Getting to Know: Norman Stacey

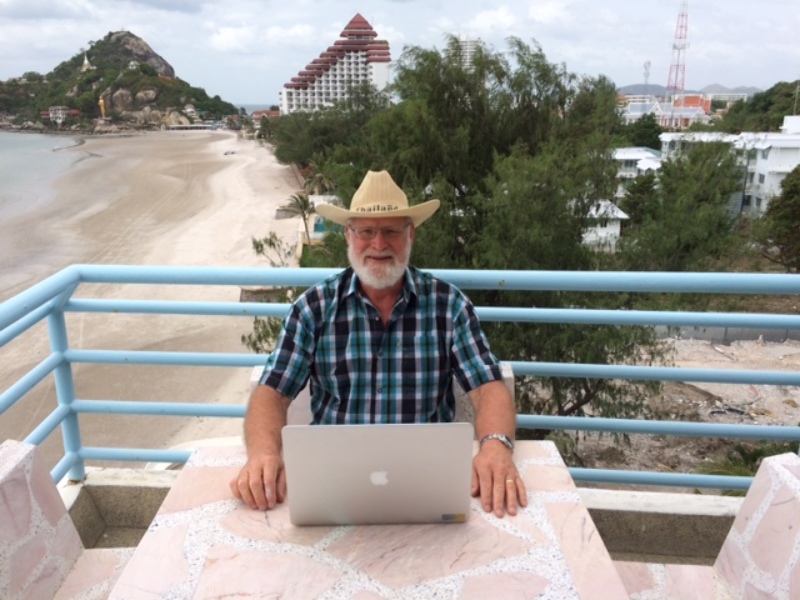

Norman Stacey is a financial adviser and investment strategist who was involved in a high-profile court case relating to the sale of his business. He now spends much of his time in Thailand.

Friday, April 28th 2017, 12:00PM

by Susan Edmunds

Norman Stacey, Director of Diversified Investments

Who are you and what do you do?

I am an Investment Strategist, and a Financial Adviser to a small number of high-net worth individuals or Trusts. Portfolios enjoyed 16% returns for the year just passed (to March 31st 2017) and 35% cumulative over the three years (since March 2014).

How did you get into the industry?

I studied Economics, became an investment analyst and then a stockbroker in North America, before returning to New Zealand in 1994.

If there is one thing you would like to change about the financial advice industry, what would it be?

To foster a larger, more viable and growing Independent Advisory Industry, because that is where the innovation is.

What’s the best advice you have ever received?

To maintain systemic diversification always. No matter how clever you are, or how thorough your research, there is often one more variable than you planned for. Tactical asset allocation is very beneficial, but it deals with probabilities, not certainties.

What has been the biggest factor that has driven change in your career and business over the past 10 years?

The advent of KiwiSaver has brought the Banks & Financial Institutions to dominate what had been a mostly independent Investment Advisory market. Banks had previously been neglecting advice, or had been simply product providers.

Do you regret anything about the court case over the sale of your business, or the way that process was handled?

Yes, I think Fisher Funds and the other 50% partner of Diversified Investment Strategies Ltd could have been far more open.

Is it still possible to operate in New Zealand as a smaller-scale manager?

Not impossible, but very difficult. Decimation of the Independent Adviser industry has greatly reduced distribution channels available to them to access the New Zealand retail market. Legislation and the Regulators structurally favour institutions, whose advisers are strictly limited in what they can recommend to investors, and who primarily tout in-house products - even when they are clearly inferior. We should be grateful that there are some surviving, small-scale managers at all, as their efforts would likely have been more rewarded had they applied their talents in other jurisdictions.

Are you a KiwiSaver member?

Yes. You are a mug not to be. The return on the first $1040 is the best you can short of get doing something illegal!

If so, what’s your investment strategy?

‘Balanced’ - but the investment return is very, very mediocre. KiwiSaver operators are not very innovative – the best of them achieved an investment return about half of the NZ Superannuation Fund’s 13% last year – so it can be done. The concern is that KiwiSaver Funds are closet indexers, so will destroy a lot of wealth in the next market crash. I only put the minimum or employer-matched contribution into KiwiSaver, because you can do significantly better on investments outside it.

Outside of work what do you do?

I am a Justice of the Peace and do volunteer ministerial duties at the Glen Innes CAB periodically. I am on the Board of a few small companies – one in Canada. I spend time at my place in Thailand where I write for a magazine.

What would you say if one of your kids told you they wanted to be a financial adviser?

Get a good education and some worldly experience first. Financial Advising is best as a second career from mid-life onward. Meanwhile, pursue your passion, but take an active interest in financial markets and venturing your own money – you will learn heaps.

What’s one thing people may be surprised to know about you?

I am a Geologist with some silver-lead-zinc, gold and uranium discoveries offshore to my credit. (That is just as well, as it is easier to husband a little personal portfolio than it is to accumulate a decent nest-egg in the Advisory business in NZ).

What would you like to be doing in 10 years' time?

Is ‘getting younger’ allowed? Hopefully still with the marbles to achieve a good return from financial markets – it is fun. Alternatively, I would hope to have found a Financial Adviser I can confidently delegate that to. Mostly, I would like to be healthy, hearty and drinking better wine – along with a similar status for those around me.

| « Clients can't stomach risk: Ndege | LVR restrictions to be reviewed » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |