Market review: October 2007 commentary

In many respects, the bout of volatility experienced in investment markets over the last two months represents a return to more normal market conditions; We review these changes in market conditions – and the market realities that are driving them; This month's Comment from Tyndall is penned by Andrew Hunt, who is based in London.

Wednesday, October 3rd 2007, 9:24AM

by Andrew Hunt

Over recent weeks, global equity markets, and even the currency markets, have seemingly returned to an optimistic 'business as usual' footing following August's credit market scare. Although the popular explanation for August's credit crisis has focused on the problems in the US 'sub-prime' mortgage sector, we suspect that this is too simple an explanation. Even if the loss rates currently being witnessed on mortgages in this relatively small sector of the US economy deteriorate significantly further, the sums actually being lost by lenders are unlikely to pose a systemic risk to the US – or global – financial system.What the sub-prime crisis has revealed, however, is the inherent fragility of the structured finance industry and credit derivatives sectors and it is this feature that we suspect will dominate the economic landscape over the next year.

In essence, the mortgage industry in the US and elsewhere had indulged in a little financial alchemy over recent years by grouping together mortgages from different income strata and geographic areas of the economy in order to attain investment grade or "AAA" ratings (i.e. akin to those given to only the very best companies). The high ratings awarded to these vehicles were based entirely on the assumption that the loss rates amongst the various components of the whole 'basket' of mortgages would be uncorrelated, in that the chance of a mortgage in the high income US North east going 'bad' was assumed to be completely unrelated to that of a mortgage going 'bad' in the lower income Western US and so on. This assumption of low correlations was allowed by the various rating agencies, who duly rated them as being inherently 'safe' investments. Consequently, many investors in banks, insurance companies, pensions and other financial entities then purchased these instruments purely on the basis of them representing low risk investments.

Unfortunately, the short but relatively sharp upward move in interest rates in the US credit markets in May-June of this year proved that the correlations between the mortgage markets in the different parts and sectors of the economy were indeed quite high and this led to a near hysterical re-evaluation of the assumptions and models that had previously been used to value the mortgage securities.

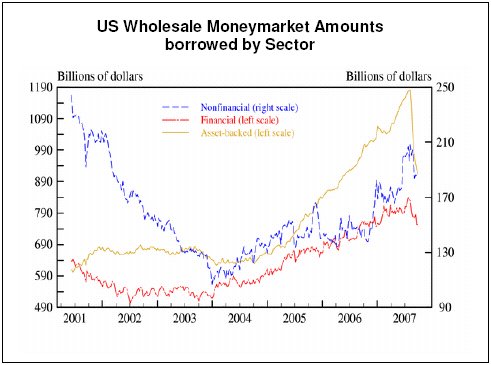

Then, as more and more investors began to lose money in these exotic instruments, many financial institutions began to fear what is known as 'counterparty risk'. This is a situation under which you begin to fear that the person with whom you are either buying or selling assets could fall into bankruptcy before delivering to you what you are owed, a scenario that could then endanger your own solvency in today's world of billion dollar deals. At this point, the wholesale money markets ceased to function, as potential lenders (to these money markets) stayed away and consequently the banks and other mortgage companies in the US, New Zealand, Australia and the UK who had previously relied on the money markets for their own funding, found themselves also plunged into a financial crisis, as the shareholders of Northern Rock in the UK now know only too well.

We recount this story not merely because of its historical interest but because it suggests that the rules of the international financial game have now changed. Although the US Federal Reserve and other central banks have attempted to offset the crisis by lending money at discounted rates to struggling banks and by cutting interest rates in some cases, and while this may have prevented a number of potentially high-profile bankruptcies, we doubt that it will be able to fully offset the damage that has been done to the mortgage and structured finance industries. In practice, the sector's whole modus operandi has been shown to be flawed and a period of consolidation and re-invention will now be required for the credit system.

For example, since mid-August, it has become impossible to issue the collateralised debt obligations (the infamous CDOs) and other 'alphabet instruments' that had provided much of the funding to the US's previously burgeoning mortgage industry. Similarly, those institutions like RAMS, Northern Rock, Countrywide and others who had relied on short term borrowing from the money markets to allow them access to the funds that in turn allowed them to offer 'cheap' mortgages to their own clients have found their situations now very different. The result of this situation will be that the banks and other lenders will be more cautious about extending new credit to clients and they may well require higher interest rates when they do lend. Since the financial institutions have suffered losses and a rise in their own cost of borrowing, they will need to be more careful and less generous to their customers when they lend money.

This shift in borrowing conditions may go largely unnoticed by thrifty German and Japanese consumers (although the latter have their own unique problems at present connected with a rising tax burden and the return of a weak labour market) but for households in New Zealand, Australia, the USA, UK, Spain and South Africa, the change in credit conditions will be very important. In each case, consumers in these countries manage to spend more than they earn in aggregate and they therefore are obliged to rely on credit to cover the gap between earnings and outgoings. However, as credit conditions tighten, this gap will become either more expensive or more difficult to cover, with the result that many households may find themselves being obliged to drop their level of expenditure so that it matches their incomes. Such a drop in spending is usually referred to as being a recession and we suspect that many of the countries listed above will suffer such a fate.

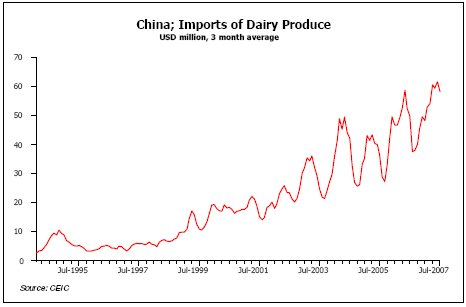

Moreover, as consumer spending growth slows or reverses and corporate input prices rise as a result of both the high oil price and China's own emerging inflation problem (which is leading to higher import costs for companies that buy their goods from China), we can expect profits to come under pressure.

Over the last few weeks, sharemarkets have rallied on the basis that the economic slowdown will allow central banks around the world to continue cutting interest rates (a forecast with which we would agree – including in New Zealand) but we suspect that the sharemarkets have yet to discount what could soon be quite a significant drop in corporate earnings as the recessions unfold in 2008.

Andrew Hunt, Andrew Hunt Economics Limited

Andrew Hunt, Andrew Hunt Economics Limited

Andrew Hunt Economics was formed in 2001 when Andrew left Dresdner RCM Global Investors, where he had been Chief International Economist.Andrew worked for four years in the Dresdner / Thornton London office, covering the G7 Economies, before moving to Hong Kong in 1991 in order to spend more time working in the Pacific Area.Whilst in Hong Kong, Andrew formed strong links with many regional central banks, and the local hedge fund community. Consequently, he was heavily involved in the analysis surrounding the Asian Crisis.In 1997, Andrew returned to London and took up his international role in the renamed Dresdner RCM Global Investors. During his time at DRCM, Andrew was a frequent traveller to a large number of central banks for research purposes.Since 2001, Andrew has operated his own economics consultancy. His current client list of 45 includes a number of prominent asset managers, hedge funds and family offices, together with a number of central banks and other official institutions. In order to fulfil his research role, Andrew travels extensively in the USA, Europe and the Asian Pacific region.

Tyndall's Comment on the Month's Numbers

A strong rise from the New Zealand sharemarket in September, resulting in the NZX50 Gross Index rising over

21% for the past twelve months. Both the Dow Jones and the NASDAQ indices also returned over 4% for the

month (in USD terms). Asian markets (except Japan) were all very strong. In contrast, the smaller non-

Scandinavian markets in Europe, as well as France, were very weak. It was a toss-up between the Irish

sharemarket and its rugby team as to who was the worst performer. The NZD rebounded very strongly following

the US Fed Funds rate cut, up nearly 8% against the USD for the month.

Andrew Hunt International Economist London

| « ASSET - Inflated Upfronts | What PIE means for New Zealand Investors » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |