Levelling The Tax Playing Field

What it means for Trans-Tasman share investors

Wednesday, April 4th 2007, 3:47PM

By Murray Harris, Director – Business Development & Relationship Management for Goldman Sachs JBWere (NZ) Asset Management

Our Favourite Game

It was only February, summer just seemed to be hitting its full stride and already we had turned our attention to the hype and rivalry which we so love at this time of the year – and doesn’t it get earlier every year? – that’s right, the Super 14 competition got into full swing.

But just imagine if the Super 14 competition was played on a field which was tilted at a slope of 33% in favour of one team – and the teams don’t get to change ends at half time. Absurd! I hear you say… the teams would never agree to that. It simply wouldn’t be a fair game!

Well, that’s exactly the way the tax game has been played for Trans-Tasman share investors with respect to tax on capital gains. On the one side you have investments held in New Zealand and Australian shares by direct New Zealand investors – they are playing on the downhill slope i.e. no tax payable on capital gains – and on the other you have fund managers offering managed funds investing in New Zealand and Australian shares – they are playing uphill at a 33% gradient i.e. are taxable on capital gains at 33%. Absurd I hear you say!

The Tax Game

Whilst the Super 14 competition continues to hold our interest at the ‘business’ end of the competition – complete with reconditioning All Blacks, the big news in ‘The Tax Game’ is that due to legislation passed into law in December 2006 , the tilted playing field will be levelled come 1 October 2007.

Under the new legislation, investors in New Zealand and Australian shares listed on the NZX or recognised ASX indicies , will be treated the same for tax purposes. This means investors will not pay tax on capital gains regardless of whether they invest on a direct basis or via a Portfolio Investment Entity (PIE) managed fund.

In addition to paying no tax on capital gains within a PIE, there are a number of other tax benefits relating to managed fund investments under the new legislation. For example, if you are a PIE investor who currently pays 39% income tax, any income earned within the PIE will only be taxed at a maximum tax rate of 33%. This gives you a tax saving of 6% compared to the investor holding the shares directly.

However, it does get trickier as PIE tax rates will not necessarily be the same as an investor’s personal tax rate. The Prescribed Investor Rate (PIR), the investor’s tax rate within the PIE, will depend on the make up of each investor’s individual income. For example, if in a financial year an individual had non-PIE income of up to $38,000 and their total income was less than $60,000, then their tax rate for any PIE income would be just 19.5%. Or even better, if an investor had only PIE income up to $60,000 they would pay tax at just 19.5% versus the current situation where any income over $38,000 would be taxed at 33%.

Clearly this is a much better tax outcome for investors in managed funds, as managed funds are currently taxed on all income and realised gains at 33% as well as having to provision for tax on unrealised gains at 33%.

A further added benefit of investing in New Zealand and Australian shares via a PIE managed fund post 1 October 2007 (which you could argue tilts the playing field in favour of managed funds), is that the fund can actively ‘trade’ the stocks in the portfolio without the risk of being deemed a ‘trader’. An individual who regularly and actively trades a direct share portfolio runs the risk of being labelled a ‘trader’ by Inland Revenue and thus being taxable on all gains and income at their marginal tax rate.

To be eligible for the tax benefits, investors will need to calculate their PIR and provide this to their fund managers.

Playing the Game

So how can investors participate in the new tax game on the levelled playing field? Unlike Super 14 players, you don’t have to be selected to play this game. Current investors in managed funds which invest in New Zealand and Australian shares need do nothing other than check with their fund manager to see whether or not their fund will become a PIE on 1 October 2007. So long as the fund will become a PIE and the fund manager has a record of the investor’s PIR, then the new tax rates and treatment will be automatic.

Investors who currently invest directly into NZ and Australian shares and would like to become PIE investors should contact a fund manager for more details about funds which will meet the PIE requirements.

So What is the End Game?

Of course the end game, and a key driver of the tax changes by the government, is to ensure investors are not discouraged from saving due to unfavourable tax treatment.

While that is all good in theory, how will the tax changes actually affect investment returns as we move forward? There are no guarantees in this game, however all things being equal, total returns to investors in PIE managed funds from 1 October 2007 will be better due to the capital gains no longer being subject to tax within the funds.

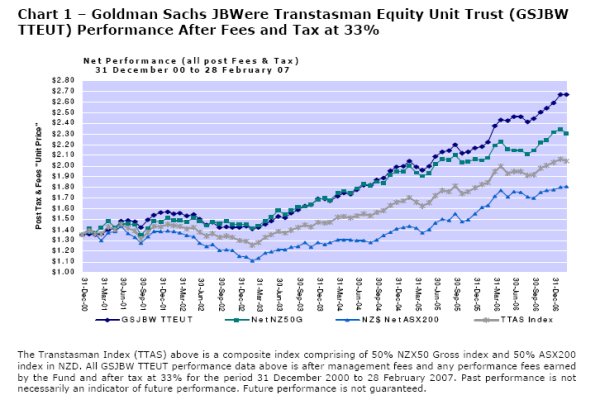

To illustrate this improvement we have calculated returns from the Goldman Sachs JBWere Transtasman Equity Unit Trust from 31 December 2000 to 28 February 2007. Chart 1 shows fund performance for the period, after management and any performance fees and after tax at 33% - i.e. actual returns to investors in this fund over the period.

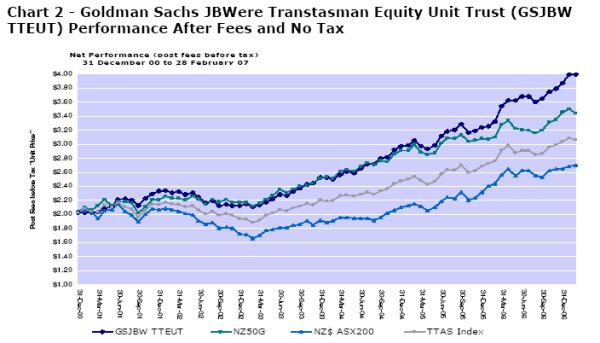

Chart 2 shows the returns to investors after management and any performance fees but before tax for the same fund over the same period. Of course the before tax returns do not account for any tax which under the new PIE tax rules would still be payable on income within the Fund. As a proxy of the potential income an investor might receive though, we can look at the current dividend yields for both the New Zealand and Australian sharemarkets. The dividend yield of these markets is 6.00% and 3.55% respectively or 4.78% if calculated on a simple 50:50 transtasman basis.

The income portion of the Fund’s return will still be taxable under PIE but of course remember this is no different to if an investor held the shares directly. And, under PIE, the income could be subject to a lower tax rate if the investor’s PIR was lower than their personal tax rate. PIR’s won’t apply to direct share holdings.

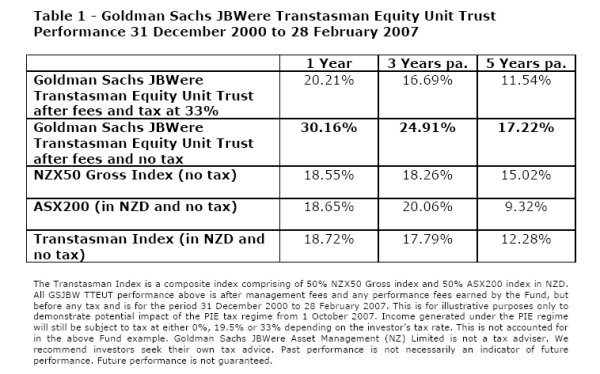

If you prefer to see the data represented as numbers rather than colourful charts, below is the same comparison in a number format.

Clearly, as demonstrated by the examples above, investors in managed funds will be significantly better off going forward than they have been in the past. And of course it is important to remember the added benefits of an active and professionally managed fund, employing the skills and resources of a business focussed on generating active returns for investors.

Clearly with a playing field which post 1 October 2007 will be level (or even slightly tilted in favour of PIE managed funds), we should expect the results of the tax game to be less one sided. Whether it be Super 14 or saving for retirement, all players should at least start the game on an even footing.

| « Market Review: The past 7 years - A roller coaster ride | Market Review: The Return Of Volatility » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |