focus of attention, other countries are waiting their turn. Trump has said the UK and EU were acting “out of line,” but that the EU was worse, and that tariffs could be imposed on the bloc “pretty soon.” He added “They don’t take our cars, they don’t take our farm products, they take almost nothing, and we take everything from them. Millions of cars, tremendous amounts of food and farm products.” Several European corporates have also changed their outlooks as a result of this uncertainty, including Estée Lauder and UK-based drinks giant Diageo. The European Commission has said tariffs would trigger “firm and proportionate” countermeasures.

Following the proposals on steel and aluminium, across the board tariffs, which may impact New Zealand, now appear an increasingly real prospect. Initial moves have already an impact on our largest company. Fisher & Paykel Healthcare announced that (notwithstanding the pause) it expects costs to increase under new US tariff regime. The company currently manufactures approximately 45% of its volume in Mexico (and approximately 55% in New Zealand). Approximately 43% of the company’s revenue comes from the US and 60% of US volumes are supplied from the company’s Mexico manufacturing facilities. US trade policies could therefore add 2-3 years to the company’s efforts to achieve a gross margin target of 65%.

It is worth noting that FPH has pass-through agreements in many of its contracts and customers may wear some of the tariff pain. FPH also has some optionality in the event it does need to pivot. While coming with additional freight costs, some manufacturing capacity could be moved to NZ. Sales out of Mexican facilities could be redirected towards Europe. These potential developments are not ideal, and the uncertainty around whether the company will need to recalibrate looks set to persist for a while year.

Uncertainties with respect to trade, and Trump’s policies generally, could well increase levels of market volatility in the near term (as also suggested in our Top 10 Predictions for 2025). Heightened levels of volatility do though create conducive conditions for astute active investors.

Adopting a more domestic focus, the kiwi earnings season which is now underway will once again be a fascinating one, against the backdrop of an economy that is experiencing the worst per capita recession in over 30 years. The challenges of the “here and now” are well known, but markets are of course forward looking. Outlook statements will be in focus.

There is then the small matter of the RBNZ. Arguably some economic metrics are plateauing, but current confidence (consumer and business) is low. Unemployment is at a 4-year high of 5.1%. Will officials roll out a much-needed super-sized rate cut? Time will tell. Across the Tasman, the door to an RBA rate cut this month is now ajar following a softer than expected quarterly inflation print (which has added to weak prints on housing and retail sales). Interesting times!

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Harbour Outlook: A rebound amid uncertainty | Credit where credit’s due » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |