Tourism Holdings – Motoring Through the Capital Cycle?

"When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact." - Warren Buffett

Monday, May 15th 2017, 10:34AM

by Richard Stubbs

We do not own Tourism Holdings but did once. We inherited a position in Tourism Holdings when the new Tower investment team was established in Auckland in 2010 and we came together as a team. Tourism Holdings at that time was deeply out-of-favour and its price was regularly hitting new lows as profitability suffered from an oversupplied campervan rental market.

The decision to keep the investment in Tourism Holdings was nevertheless simple. While it was making losses, it had assets that it could sell, namely campervans. An orderly sell down of those assets would have allowed Tourism Holdings to generate enough positive cash flow to service and pay down its debt. The share price was so low that it was more than twice backed by those assets. We were effectively buying two campervans for the price of one.

Also, capital was leaving the industry as competitors failed or consolidated. To us, it looked like a perfect time to play the capital cycle.

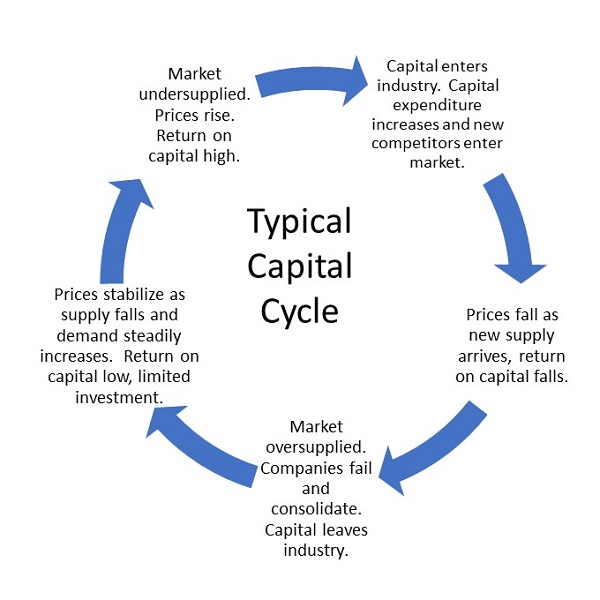

The diagram below summaries the capital cycle. Industries with limited barriers to entry and products that are relatively undifferentiated often suffer from the effects of a capital cycle. When times are good and returns are high, capital flows into the industry, chasing those returns, but ultimately oversupplying it and subduing prices and returns. Low returns force capital out of the industry until supply and demand are balanced and pricing improves. New supply lags investment, which lags prices. Any further increase in demand results in a period of tight supply, high prices and super-returns, encouraging capital into the industry again.

While our decision to hold Tourism Holdings was a simple one, it was far from easy. As the near-term operational outlook for the industry continued to deteriorate, the share price fell further. As can often happen with value-style investments, an outside observer would say we bought too early and we suffered some short-term price volatility. The best time to buy these types of investments is when there is no near-term likelihood of improving prospects. This, however, makes the investment difficult to defend, as the problems for the company are available for all to see! As Jean Marie Eveillard said - “To be a value investor, you have to be willing (and able) to suffer pain.” That is why this style of investing works - as so few are willing to suffer in the short term.

To Tourism Holdings' credit, its management worked hard over this period of pain. Its board was strengthened and management worked on an orderly consolidation of its industry. Management also strengthened the business by optimising not just the operating of its vans, but also the buying and selling process. We did our best to support this process. A news article on its work and our comments can be found clicking here.

Over time, tourism numbers increased, weaker operators failed and Tourism Holdings downsized. The market normalised and the outlook for Tourism Holdings improved. We exited Tourism Holdings at a measly 100% return over our two and half year holding period. I say measly because the price has now risen over 100% again to $3.75! However, we would do the same again. Paper profits can disappear as quickly as they sometimes arrive and are only certain once they are realised. In the same way that you cannot predict how low a stock price will go in times of agony, you cannot predict how high it might go in times of optimism. The two-for-one campervan deal is gone. Tourism Holdings' share price is nearly three times its Net Tangible Assets per share. At this price, you are buying campervans at almost three times their cost.

And, in our opinion, we might be close to completing the capital cycle. Supply has lagged demand and industry profits are currently high. One of Tourism Holdings largest competitors has listed and raised capital for growth. While highly unscientific, we have noticed large lines of campervans once again appearing out of car ships at Auckland's port! Slightly more scientific analysis shows Motor Caravan registrations in February 2017 were 5% up from February last year.

Tourism Holdings has a sound board and management team. It is possible that with a dominant market position and innovative solutions, Tourism Holdings might find ways to build a moat around its clients, protecting itself and its earnings from an oversupplied market. But we fear that the industry is against them. If the industry becomes oversupplied, prices will fall as companies fight to maintain market share and Tourism Holdings is likely to have to follow to some degree. At which point the market will again look to blame management for decreasing profits, despite it being largely out of their control. If that happens we will be eagerly waiting to pounce on any two-for-one campervan deals that Mr Market might offer us during periods of despair.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique funds management business established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point has a focused investment approach based on a long-term perspective, capital preservation and investor alignment. More information can be found at www.castlepointfunds.com.

Richard is the co-founder of Castle Point Funds Management. Previously he was Head of Equities for Tower Investments in Auckland.

| « China's Dominant Deficits | Socially responsible investing (Part 4): Growing pineapples in Alaska » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |