Market Review: The Return Of Volatility

We have been highlighting over recent months how the markets have been relatively calm and that it was likely that such a state would not persist.

Tuesday, April 10th 2007, 9:32AM

|

This market summary is provided by Tyndall Investment Management. To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

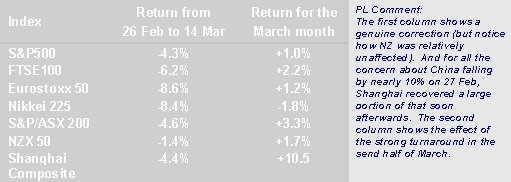

We have been highlighting over recent months how the markets have been relatively calm and that it was likely that such a state would not persist. That calmness was shattered on 27 Feb and we saw the first half of March continue a global retreat in stock markets. Then, all of a sudden, markets around the world produced the best one-week performance in four years. It was an interesting ride in March. The table below shows the various market falls (in local currency) in the period from the start to the end of the correction, compared with the returns for the whole month.

The big fall that kickstarted the correction was on the Shanghai Stock Exchange, which reacted to comments from the Chinese Government that it may have to cool down its overheated economy. It fell 8.8% on 27 Feb, but let’s put this in perspective – over the previous twelve months it rose 122%. In that context, a 9% fall neither seems that out of place nor indeed seems that unexpected. (It is worth noting that the market was up nearly 4% the next day.) However, the 27th Feb’s negativity transferred to other global markets. The Japanese market was also particularly badly hit, with the fear that the Yen carry trade was starting to unwind. (A carry trade is borrowing in one market – usually one with a lower interest rate, such as Japan – and investing in a high interest rate market – such as NZ.)

With the markets already falling, it seemed inappropriate that former US Federal Reserve Chairman Alan Greenspan decided to kick it even further with a comment that the US had a 30% chance of falling into recession in 2007. Greenspan is supposed to be retired and I am not sure current Chairman Bernanke would have been too happy with his predecessor stirring things up. On top of that, a new word entered our investment lexicon, “subprime”, which became a byword for default. Subprime is a class of house mortgages in the US that are lent to those with blemished credit histories. Although it represents a very small section of the US housing mortgage market, there was genuine fear of massive defaults in this sector. While in isolation this would only have a small impact, the flow-on effects to higher tiers of lending and indeed the US economy could be major, with a consequent evaporation of consumer spending a possibility.

After more than two weeks of such negativity, the markets turned around and produced returns of around 4% for the following week in the US, Europe and Asia. In fact, the US and European rises were the largest weekly rise in four years. The major driver was the US Federal Reserve’s decision to leave interest rates at 5.25%, or more correctly, the driver was the statement accompanying that decision. Markets jumped for joy after the statement made no mention about future rate rises, leading many to believe the bias for the future may in fact be interest rate cuts. By the end of the week, however, re-evaluations of the statement had highlighted comments about inflation risks and the rate cut scenario seemed less likely.

The Fed statement and possible rate cuts also caused the US dollar to fall to a two-year low, which of course meant that the NZ dollar went even higher against it. After a fall below USD0.6800 in early March, the March 8 increase in the Official Cash Rate by our own Reserve Bank saw the NZD embark on yet another rise, breaching USD0.7200 close to the end of the month. The fact the RBNZ raised rates to 7.5% was not unexpected, but you would have to question whether it was the right thing to do, given the signs of a worsening NZ economy and the already very high NZ dollar. Certainly, one feels that the RBNZ needed to act to back up its statements of the past, but the already-struggling export community has just found life even tougher.

So, what of the outlook for the global economy over the rest of the year? The past month may provide some sort of guide. Volatility is likely to remain a factor that will test investors’ nerves at future times. However, despite the volatility that occurred in March, global stockmarket levels are still at either all-time highs, or at least highs since early 2001. Indeed, as we saw in March, the dip in the Chinese market was just a small blip on the continued strong growth path of that market. The massive urbanisation taking place (and is expected to continue taking place for a while yet) in China will cause a huge demand for resources and consumer goods from its citizens. India is another country with a huge potential for urbanisation and demand on a massive scale. At the same time, there are real concerns about the deteriorating housing market and its flow-on effects in the US. So, it may be a case of these emerging Asian economies starting to assert themselves as the drivers of a strong global economy, rather than the US doing the bulk of the work, as has been the case for several years.

There is a possible note of caution, particularly on the US market. During the one year period to 16 Oct 1987 (when the DJIA index rose 22.4%), there were 10 days in which the market fell by 2% or more. In the 18 months to that same date, there were sixteen occurrences of a daily market drop of at least that magnitude (there was only one such example from 24 to 18 months prior to 16 Oct 1987). We all know what happened on Black Monday, 19 Oct 1987. A similarly large number of significant daily DJIA falls occurred in 1928 and 1929 before the large crash in the latter year. After the DJIA suffered no such occurrences at all in 2006, we have now had two 2%+ daily falls in the past five weeks. While it may be spurious to draw any conclusions from this, we will be looking out for such falls over the coming quarter. Maybe the presence or absence will indicate the likelihood of another large market correction.

The key, as always, is diversification (often referred to as “the only free lunch available”). Diversification is important across asset classes, across geographies and within asset classes. The March month provided a clear example of this. Global bonds were strong in the first half (when equities were weak) and both positions were reversed in the second half. If we expect volatility to be increased over the remainder of 2007, a diversified portfolio should at least let investors sleep at night.

Peter Lynn – Interim Managing Director of Tyndall Investment Management

| « Levelling The Tax Playing Field | BT rolls out farm fund » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |