KiwiSaver gender gap widest in middle-age

Balances have climbed after a year of strong market performance but women are still being left well behind as compound interest works its magic on their male counterparts’ larger balances in the lead-up to retirement.

Tuesday, March 18th 2025, 6:00AM

by Kim Savage

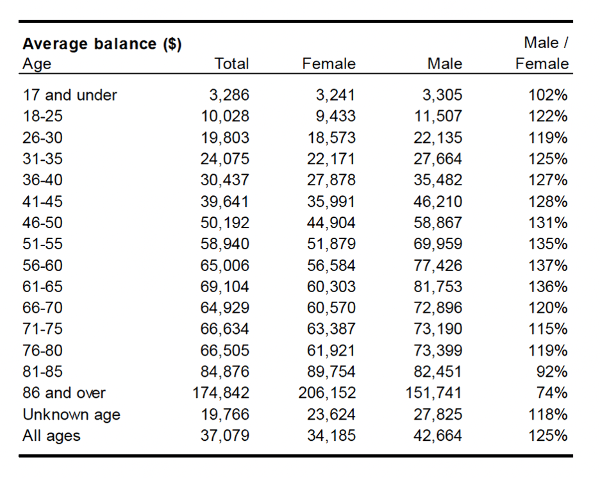

Research from actuaries MJW based on data from KiwiSaver providers and released today by the Retirement Commission shows the average KiwiSaver balance is $37,079, up by $5,256 on the previous year.

The 25% difference in average balance between men and women has remained steady for the past two years. The average balance for women is $34,185 while for men it is $42,664.

As KiwiSaver members age, the gap widens, peaking around 37% for those aged 56-65, which concerns the Retirement Commission, with women retiring with around $20,000 less than men.

Source: KiwiSaver Demographic Study 2025, MJW for the Te Ara Ahunga Ora Retirement Commission

“It tells us that at an age when many women may be returning to the full-time paid workforce after years of unpaid caregiving and necessary part-time work, the effect comes more starkly into focus,” says Te Ara Ahunga Ora Retirement Commission Policy Lead Dr Michelle Reyers.

“Also of significant interest is that as at 30 June 2024, the gender pay gap is 8.2% and trending downwards, yet we’re not seeing that decrease reflected in the average gender KiwiSaver retirement savings gap.

“The impact of compounding interest on balances informs some of this, as money invested earlier has time to grow, but if women’s balances are lower than men’s in younger life, they will likely remain lower.”

Shrinking the pay gap not enough

Calls to raise minimum contributions for KiwiSaver are growing louder, and the Minister of Finance Nicola Willis has confirmed she is taking advice on where to take KiwiSaver next, looking at both contributions and how members can see improved returns.

Retirement Commissioner Jane Wrightson says the gender pay gap can mean women earn less and therefore save less. Women also tend to spend longer periods in unpaid work, and are hit harder by life shocks like unemployment and divorce.

“This unchanged KiwiSaver retirement savings gap is one of several reasons why we’re advocating to get New Zealanders contributing more to KiwiSaver across the board.

“We’re arguing for system change, and one opportunity we’ve identified is to increase the default contribution rate of all individuals to at least 4%, with employers matching it at this level or contributing more.”

What happens when we turn 65?

Aside from the gender gap continuing to show up in the data, the research offers some further insight into life after 65 with KiwiSaver.

While the average balance among the membership is growing, there are still members in each age group with less than $10,000 saved. For those aged 61-65, 15.8% are reaching retirement age with less than $10,000 saved, although they could well have joined late or contributed less for various reasons including being self-employed and opting out.

A small portion of members aged over 65, 5.8% or 190,000 people, seem to be using KiwiSaver as a means to invest in their retirement, or they may well still be working.

| « [The Wrap] Just when you thought there would be less there's more. | FMA files charges against former adviser » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |