China's Dominant Deficits

As the PBoC tightens its lending stance and as a result China's banks are experiencing a constraint on their ability to expand their assets, international economist Andrew Hunt examines what the repercussions could be not only for China, but also world markets

Wednesday, May 3rd 2017, 9:30AM

by Andrew Hunt

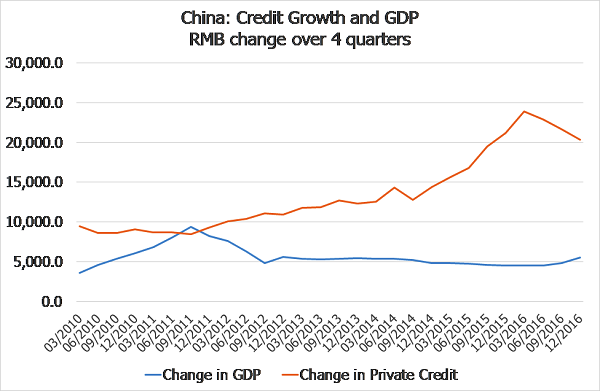

Despite the country’s apparent export prowess and its persistent trade surpluses over the last twenty years, we estimate that the Chinese corporate sector is currently running a financial deficit (i.e. the financing gap between in current expenses plus CAPEX and its current revenues) of between US$1.5 and US$2 trillion per annum. This situation is not unique to China – both Japan and Korea’s corporate sectors operated with similar (if not quite so large) deficits during their high-growth phases in the 1960s-70s and 1980s respectively – but as Japan proved in the early 1990s, if and when the necessary financing for these deficits dries up, the results for the domestic economy can be severe. In fact, we further estimate that if China’s corporate deficit were to become unfinanced for whatever reason, then China would in all probability suffer an economic slowdown that would rival the West’s 2008 Great Recession. At the very least, there would be a sharp fall in capital expenditure by companies and also a sharp decline in employment levels and, for this reason, we can reasonably assume that the Chinese government will always attempt to do whatever is necessary in order to ensure that the banking system remains in a position to be able to meet the corporate sector’s funding requirements. China would certainly not wish to see a 1990s-style Japan banking crisis that forced austerity onto its major employers.

In fact, we believe that in order to ensure that the corporate sector’s deficit is funded, along with some degree of property market activity and even a modest amount of consumer credit, it is quite probable that China’s banking system is currently being required to grow its total assets by between $2.5 trillion and $4 trillion per annum, simply to maintain the ‘status quo’ within the economy. Unfortunately, this implies that China’s banking system must continually expand its assets and relative size, despite its already immense existing aggregate balance sheet.

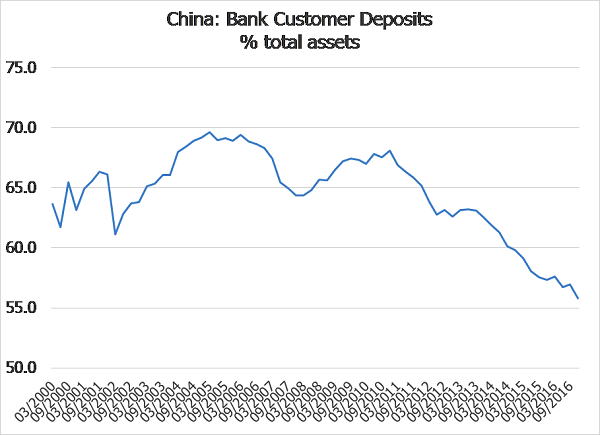

Indeed, according to the IMF’s IFS data, which we suspect is probably too conservative on the subject, China’s banking system possesses total assets that are the equivalent of around 300% of GDP, an already extreme number by any standards (either historical or even regional). Moreover, the IMF also reports that the banking system currently possesses an asset to deposit ratio of circa 2:1, an immensely disturbing situation that has arisen (we believe) simply because of the private sector’s growing levels of satiation with bank deposits as a medium or vehicle for their savings. Having been obliged to save via low-yielding deposits for so long, China’s savers now require something more effective and it is this dynamic that we believe lies behind China’s recent huge capital outflows and sharp equity / commodity / BITCOIN speculation cycles. Certainly, we see these features as being symptoms of this satiation with bank deposits.

From a practical perspective, we believe that the ‘best way’ to think of the collapsing customer deposit ratio within China’s banking system is as being akin to – and the result of - the funding deficit in the commercial banking system itself.

In short, the need for the banking system to fund the corporate sector’s persistent financial deficits has left the banks with a substantial funding deficit of their own; the corporate sector’s financial problems have not only created a perceived (but of course rarely crystalized) asset quality problem within the banks, it has also left the banks with a much less well recognized but perhaps more important (liabilities) funding problem of their own.

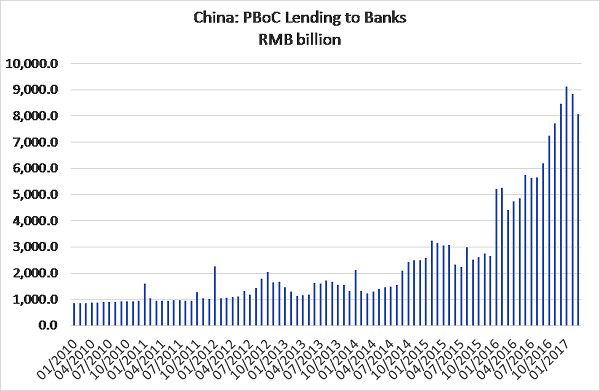

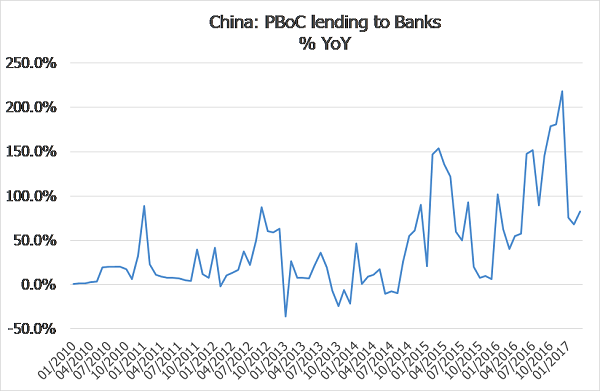

During 2014, the funding gap within the banking system was partially met via the importation of foreign funding, an event that caused some concern at the time and which ended as 2014 drew to a close and the RMB began to be seen as less of a ‘one way’ appreciation ‘bet’. Thereafter, during early 2015, as their access to foreign capital became restricted, China’s banks did experience some degree of funding stress that led to a weaker economy in the early part of the year but, over the second half of 2015, the banks’ problems were alleviated via their sharply increased issuance of bills and bonds, an event that allowed both credit growth and of course economic growth rates to recover to some extent by the end of 2015. However, we also find that, over the course of 2016, China’s banks have also become increasingly reliant on the largesse of the PBoC’s own lending operations (i.e. the PBoC began ‘printing money’ in order to help the banks). In fact, we could argue that the PBoC became so generous last year that it perhaps inadvertently caused China to experience yet another credit boom. It is this latest credit boom that lay behind China’s recent faster growth and its increased appetite for in particular hard commodities.

Crucially, however, we can now further observe that, since December last year, the PBoC has switched its stance once again to become notably less generous and as a result the banks are experiencing a constraint on their ability to expand their assets.

Hence, we note that the corporate sector has begun to experience credit supply constraints of its own and this has resulted not only in a probable slowdown in domestic CAPEX and other forms of corporate expenditure but also in a renewed reduction in the sector’s demand for commodities and other externally produced goods. Indeed, the slowdown in China’s demand for commodities appears to be leading to weaker commodity prices globally – particularly as it appears that the markets hopes for the great Trump Reflation have so far come to nought and Europe’s economies remain decidedly mixed in growth terms.

We do suspect, however, that this ‘growth scare’ and correction in commodity prices may prove merely to be a temporary event. Given the profoundly cash flow negative position of China’s corporate sector that we noted above, we can assume that if domestic credit growth continues to slow within China (and, in particular, if credit growth drops below what we suspect is a circa $2 trillion critical level), then the corporate sector will indeed be obliged to enter a period of sharp austerity with regard to its own spending on employment, imports & CAPEX, and to quite possibly begin raising its output prices towards profit-maximizing levels.

Indeed, if China’s credit slowdown continues for another few months, we can expect a corporate recession and quite possibly higher rates of domestic inflation. Quite naturally, we doubt that the Chinese Leadership will wish to see such a scenario unfold, particularly in what is a politically charged year.

Consequently, we suspect that, just as much of the world is beginning to embrace the notion of the tighter policy / Chinese slowdown hypothesis, the powers that be in China may be beginning to consider another policy flip flop. Such an abrupt U-turn would of course represent nothing new – we have witnessed three or four such cycles in the last 18 – 24 months – and another reversal in direction may soon be upon us. (One could almost suggest that there is a 4-5 month ‘wave-length’ cycle present in the data….)

As far as we can tell, at present the PBoC is still behaving in a quite parsimonious fashion and China’s rate of domestic credit growth has slowed as a result. However, we do not believe that this policy stance is in anyway sustainable. Ultimately, policy must ease and the currency must one day be adjusted lower.

Indeed, we suspect that as we approach June and the run up to the Autumn congress, the PBoC will shift back into a more generous mode even if this leads to a resumption in import demand, pressure on the currency, and most of all to an increase in ‘demand-pull’ pressure on the domestic inflation rate.

In fact, it is our firm belief that a combination of structural and financial factors will inevitably lead to significantly higher trend rates of inflation in China later this year and in early 2018 and we further believe that this inflation will tend to ‘infect’ global inflation rates and erode global household real incomes in aggregate over the medium term. However, in the very near term, the PBoC’s recent tighter stance seems likely to constrain growth in the Chinese economy and depress commodity prices globally. Indeed, we have already witnessed some defusing global inflation fears, at least in the ‘mind of the financial markets’.

Of course, if China’s central bank drops the ball entirely and neglects to ease this year, then we could imagine a relatively rapid and disturbing descent into a financial crisis and a recession in China that results in a sharp fall in the RMB and of course to another global deflation scare but we very much doubt that China’s leaders would willingly allow such a chain of events to occur.

Therefore, we believe that in the near term one should seek to ‘trade’ changes in the PBoC’s stance but to bear in mind that the ultimate end game for China and its export prices is likely to be an inflationary one and that, if China begins to inflate, then so too will much of the global economy given the country’s crucial position within the global supply chain. Indeed, when and if the PBoC eases in the months ahead could mark the turning point in the global inflation cycle almost regardless of events within the White House.

Nikko Asset Management New Zealand Limited

Level 48 Shortland Street, Auckland 1010

Phone: 09 307 6363

Email: NZenquiries@nikkoam.com

Andrew Hunt International Economist London

| « The view from the other side of the world | Tourism Holdings – Motoring Through the Capital Cycle? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |