The view from the other side of the world

The levels of offshore ownership in the New Zealand share market have increased dramatically in the last few years. But now offshore rates are beginning to rise again, what could that mean for our local market?

Monday, April 24th 2017, 11:06AM

by Gordon Sims

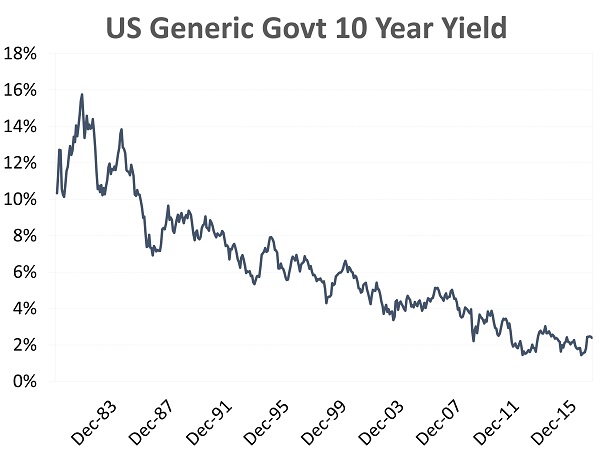

An investor in 10-year US treasuries has been handsomely rewarded over the last 30 years. Yields have contracted from a high of 16% in the early 1980's to well below 2% more recently.

As yields have fallen, investors have significantly benefited from capital gains, giving rise to the slightly perverse current situation where investors are in bonds for capital gains and in equities for income. Such an investor might be a North American baby boomer (there are after all over 70million of them) nearing or in retirement with a well-earned nest egg to protect and use for an income.

When these boomers were in their middle age they would have seen a $500,000 investment in US 10-year treasuries providing a comfortable annual income of $80,000. Not too bad, and an awful lot more than the $10,000 it would provide today. Of course, a prudent investor might also want protection from future inflation, something that bonds don't do, and something we will come back to.

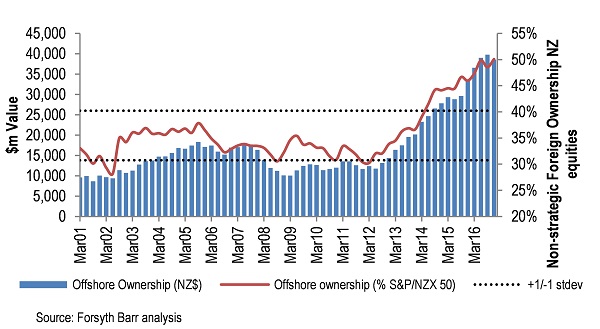

Faced with a paltry 2% yield from local treasuries, global investors have, over the last 10 years (and increasingly over the last three years), searched for higher yielding 'safe' investments. New Zealand's stable and growing economy and high-yielding companies have been incredibly attractive and many local investors have been significant benefactors of the much-discussed yield trade.

The result of this is most clearly seen in the chart below, which shows the levels of offshore ownership in the New Zealand share market. In dollar terms this has risen from below $15bn to nearer $40bn in just a few years, and in percentage terms from 30% to around 50%.

Whilst we highlighted our North American baby boomer above, the recent buyers of the largest New Zealand stocks are offshore funds such as the ones below:

• Artemis Global Equity Income Funds

- Owns 57m shares, 9%, of Sky City

• Newtown Investment Global Equity Income Funds

- Owns 131m shares, 7%, of Spark

• Blackrock Global Dividend Select Funds

- Own 42m shares, 6%, of Fletcher Building

- Own 40m shares, 10%, of Sky Network TV

- Own 116m shares, 6%, of Spark

Many of these fund's clients are the baby boomers themselves, or pension funds working for them.

Some of these are managed by active investors, making their own informed decisions regarding the relative merits of their investments. Others are ETFs or similar, with strategies driven only by arbitrary decisions by a third party on whether stocks should be included in a particular index. Regardless of what has driven these buyers, they will likely have two common motivations for deciding to exit their holdings.

Firstly, if these funds can get a similar yield elsewhere, especially one closer to home, there is less reason to own a relatively obscure stock on the far side of the world. Rising interest rates in the US or elsewhere should then lessen the attractiveness of New Zealand’s “yielders”.

Secondly, if yields themselves fall investors will leave. This can happen in two ways. Increasing stock prices reduce yields and provide a natural cap to further buying (e.g. Auckland Airport), or a company can cut its dividend.

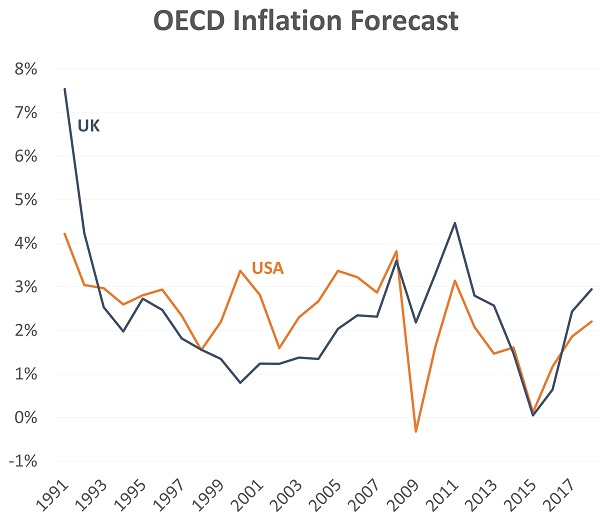

This means that investors in the New Zealand share market need to keep abreast of both offshore yields and local dividend sustainability. Offshore rates are beginning to rise again and after years of money printing in the northern hemisphere, inflation is showing signs of starting to appear.

Unemployment in the US is now just below the level at which many economists believe it becomes inflationary. The level of inflation surprises is also increasing, as illustrated in the below Deutsche Bank chart.

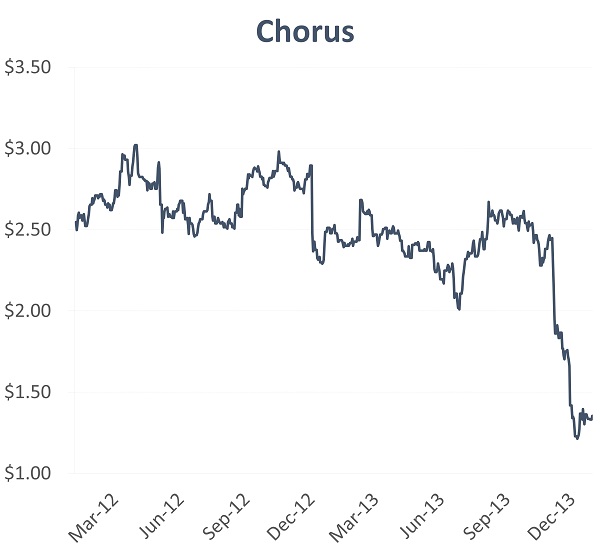

In the case of dividend cuts, things can get ugly quickly. In late 2013, an uncertain regulatory outlook caused Chorus to announce the suspension of dividends. BNY Mellon was one of many alarmed shareholders, exiting its 7% stake. In the process, a supposedly stable utility company lost nearly 50% of its value in only a few weeks.

Source: Bloomberg

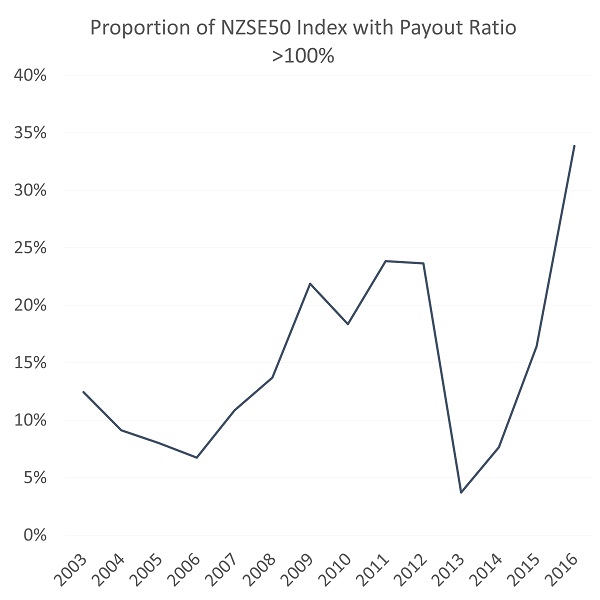

Some of New Zealand's largest companies have been aggressively raising dividends. The chart below shows the increasing proportion of NZX50 companies paying out more than 100% of their earnings in dividends. In 2016, thirteen companies, making up 35% of the Index, paid out more than they earned.

Source: Bloomberg, Castle Point

So where does this leave us? There are some things we know for sure:

- More of our local market is owned by offshore investors.

- Offshore investors have been attracted by New Zealand’s dividend yield.

- Valuations have been driven to extreme highs.

And there are some that things that we know are likely to happen in the medium to long term:

- Global growth will rekindle, and interest rates will rise.

- Given the increasing prevalence of high dividend payout ratios, some New Zealand companies may be forced to reduce, or even cut, their dividend.

And, as we have seen before, when the North American baby boomers decide to leave, the impact on prices can be dramatic.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique funds management business established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point has a focused investment approach based on a long-term perspective, capital preservation and investor alignment. More information can be found at www.castlepointfunds.com.

Gordon Sims is a partner of Castle Point. He has a Master of Finance from Massey University, and is a CFA Charterholder.

| « Socially responsible investing (Part 3): returns, fees and investment options | China's Dominant Deficits » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |