China's Phantom Slowdown

Economist Andrew Hunt has spent 10-days on the road talking to managers and economists. Here's what he found out about the state of the global economy - and his views on the all important Chinese economy.

Tuesday, February 20th 2018, 11:12AM

by Andrew Hunt

As the author has travelled the world over the last 10 days, three things have become all too apparent to us. Firstly, growth and indeed inflation expectations are a little higher in Asia than they are in Europe, although even in Asia very few people are yet talking of the danger of overheating.

Secondly, although the ‘consensus’ of opinion is that global trends are not too far away from some perceived ideal ‘Goldilocks Scenario’, many portfolio managers are currently holding elevated levels of cash or insuring their portfolios, ostensibly because they fear the consequences of an unwinding of the central bank’s extraordinary policy measures (“Q-exit”). However, we have also noted that there has been relatively little ‘hard’ analysis of this particular topic.

Finally, we note that almost everyone has accepted the ‘moderate / gentle / controlled / centrally planned slowdown scenario in mind for China’s economy..

Perhaps rather naughtily, we have been passed a number of reports on China from a variety of sources as we have been travelling but virtually all of these reports have referenced the idea that China is slowing as a result of weaker credit, central direction and the impact of pollution controls. None of these reports has however referred to inflation in anything more than a very superficial way – even those that have noted the behaviour of the seemingly permanently component series….

For our part, we believe that it is likely that China’s industrial sector has indeed witnessed what seems to have been quite a significant slowdown in its rate of output growth over the last three months. We can infer that this deceleration has been the result of the now quite draconian anti-pollution rules (which are obviously needed – the air quality in Southern China looked quite bad) together with some degree of credit constraint within the corporate sector. Although it is no longer possible for us to construct a reliable estimate of the Chinese corporate sector’s financial balance, we suspect that China’s corporate sector continues to possess a $1.75 trillion borrowing requirement and it does appear that the volume of credit that is being extended to companies is only just sufficient to cover this deficit – hence the softer production and in particular the weaker investment data that has been so remarked upon in the press.

It is however our understanding the reduced availability of credit is the result of a centralized policy decision (just as much as the pollution measures have been) and therefore we can suggest that the primary driver of the industrial slowdown has in effect been “an official edict”; China is after all still a largely command economy.

This weaker industrial data has of course been reflected in the high-profile Purchasing Managers’ Survey and some of the other ‘short cut series’ that markets have become accustomed to watching. Moreover, the weaker production data has led many to conclude that the real GDP data may have been overstated – even the ever consensus BBC financial news has risked putting its head above the parapet on this particular topic and there may well be some truth in this viewpoint.

However, we must emphasise that China’s own nominal spending data has shown no sign of a slowdown in RMB terms despite the recent increase in import prices. As a mathematical result of the method of compilation of the GDP data, rising import prices will tend to depress reported nominal GDP growth and we estimate that China’s import prices have increased by 5 – 7% over the last year.

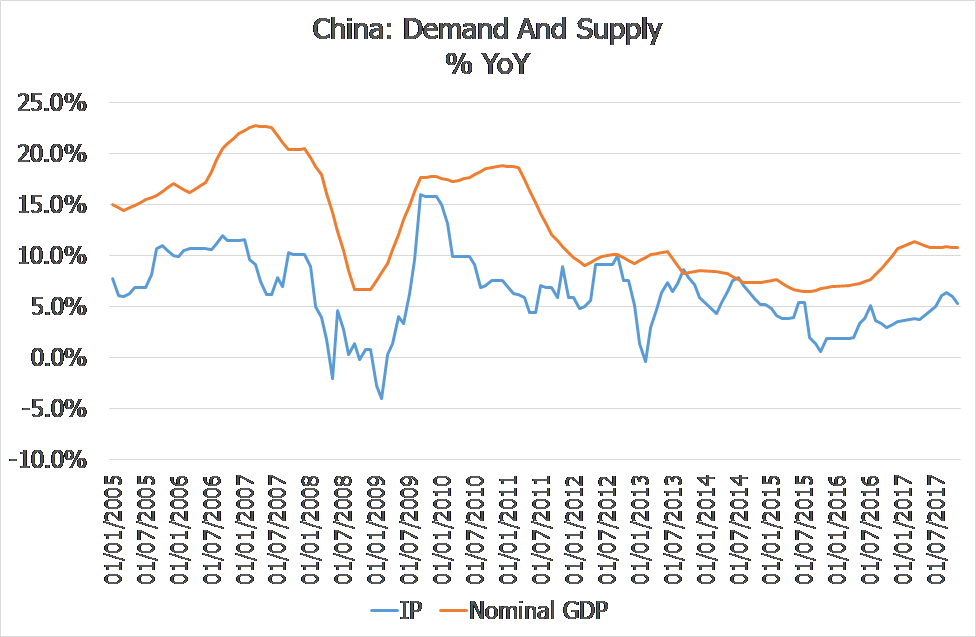

We can therefore suggest that China is experiencing a situation under which nominal demand is expanding at an 11% rate (or perhaps even a little faster), while the economy’s supply potential has been expanding at only around 4%, in part as a result of an official ‘command’. Clearly, this situation should be imposing an inflationary bias to the economy, the like of which we have not witnessed since 2007 or 2011 (admittedly the exact circumstances on these occasions were a little different then but the result was the same).

China: Demand and Supply % YoY

For investors – and indeed policymakers – there are a number of obvious conclusions that follow from this situation. Investors should, we suspect, be seeking to find those companies that will benefit from strong consumer demand / rising inflation in China, while perhaps avoiding those ‘plays’ that are reliant on the Chinese production and investment cycles. This is one reason why we suspect that Australia’s economy, which is of course very sensitive to the Chinese production cycle, may not perform as well in growth terms this year as the consensus is expecting.

There may be something of a synchronised global economic recovery occurring but Australia’s biggest customer – the Chinese supply side – is perhaps the one part of the global economy that has become de-synchronised. New Zealand, on the other hand, is more sensitive to Chinese consumer trends, as of course are many European exporters to China.

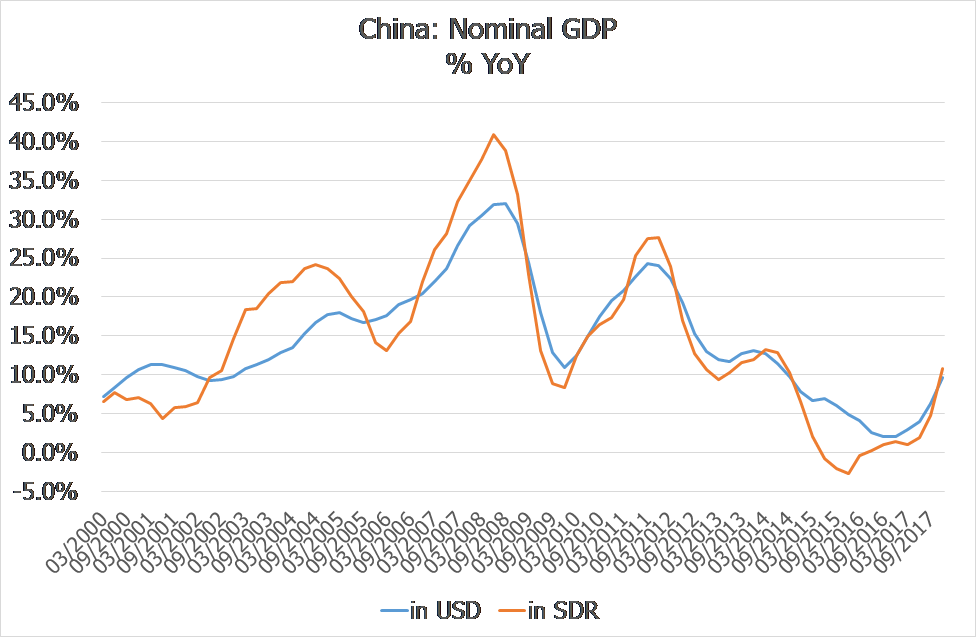

In terms of China’s likely influence on the rest of the world, we would argue that what matters is the growth rate of its “purchasing power” and, particularly from the point of view of equity investors who theoretically at least should be concerned with corporate earnings, that this purchasing power is measured in dollars, yen, euros etc., rather than volumes.

Given these considerations, we would suggest that the world should be very conscious of what is happening to China’s nominal purchasing power at the moment and we would suggest that this can be proxied by two simple variables, namely i) China’s rate of nominal income growth measured in dollars or SDRs (Special Drawing Rights) i.e. nominal GDP, and ii) China’s rate of credit growth in third party currency terms.

The simplest explanation for this assertion is simply to imagine a tourist from China walking down Fifth Avenue in New York; his or her ability to raise demand in the USA by spending more will be determined by the dollar level of his income, or the dollar value of his wealth, or his ability to borrow. Judged by these metrics, China’s economy is doing anything but slowing currently and we would argue that its influence has become decidedly inflationary for the world, via both its absorption of imports from the rest of the world and its own rising export prices.

China: Nominal GDP % YoY

In reality, it is a decade or more since the financial markets last had to worry about inflation (2005-7 was the last real inflation scare and one probably has to go back to 1994 to find a period when markets were truly fixated on inflation for any significant length of time). This is sufficiently long ago to represent something resembling ‘ancient history’ for many Portfolio Managers and surprisingly we find that few in the industry even bother to draw their analyst charts, or run their correlations, as far back as these dates.

One direct consequence of this long absence of inflation is that few people even bother to note what is happening to nominal GDP or nominal variables – even most of the soft sentiment subjective data is notionally aimed at predicting volumes - but, ultimately, it is nominal variables that cause tightening reactions from central banks, or more positively cause earnings surprises for equity markets.

At present, it is firmly our view that the recent upturn in nominal demand growth in China will continue to lead to positive earnings surprises in Asia and those parts of the OECD that are sensitive to global trade variables – and particularly to the global trade in consumer goods.

Consequently, we are notably bullish on Asian equity markets at present but, ultimately, we must caution that the central banks will find that they too need to return to looking at nominal values. We judge that this moment in central banking is likely to still be some way off (2018H2 at the earliest) but, when policymakers do turn their focus to such things, the investment world may well begin to change quite significantly and in a way that many managers have not experienced for a considerable time.

Indeed, we suspect that if market participants come to view there being a regime change within the central banks away from targeting / supporting asset prices and towards combating inflation, the re-pricing of financial assets may be severe. However, as we have noted, until this point is reached risk assets will likely remain well-bid.

Andrew Hunt International Economist London

| « Rethinking retirement assumptions | Sound corporate governance is good, but management alignment is better » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |