Socially responsible investing (Part 3): returns, fees and investment options

In this month’s commentary, Pathfinder looks at real world implications of responsible investment (RI). Are RI returns better, worse or no different than market returns? What investment options are available within NZ and from offshore?

Thursday, April 20th 2017, 10:02AM

by Pathfinder Asset Management

Can investing in “bad stuff” pay off?

The short answer is “yes, sometimes.” Sectors avoided by many ethical investors can have periods of strong returns. Tobacco is the most widely discussed sector – it has been bad for your health as a consumer but great as an investment. Despite tobacco consumption shrinking globally and large law suit settlements, tobacco stocks have delivered total returns of 13% annualised since 1997. This is quite remarkable, especially given the overall market has returned 4.5% over the same period.1

But outperformance by the likes of defence, casinos and armaments (let’s call these “bad stocks”) is not guaranteed. If you want to invest in “bad stocks”, your first option is to construct a diversified portfolio of directly held stocks. Motif (a US investment website platform) created a model 20 stock portfolio based around the seven deadly sins – which includes junk food, tobacco and alcohol stocks. It has returned only a little more than half of the S&P500 over the last year:

Your second option for “bad stock” exposure is investing through managed funds, although there are few options. One is the “Vice Fund” – a US mutual fund (VICEX) with a focus on tobacco, alcohol, gaming and weapons/defence companies. The investment thesis is that these industries have high barriers to entry and tend to thrive regardless of how the economy overall performs.

The US$232m Vice Fund (which changed its name to the Barrier Fund in 2014) has been running since 2002. It has underperformed the S&P500 over one, three, five and ten years.2 Its “anti-responsible investing” credentials are reflected in its low Sustainability Rating from Morningstar – its one out of five scoring reflects how companies in the fund manage environmental, social and governance (ESG) factors – not very well it would appear!

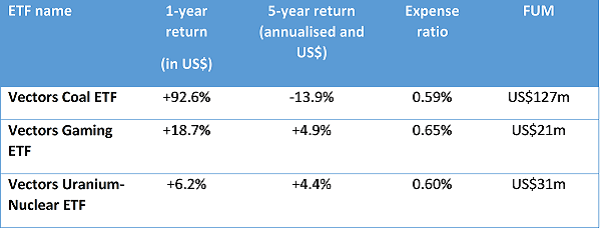

Your third option is to invest in US listed ETFs that offer concentrated sector exposure to the “bad” stuff. There are actually surprisingly few “sin” ETFs - for example there is no US listed tobacco ETF. Below are three “sin” ETFs from VanEck:

None of these have shot the lights out as an investment over the last five years. Aside from tobacco stocks' consistent outperformance, it is a struggle to find evidence suggesting a portfolio of “sin stocks” outperforms over long periods.

Can you do good and do well?

There is an increasing weight of evidence showing you can “do good” by investing responsibly and “do well” by outperforming the market. The Responsible Investment Association of Australasia (RIAA) publishes an annual comparison of RI fund returns against broad market returns. Their 2016 survey shows Australian RI funds outperforming non-RI funds in 10 of the 12 time periods:3

Globally, there is a large body of academic and industry studies that establish investing responsibly does as well as (or better) than the market, without taking on extra risk. Here’s a selection of studies from 2015:4

- Deutsche Asset & Wealth Management and Hamburg University conducted a meta-analysis of over 2,000 studies (the most comprehensive review of academic research on this topic). They conclude “the business case for ESG investing is empirically very well founded…. the large majority of studies report positive findings.”

- Oxford University and Arabesque Partners reviewed over 200 sources and concluded "80 percent of the reviewed studies demonstrate that prudent sustainability practices have a positive influence on investment performance."

- The Morgan Stanley Institute for Sustainable Investing found that "investing in sustainability has usually met, and often exceeded, the performance of comparable traditional investments" (on both an absolute and a risk-adjusted basis).

The evidence from offshore seems clear – if you invest responsibly you should do at least as well as the market. In fact, you will probably do better.

Investment options

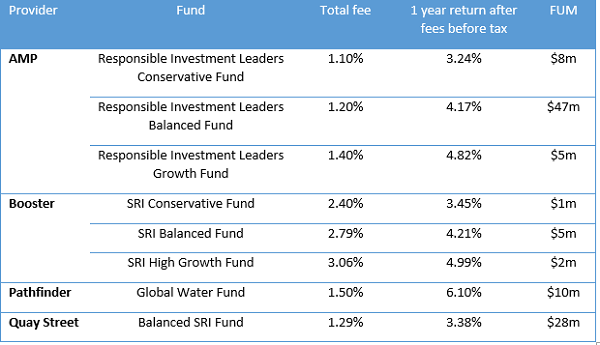

So how do you access responsible investment products? Outside KiwiSaver there is a limited universe of NZ PIE managed funds in the responsible investment space. Below are a collection of RI funds with at least a 12 month track record: 5

From the table we see that assets under management in specialist retail RI funds are relatively low - it is an evolving area. We also see cases where fund manager fees for investing responsibly are much higher than what you’d expect (this is not just a NZ problem but also evident in Australia with Australian Ethical’s Balanced Fund charging 2.5% and Perpetual’s Ethical SRI Fund charging 2.28%).

Within KiwiSaver there are a range of fund options for investors wanting a responsible focus, for example AMP, Koinonia, Amanah, SuperLife, Quay Street and ANZ. Interestingly, when it comes to responsible investing KiwiSaver funds differ from conventional managed funds in several ways:

- Disclosure: KiwiSaver funds are required by law to disclose their approach to responsible investment – this is not the case for conventional (non-KiwiSaver) funds.

- Exclusions: The exclusion of tobacco and controversial munition stocks are now standard across KiwiSaver managers (again not the case with conventional funds) – for example, Simplicity, ASB and Booster have all implemented exclusions in their KiwiSaver offerings.

- Fees: There are instances of the equivalent fund in KiwiSaver being significantly cheaper than the same fund outside of KiwiSaver (this is not across all managers but it shows the FMA’s focus on KiwiSaver fee levels does have an impact).

Outside of NZ PIE funds investors can also choose ETFs or Australian unit trusts. There are a number of US listed ETFs from providers such as iShares and SPDR that select stocks on ESG criteria or focus on niche areas like fossil fuel free stocks, gender diversity and clean energy. Management fees typically range 0.20% to 0.50%. Of the Australian ethical managers, Hunter Hall, Australian Ethical and Perpetual appear to be the most widely known in NZ.

Conclusions

Here’s some final thoughts:

- You can invest responsibly and do well. There are a range of studies globally establishing RI performs as well as or better than the wider market. Closer to home this is supported by 10 years of Australian data from RIAA showing outperformance by RI funds.

- A portfolio of “bad stocks” probably won’t beat the market. It is possible to invest in a “bad stock” sector (i.e. tobacco) and have above market returns. However, a diversified portfolio of “bad stocks” seems to underperform the market (admittedly this conclusion is based on a small universe of “real world” examples)

- Do your research selecting funds. Be aware some responsible investment fund fees can be high compared to non-RI funds or compared to the same fund inside KiwiSaver (that doesn’t seem very responsible of the manager!)

Putting aside personal values when making investment decisions, there is a strong financial case to invest responsibly. This has helped responsible investing become a mainstream thought process for investors in large offshore markets – and it is moving RI into the mainstream of NZ investing.

John Berry

John Berry is a founder of Pathfinder Asset Management Limited, an independent director of Punakaiki Fund Limited and a member of the Responsible Investment Association of Australasia. Pathfinder is manager of the Global Water Fund (a responsible investment fund). This commentary is not personalised investment advice - seek investment advice from an Authorised Financial Adviser before making investment decisions.

Notes:

1 Deutsche Bank

2 Morningstar website

3 www.responsibleinvestment.org

4 www.ussif.org/performance

5 www.companiesoffice.govt.nz/disclose

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « Beware a 2019 recession | The view from the other side of the world » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |