Accessing the Water H2Opportunity

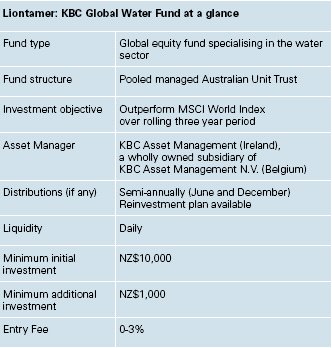

A water fund with liquidity Liontamer have just launched a new managed fund that taps into the investment potential of the global water industry. And in keeping with the theme, this open-ended fund has daily liquidity.

Wednesday, November 14th 2007, 10:20AM

Liontamer Investments are known in New Zealand for their range of innovative capital protected funds. Now, with their first foray into open-ended managed funds, they utilise the resources and experience of their parent company, KBC Asset Management N.V., to bring a new Eco fund to the New Zealand market – the 'KBC Global Water Fund'.

Why water?

Water is fast becoming the earth's key resource. It's clear that water availability will play a leading role in global economic development, the success of industry, agriculture and the quality of human life. All over the world demand for water is growing faster than supply. Access to clean water comes at a price and that price is expected to keep rising.

Investing in water, or 'blue-gold' as it is becoming known, involves buying the shares of companies who make profits from various stages of the water cycle. These are the likes of utility companies who supply fresh water and treat waste water, through to companies who make the pipes, pumps and valves. The water industry also includes engineering and construction of plants, environmental controls such as metering and new technology such as desalination (removing salt from sea water).

Finite supply

The supply of fresh water remains a limited resource thanks to climate change, pollution and difficulties in getting water from its source to the areas under water stress. Increased supply can be achieved with new technologies such as desalination. Cutting the costs and energy used in removing salt from sea water is one way to unlock future profits for companies with this expertise. From the water stressed markets of China, to right on our doorstep in Australia, desalination is a crucial element of new water supply.

Unrelenting demand

It was only 200 years ago that the world's population stood at 1 billion people. Today, our numbers have increased by six times (to around 6.5 billion people) and within 20 years estimates sit at an incredible 8-10 billion. It's no wonder that population growth is putting pressure on water resources as we try to grow enough food to feed our inhabitants.

The amount of water that each of us is consuming is rising too. Over the last 100 years water usage has been increasing at twice the speed of our rising population. The more industralised we become and the more we live and work in cities, the more water we use.

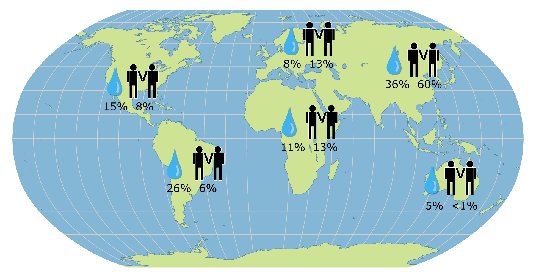

Geographic imbalances

Fewer than 10 countries possess 60% of the world's available fresh water supply. China for example makes up 21% of the world's population, but possesses only 7% of the renewable water resources. By contrast, Canada is one of the richest water nations per person, but they have bought in laws to prevent water diversions from the great lakes to the US. Deceptively, Australasia may have 5% of the water resources and only 1% of the population, but we know only too well that the location of water and rainfall is not always where it is desperately needed.

Our water imbalances highlight the importance of companies who deliver and manage our water supplies through to those involved in new water technologies.

Legislation and politics

Water management has now become a political issue with legislation on water quality and metering expected to drive up prices. Governments, local councils and industry leaders are all working to secure access to reliable, renewable and sufficient fresh water supplies. The rationale behind the Global Water Fund is that investing in an industry which is supported by growing levels of legislation around the world, provides a solid back-drop for share prices.

Global Water Fund objectives

Picking superior companies

The Global Water Fund is an international fund investing in a wide range of countries and many sectors of the water industry. The portfolio manager, KBC Asset Management N.V., invests in companies that they believe will outperform their competitors over a two year period. The key objective is to identify superior companies. To do so, their team of fund managers and analysts look at each company's rate of growth, profitability, the quality of the business plan and management.

The team at KBC typically visits around 70 companies a year, where they meet senior management and have a chance to really look under the hood and see what makes them tick. Only after going through a rigorous investment process will a company be considered for inclusion in the Global Water Fund.

Delivering superior investment returns

The Global Water Fund is run by KBC's team of fund managers based in Dublin, Ireland. This team have been running other water funds for seven years and investors around the world have placed €1.4 billion (NZ$2.6 billion) in KBC's water funds over this time. The water fund they've run since 2000 is one of the leading funds in the world and consistently outperforms other well known competitors. KBC are one of a small group of fund managers worldwide who have been running an actively managed water fund.

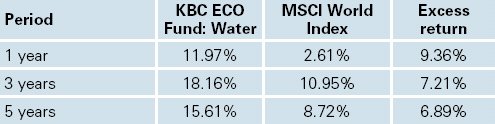

The real proof always lies in the numbers, but as professional financial advisers know, it's important to remember that past performance is no guide to the future. The numbers in our charts simply show that KBC have had an excellent track record and they are a leading manager in water funds.

KBC ECO Fund: Water vs. the MSCI World Index

This is the track record of KBC's existing mandates

Annual returns to 30 September 2007 in Australian dollars, with dividends reinvested and after taking into account fees and expenses. Calculated by KBC from Datastream.

Full details are contained in the Product Disclosure Statement (PDS) and registered Prospectus, provided by Liontamer Investments Ltd (ABN 71 121 832 157, AFSL 306682), the responsible entity for the Fund. A copy of the PDS may be obtained from Liontamer by calling 0800 210 450 or emailing adviser_relations@liontamer.com. A person should consider the PDS in its entirety in deciding whether to acquire a unit in the Fund. Liontamer has given a mandate to its related company KBC Asset Management Ltd (KBCAM) to manage the Fund. The mandate will mirror the existing KBC water portfolio. Neither KBC Bank N.V. nor KBC Group N.V. guarantees repayment of the investment amount or any returns on the investment nor do either of them accept any liability to investors.

Disclaimer: The above material contains comments of a general nature only and should not be relied upon as giving any specific or general investment or financial advice of any nature. The licensee does not guarantee that the earnings rate on your investments will be the percentages shown. Past returns are no guarantee of future returns. Actual returns can rise and fall. You should seek financial advice before investing. The returns shown may not take into account taxes, fees or inflation or currency risks.

| « Kauri Notes - High targeted returns | Kauri Notes - Higher returns, regular income » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |