Sound corporate governance is good, but management alignment is better

It's better to hang out with people better than you. Pick out associates whose behaviour is better than yours and you'll drift in that direction. - Warren Buffett

Tuesday, March 20th 2018, 9:26AM

by Castle Point Funds Management

In his book The Outsiders William Thorndike attempts to answer the question "Who’s the greatest CEO of the last fifty years?"

Thorndike looks for cases where a company listed on the US market handily beat both its peers, and Jack Welch.

Jack Welch was CEO of General Electric for 20 years and is often to the go-to answer to the above question.

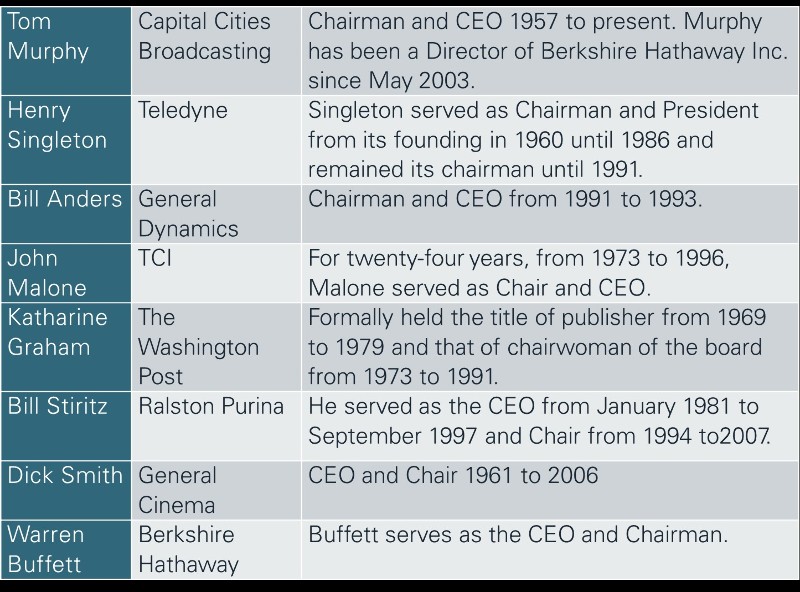

After extensive searching in databases at Harvard Business School’s Baker Library, he came across only seven other examples that passed those two tests, which he then discusses in the book.

Thorndike identifies some common themes among these individuals’ leadership styles. They generally ran decentralised management structures and were excellent capital allocators.

The companies themselves, however, were generally poorly governed. In fact, all the CEOs were for at least a period of time also Chair of the Board. This severely limits the independence of a Board and is considered a major governance breach.

The Outsider CEOs

Warren Buffett's Berkshire Hathaway is on Thorndike’s list and is a classic modern-day example of a poorly governed but highly successful business.

While Buffet has created an incredible amount of wealth for his shareholders over a long period of time, you wouldn't have owned Berkshire Hathaway if you rated it on its corporate governance score. You also probably wouldn’t have owned Apple, the largest company in the world by market capitalisation.

Also, investing in companies that rate highly on governance is not a sure-fire way of avoiding blow ups, Fletcher Building being a classic recent example.

A board might tick the boxes for all the qualities that you look for in good governance, but if it presides over a poor quality, misaligned executive team there can be big problems.

Undoubtedly, if you invest in a company with weak governance you are missing an important safety net. But, if you can find a quality management team that is appropriately aligned then it can be worth breaking the governance rule.

At Castle Point we place management quality, integrity and alignment over governance.

Eight of our 10 largest Ranger Fund holdings have highly aligned executive teams, predominantly through direct share ownership.

Some of them do not necessarily rate highly on governance. IVE Group, for example, has an executive chair.

Wellcom also has an executive chair. However, in our opinion, the CEO's are highly aligned to shareholders and show similar attributes to the "Outsiders".

They run decentralised management structures and have proven to be excellent capital allocators.

There is no simple answer regarding appropriate governance. Investing in companies that rate highly on governance might reduce the risk of owning poor returners, but it won't eliminate it. It also might exclude some truly exceptional performers.

In our opinion a well governed business is a positive, but nothing beats a capable and aligned management team with integrity.

| « China's Phantom Slowdown | Is active investment management the solution to navigating technological disruption? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |