Market Review: July 2008 commentary

Another long term driver of value will be the emerging markets. We explain what constitutes an emerging market and their growing importance. We will be commenting further on these markets, including efficient ways to access them with your 2007 Morningstar International Equities (and overall) Fund Manager of the Year.

Wednesday, July 2nd 2008, 11:24AM

Emerging Markets: From Survival To Global LeadershipThe term "Emerging Markets" as opposed to "Third World" countries was originally coined in 1981 by then World Bank economist Antoine van Agtmael to describe developing countries. He felt that the term "Third World" focused too much on stagnation, while "Emerging Markets" suggested progress and uplift. Developing countries are characterised by a business phenomenon that is not fully described by or constrained to geography or economic strength. Examples of today's emerging markets include Asia, Central and Latin America, Africa, the Middle East and parts of Eastern Europe. The mature developed world comprises North America (USA and Canada), the Pacific (Japan, Hong Kong, Singapore, Australia and NZ) and Europe (UK, Scandinavia and most of continental Europe).

The World Bank further defines an emerging market economy (EME) as an economy with low-to-middle per capita income. Such countries constitute approximately 85% of the global population, but only 20% of the world's economies. The World Bank's main criterion for classifying economies is gross national income (GNI) per capita. Based on its GNI per capita, every economy is then classified as low income, middle income (subdivided into lower middle and upper middle) or high income. According to 2006 GNI per capita, calculated using the World Bank Atlas method, the groups are:

- low income: USD905 or less

- lower middle income: USD906-3,595

- upper middle income: USD3,596-11,115

- high income: USD11,116 or more

Therefore an EME is an economy with GNI per capita of less than USD11,116 (low to middle per capita income). Other characteristics of an EME:

- considered to be a fast growing economy

- in the process of moving from a closed to an open market economy

- in the process of reforming its exchange rate system

- most likely receiving aid and guidance from large donor countries and/or supranational organisations

Emphasising the fluid nature of the category, political scientist Ian Bremmer defines an EME as "a country where politics matters at least as much as economics to the markets".

One popular global benchmark for stock market investors is the MSCI All Countries World Index, which has a 90% weight in stocks from developed markets and only 10% in stocks from EMEs. Yet EMEs represents 85% of the global population.

The relative unimportance of EMEs on the global stage is set to change radically, though, as we head deeper into the 21st century. Whereas EMEs contributed only 21% to the world economy in 2005, they are projected to draw level with the developed world within less than 30 years from now.

In 2005, EMEs, led by the BRICs (Brazil, Russia, India and China), had a combined gross national product (GNP) of USD8.9tr, compared to USD32.4tr of the developed world. Using data from Goldman Sachs and projections by Antoine van Agtmael himself, it is predicted that EMEs will overtake the developed world by 2030-35, while the BRICs will overtake the G7 economies (USA, Japan, Germany, France, UK, Italy and Canada) by 2032.

While this is nothing short of spectacular, most investors do not realise that the key EMEs will just reclaim their former positions as the world's dominant economies. Very few people are aware that China has been the world's biggest economy for 18 of the past 20 centuries. It finally lost that position when the USA became the world's largest economy in 1875, but China is set to become the biggest once again in 2030. The current industrial revolution will cause a landslide shift, as EMEs grow at two to three times the speed of the developed world. In its April 2008 World Economic Outlook, the International Monetary Fund (IMF) forecasted that "emerging and developing economies" will on average grow by 6.3% in 2008 and by 6.4% in 2009. "Advanced economies" will only grow by 1.3% in each of those years, according to the IMF.

While many EME companies have failed and will continue to fail along the way, those who do survive have done so through unconventional thinking. In 1988 there were just 20 EME companies with sales over USD1b each. By 2005, there were 270 of them.

In 1995, there were no EME companies that could be considered world class, but today names like Samsung (South Korea), Petrobras (Brazil), CEMEX (Mexico), SABMiller (South Africa) and Gazprom (Russia) are respected around the globe. Most of these have become either powerful brands (Samsung) or managed to capture the top-three global market share in their respective industries. Mexico's CEMEX is today the largest cement company in the US, while Russia's Gazprom's gas reserves are larger than those of all the oil majors combined.

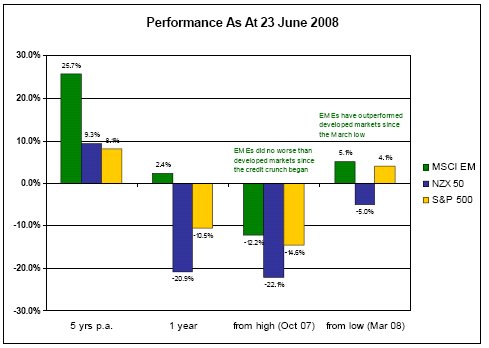

Stock market performance has also changed significantly from earlier days, with EMEs now performing better than developed markets and sometimes at less risk. The chart below shows the performance of the MSCI Emerging Markets (with net divs) Index, the NZX 50 Gross Index and the S&P 500 Total Return Index (all in local currencies), over various periods. During the last five years, EME stocks have left their peers from developed markets trailing by a country mile, while they have performed in line since the start of the credit crisis. Since the rebound off the March 2008 low, EME stocks have outperformed the S&P500.

One of the secrets to investing is that it always changes; what worked yesterday will not necessarily work tomorrow. For EMEs in particular, an investor has to look at things a bit differently and invest in companies/regions with a sustainable competitive edge that are not yet widely perceived to be world class.

One of the secrets to investing is that it always changes; what worked yesterday will not necessarily work tomorrow. For EMEs in particular, an investor has to look at things a bit differently and invest in companies/regions with a sustainable competitive edge that are not yet widely perceived to be world class.

EMEs have traditionally been viewed with scepticism and considered risky, volatile and crisis-prone. Their developed peers, though, were seen as economically stable and technologically advanced, with highly regulated stock markets and excellent corporate governance. However, things started to change with the developed world's dot.com boom-bust less than a decade ago and the corporate scandals of Enron, WorldCom, etc. soon thereafter. At the moment the developed world is reeling from a severe credit crisis with US house prices experiencing their sharpest decline since the Great Depression of the 1930s.

The latest S&P/Case-Shiller US national house-price index showed a slump of 14.1% in the year to the first quarter of 2008, the worst since the index began 20 years ago. Robert Shiller, an economist at Yale University and co-inventor of the index, has compiled a version that stretches back over a century and shows that the latest fall in nominal house prices is already much bigger than the 10.5% drop in 1932, the worst point of the Depression. As recent as 2005, former US Federal Reserve chairman Alan Greenspan described the situation as follows, "A destabilising contraction in nationwide house prices does not seem the most probable outcome. Nominal house prices in the aggregate have rarely fallen and certainly not by very much."

In the financial markets, the turmoil from the bursting of the credit bubble resulted in a number of high profile hedge funds blowing up, while venerable firms like Bear Stearns, Merrill Lynch and Lehman Brothers have been doing it tough. Bear Stearns was the hardest hit, trading almost 90% lower than where it was five years ago before being acquired by JP Morgan, while Merrills, Lehmans and Swiss banking giant UBS are all trading at big discounts to their 2003 share prices.

In stark contrast, the leading EMEs are in very strong financial positions today, most of them large creditors to the US. They have vastly increased their foreign exchange reserves, owning more than 75% of all foreign exchange reserves in the world. Their current account deficits have turned into surpluses, while the US, much of Europe and Japan all now have large budget deficits. China is now the world's second biggest exporter (behind Germany) having overtaken the US, while total foreign direct investment (FDI) into EMEs has swollen to USD255.6b in 2007 from USD167.4b in 2006. Mexico alone received USD37b worth of FDI in 2007, almost twice as much as in 2006, making it the leading Latin American recipient of FDI.

The MSCI All Countries World Index includes only about 5% of the more than 15,000 stocks listed on EME stock exchanges, while more than a third of listed global stocks are from EMEs. According to the International Federation of Stock Exchanges, about 20% of the value of all stocks in the world is in EMEs. As EMEs keep growing to eventually exceed economies from the developed world, investors will gradually adjust their exposures upwards to reflect this change in leadership.

Finally, the rise of EMEs is certainly no flash in the pan, as 85% of the world's population become more integrated in the global economy and strive for the same quality of life that their peers in developed markets have enjoyed for so long.

Peter Lynn, CFA, Head of Strategy

| « Market Review: July 2008 London commentary | ASSET – Network news: Inside 11 of NZ's top advisory firms » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |