Market review: November 2007 commentary

This month's comment from Tyndall is penned by by London-based economist Andrew Hunt. He says despite global liquidity there are still risks investors need to be aware of.

Wednesday, November 14th 2007, 9:51AM

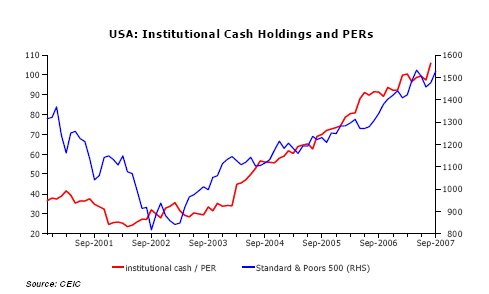

Global financial sector liquidity is booming. Despite the August credit market debacle, liquidity appears to be booming within the US and global financial systems and we have estimated that US financial institutions' holdings of cash and other deposits have risen by an almost unprecedented 9% over the last eight weeks alone. This extraordinary build up of 'firepower' within parts of the US financial system has clearly exerted an influence on not only US share and bond prices but also on global markets as well. Specifically, we suspect that this liquidity has not only powered the US share market higher, it has also been responsible for the rise in the Asian share markets over the last month and the sharp recoveries in the Australasian currencies over recent weeks.

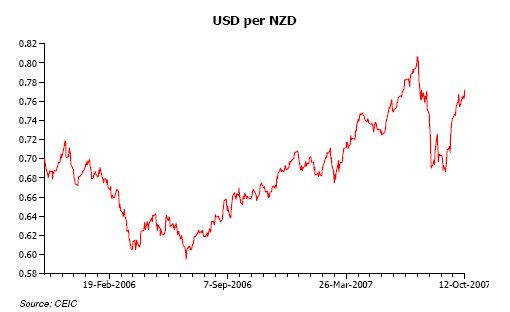

While some commentators have been quick to suggest that the US currency is falling on the foreign exchanges because 'no one trusts the Federal Reserve', or because there is some form of 'dollar crisis' emerging, we would suggest that the US currency is simply falling because highly liquid US investment houses are looking not only at their domestic markets but also for places abroad to deploy some of their cash as the Federal Reserve reduces domestic cash returns via its reduction in official interest rates. With the Reserve Bank of New Zealand (RBNZ) apparently to maintain its relatively high interest rate strategy, the NZD has of course attracted some of these flows and hence it has mounted a rebound from its sharp decline last August.

Where is this surge in liquidity emanating from? A popular suggestion is that the liquidity boom is a by-product of the Federal Reserve's and other central banks' huge injections into the banking system that were deemed necessary during the credit crisis this winter. In part, there is some truth in this reasoning but we would note that this is not the primary source of liquidity growth within the financial sector. Instead, the huge surge in liquidity within these institutions appears to be the result of massive inflows into the conventional banking system that have been sponsored by investors fleeing the more exotic worlds of commercial paper, credit funds and even the savings and loans companies that have been badly impacted by the credit crunch and US housing crisis.

In essence, it seems that some savers are fleeing savings vehicles that are perceived to possess an exposure to either US housing or to the credit derivative markets and instead seeking refuge in the federally-guaranteed commercial banks. Moreover, it seems that the banks are in turn recycling these fund flows into financing for their own surprisingly brave acquisitions of what might be described as relatively 'exotic' securities within the financial markets and it is these transactions that are lifting the cash holdings of the investment houses. The financial sector companies are receiving money from the banks when they sell their unwanted exotic securities and then using these funds to power the current global bull run in the more conventional share and government bond markets. Moreover, while there is so much liquidity in the hands of these institutions, it is difficult to imagine financial markets performing poorly, although it is likely that the USD will continue to fall while this situation persists.

We would caution investors, however, that there are several risks involved in chasing markets at present. The first is that the liquidity simply runs out. At some point, there will be no more money left to seek refuge in the banks and then the flow of money into the mainstream markets might slow as the banks are robbed of their own financing, although as yet there is little sign of a let up in this particular fund flow. Alternatively, the flow of money into the mainstream financial markets, such as those for government bonds and equities, could be undermined if the commercial banks were to stop buying up the unwanted exotic securities from other investors and here we are starting to see that the banks are beginning to pull back. Indeed, over recent days, the now infamous CDO markets appear to have undergone their third 'crash' of the year and this may lead to some drying up in the banks' appetite for exotic instruments and hence the supply of liquidity to the system as a whole.

The other major set of risks to the current bull run is a potential deterioration in the economic environment and it is these risks that appear to be rising fastest at present. In fact, we perceive two major threats to the global economy at present. The first is the on-going US economic slowdown. Although the flow of economic data has been mixed from the US over the last month (as it often is at a turning point), the majority of the data are now beginning to suggest that US growth is cooling quite significantly as a result of the credit supply problems still present in the real economy and this slowdown will clearly impact the earnings potential of both US domestic companies and the country's external suppliers. Indeed, we note that the latest US import intentions survey contained within the influential purchasing managers' survey recorded an almost unprecedented decline in US orders for foreign goods during October.

Our second economic risk to markets concerns the probability of an unwelcome inflation surprise in the near term. With US and other investors currently pouring so much money and capital into the Asian region, it is not surprising to find that overall liquidity in the Asian economies is booming and that new domestic credit booms have formed. Indeed, so powerful has this implicit stimulus been that we are seeing a coordinated recovery in domestic spending within the Asian economies (outside Japan, where the economy remains moribund).

Unfortunately, as a result of the aftermath of the 1997 Asian crisis and recent conservative economic policies adopted by the local governments, many Asian economies have experienced relatively little growth in new capacity over recent years. Therefore, as the Asian domestic recovery has gained momentum, the pressure on the region's productive resources has increased and inflation has emerged. Crucially, these inflationary pressures have extended to the region's export prices and this exportation of inflation is already placing upward pressure on consumer goods prices in the Western economies, to their central banks' obvious chagrin. Therefore, although global financial markets may be enjoying a liquidity driven bull run at present, there are signs that the fundamental situation within the global economy is deteriorating as both the credit-driven US economy slows and world trade prices rise under the impact of Asia's new cycle.

Nowhere is this economic slowdown/potential inflation dichotomy more obvious than Australasia. At one level, New Zealand is clearly benefiting from Asia's economic recovery – much of the recent rise in dairy prices is attributable to this event. However, the global credit crisis is also weighing on the housing market and this could yet derail the consumer's ability to spend in the shops. Meanwhile, higher Asian export prices are posing an explicit threat to the consumer price index. Given these multiple opposing forces, it is understandable that the RBNZ has decided to adopt a 'wait-and-see' approach to policy-setting that we believe it will maintain until Christmas, when the outlook for global growth should become both clearer (and weaker). In the near term, we expect the sharemarket booms and the strength in the Australasian currencies to persist but, from a fundamental point of view, the clock is clearly running down in this particular game as the global slowdown approaches, although the latter should lead to significant falls in official interest rates over the course of 2008.

Andrew Hunt, Andrew Hunt Economics Limited

Andrew Hunt, Andrew Hunt Economics Limited

Andrew Hunt Economics was formed in 2001 when Andrew left Dresdner RCM Global Investors, where he had been Chief International Economist.Andrew worked for four years in the Dresdner / Thornton London office, covering the G7 Economies, before moving to Hong Kong in 1991 in order to spend more time working in the Pacific Area.Whilst in Hong Kong, Andrew formed strong links with many regional central banks, and the local hedge fund community. Consequently, he was heavily involved in the analysis surrounding the Asian Crisis.In 1997, Andrew returned to London and took up his international role in the renamed Dresdner RCM Global Investors. During his time at DRCM, Andrew was a frequent traveller to a large number of central banks for research purposes.Since 2001, Andrew has operated his own economics consultancy. His current client list of 45 includes a number of prominent asset managers, hedge funds and family offices, together with a number of central banks and other official institutions. In order to fulfil his research role, Andrew travels extensively in the USA, Europe and the Asian Pacific region.

Tyndall's Comment on the Month's Numbers

Sharemarkets around the world continued the previous month's strength, with most markets in positive territory. The S&P 500 Index was up 1.5% for the month, while the Nikkei 225 Index was the only major index to fall, down 0.3% over October. The NZ market also fell, on the back of annual meeting comments suggesting a challenging environment ahead.Global bonds continued on from the strength exhibited in the September quarter, while domestic bonds reversed last quarter's trend and fell by 0.3% for the month.

| « ASSET - Advisers bite into PIEs | ASSET - Big tick for KiwiSaver » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |