Market Review: July 2008 London commentary

There are some difficult times ahead for global and New Zealand economies. Inflation (and potentially stagflation) is now a global problem. In this month's Tyndall comment, we profile the issues and drivers of these economic circumstances.

Wednesday, July 2nd 2008, 11:15AM

Financial markets, at least superficially, are now concerned over a potential return of 'stagflation' to the global economy. With inflation rates drifting up around the world, and economic growth slowing, many commentators have become concerned that the late 2000s will see a return to the slow growth – high inflation environment of the 1970s and early 1980s.Certainly, inflation is now a problem within the global economy and we suspect that it has its roots in two phenomena, notably China's systematic under investment in its agricultural sector over much of the last century, and the high level of commodity prices in general.

Over the last 30 years, we estimate that China's rate of productivity growth in its agricultural sector has been a very pedestrian 2% per annum on average and this weak rate of productivity growth, coupled with a declining labour force in the sector, environmental problems and other factors has led to a situation under which essential food prices have been rising sharply.

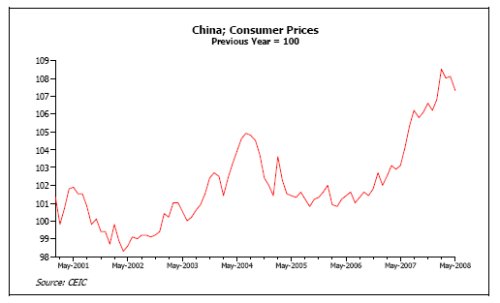

In fact, subsistence prices in the economy have been rising sharply over the last three years or so. Faced with rising living costs, Chinese workers have naturally asked for compensating pay awards and it seems that their requests have often been granted, with the result that Chinese wage inflation is now well over 20% per annum and certainly well above even China's formidable rate of productivity growth in its manufacturing sector.

Initially, it seems that Chinese companies absorbed these rising unit labour costs into their profit margins but, over the last 12 months, companies have finally been obliged to pass these costs on to the customers, both at home and abroad. Hence, China's economy is now locked in a wage-price spiral that has resulted in both high rates of domestic inflation and higher export prices. Unfortunately, China's authorities have so far proved either unwilling or unable to control this inflation cycle and thus we expect the economy to continue to inflate in the near term, to the detriment of its longer term growth potential, as we note below.

For the Western economies, this outbreak of inflation in China implies that there will be fewer opportunities to substitute cheaper Chinese goods for domestic alternatives and while some import competing companies will welcome this event, consumers will find that the cost of purchasing these items will rise, to the obvious detriment of both reported consumer price indices and consumer spending power. This situation is clearly a problem for global policy makers, but one that they can do relatively little to solve in the near term.

For the Western economies, this outbreak of inflation in China implies that there will be fewer opportunities to substitute cheaper Chinese goods for domestic alternatives and while some import competing companies will welcome this event, consumers will find that the cost of purchasing these items will rise, to the obvious detriment of both reported consumer price indices and consumer spending power. This situation is clearly a problem for global policy makers, but one that they can do relatively little to solve in the near term.

However, we must remember that as China 'prices itself out' of its export markets, China's own economy will begin to slow and we must note that there are already some signs of a moderation in investment in the hard-hit (in profit terms) manufacturing sector. Indeed, by 2009, we suspect that a combination of slower global growth and China's own problems will lead China's economy to slow quite sharply, thereby beginning a process that should in turn result in a moderation in Chinese inflationary pressures by late 2009.

Moreover, as the global economy cools, and in particular as China's economy slows, we expect the current upward pressure on commodity prices to ease. In fact, we suspect that the commodity cycle may already be close to a peak. Clearly, end-user demand for commodities has increased over recent years, although so too has the efficiency with which we use these items but the hundreds of billions of dollars that have been attracted to commodity instruments of late have clearly impacted prices and caused obvious signs of speculative excesses in oil prices, farm prices, farm land prices and many other related vehicles. Indeed, it is estimated that investment by pension funds and others into commodity instruments has risen by at least a hundred-fold over the last five years and we would attribute much of the increase in commodity prices of late to the actions of these investors. However, these investors actually have no demand for commodities per se, they are simply buying something that they hope to sell to someone else at a higher price in the future. Therefore, if sentiment changes with regard to commodity price markets (perhaps as a result of new legislation currently being rushed through the US Congress), or as a result of changes in the perception of global growth, then many of these investors may attempt – or be forced to - exit the commodity markets quite quickly. Certainly, we think it highly probable that commodity markets may correct in the second half of 2008 and this may do a lot to cool global inflation worries.

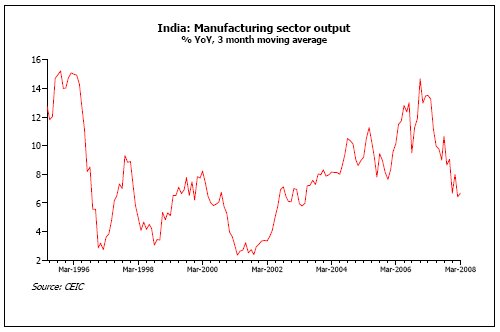

In essence, we would suggest that given the current global slowdown, which we believe is continuing to gather pace, inflation can only be a transitory problem. Certainly, economic growth is now cooling around the world. In particular, it seems that growth has all but evaporated in the USA (and we expect further weakness in 2008H2 as the positive effects of the recent tax rebates fade), Japan's economy stalled, and the UK is flirting with a recession. In Canada the economy is weaker while Southern Europe is becoming increasingly soft and potentially crisis-hit. France's economy is now also slowing and Germany already weak, there would seem to be little to power growth in the major G7 economies. In many of the Emerging Markets in Asia, there are now clear signs of slower domestic growth and in particular we note that India's economy has recently started to produce some notably weaker data. In Brazil, the economy remains firm but the central bank is now attempting to cool this growth rate.

Clearly, the current environment is likely to be a difficult one for equity markets. Although we do not believe that stagflation fears are justified in the medium term, the next few months could prove problematic as global growth slows and reported inflation remains high. Moreover, the equity markets may also have to deal with specific news events such as continued problems in the global financial system and potential crisis situations in some Eastern European economies (i.e. those countries with large un-hedged foreign debts that they are now struggling to finance) and in Spain, where the economy may soon enter a de facto depression that will likely test its resolve to remain within the Euro.

Clearly, the current environment is likely to be a difficult one for equity markets. Although we do not believe that stagflation fears are justified in the medium term, the next few months could prove problematic as global growth slows and reported inflation remains high. Moreover, the equity markets may also have to deal with specific news events such as continued problems in the global financial system and potential crisis situations in some Eastern European economies (i.e. those countries with large un-hedged foreign debts that they are now struggling to finance) and in Spain, where the economy may soon enter a de facto depression that will likely test its resolve to remain within the Euro.

Clearly, such events are unlikely to make the next few months easy ones for equity markets, although we do expect the weaker growth situation to lead the major central banks to abandon any plans for higher interest rates. In fact, by the fourth quarter, we expect interest rates – even in Europe – to be declining once again and this should be supportive for bond markets as the fourth quarter approaches, and equity markets thereafter.

With regard to currencies, we would expect a resumption of difficult times in the global financial system to cause a further rally in the Japanese yen in the near term, although Japan's own weak economic situation should cap this rally by 2009. With regard to the Euro, we expect the bad news from Southern Europe, coupled with signs of generally slower growth to begin to undermine the currency, thereby leaving the way clear for a US dollar rally over the next six months or so. In fact, we would also expect the US currency to rise against the Emerging markets and even the commodity markets in the medium term. Overall, it would appear that the next few months may be volatile ones for financial markets, at least until the global central banks become more confident that the current inflation scare is merely transitory and therefore feel able to resume their interest rate cuts.

Andrew Hunt, London

| « ASSET - Doing the distribution reshuffle | Market Review: July 2008 commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |