RBNZ clearly has life insurance commission in its sights

Insurance advisers' commissions have come in for heavy criticism again, this time from the Reserve Bank.

Wednesday, November 28th 2018, 1:55PM  4 Comments

4 Comments

It released its latest Financial Stability report this week, which looks at the banking and insurance sectors.

The report highlighted life insurers' tendency to rely on financial advisers, rather than shifting to online and direct distribution as many general insurance providers have done.

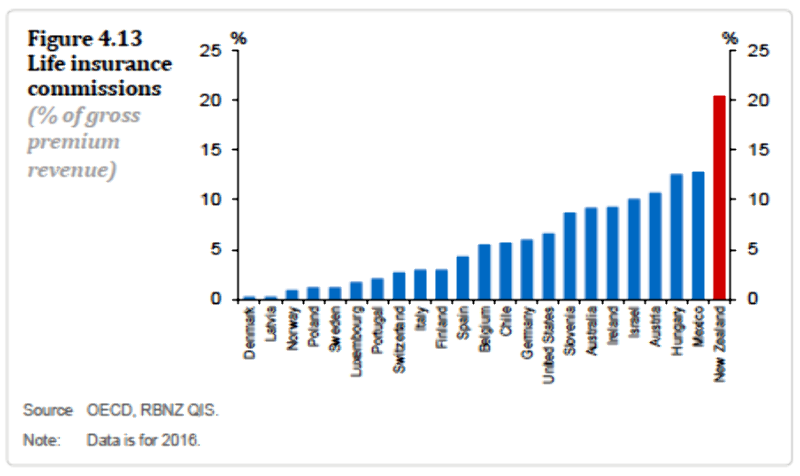

It compared commission in New Zealand to that paid by insurers in other countries and found New Zealand's insurers - paying commissions of about 20% of gross revenue - were at a level almost double their nearest counterpart, Mexico, at just under 13%.

The United States was at about 5% of revenue and Australia just over 10%.

Reserve Bank governor Adrian Orr said the comparison was included "because sunlight is a good disinfectant".

“We can’t micro-manage this industry but it has some real specific issues.”

The report said, while advisers had an important role in helping buyers pick the right products for their circumstances, the commissions and other incentives they were paid created a risk.

"In some cases, advisers could be incentivised to encourage policy-holders to switch to different insurance policies, even if the changes do not benefit the policyholders.

"Such activities can compromise the efficiency of the sector because policyholders may not be matched with the best policies and ultimately end up funding high commissions through high premiums."

The Reserve Bank and Financial Markets Authority are working on a review of the conduct and culture of the life insurance sector, following a similar investigation into banks.

A report is expected in January.

Orr said insurers should expect a verdict worse than that handed down to banks.

| « It's goodbye to Sovereign | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

Even the international experience and research supports life insurance commission.

The exception is the Aussie regulator, though they seem to be determined to prove their point by destroying the Aussie insurance industry.

The only people no commission life insurance sales help is banks.

Which is demonstrated in the only factual comment in the article, bank-assurance has a higher profit margin.

No shit, poor products, distributed exclusively with no competition, comparison or skill of implementation.

VIO/Bank distribution proven by our own FMA's research delivers poorer advice outcomes than adviser business.

Yes, insurers distributing through advisers have a lower profit margin, we advise the best products for clients as age and stage changes, we keep the insurer honest and nimble because we have choice.

No one is keeping bank assurance honest. And the Reserve Bank comments only demonstrate their desire to drive profits for banks and not outcomes for consumers.

Sorry, Reserve Bank, you've published an own goal that demonstrates you're out of line with the rest of the regulators focused on better client outcomes.

The days of only driving for corporate profits are done. The people are revolting and the sun is setting on profits at all cost.

Warning; this is a long one.

Here goes:

report is here https://www.rbnz.govt.nz/-/media/ReserveBank/Files/Publications/Financial%20stability%20reports/2018/fsr-nov-2018.pdf

I would direct you, dear reader, to page 8.

On page 8 the sentence "High commission structures remain a challenge to efficiency in the life insurance sector..." appears. But that sentence appears in a paragraph that starts with ‘CBL Insurance Ltd (CBL) was placed into liquidation….” and goes on to talk about capital requirements, strength and reducing buffers THEN makes the astonishing Segway into high life insurance commissions! And conduct! And culture!

There’s a lot to unpack there. Not least the fact that life insurance commissions paid to Jim the life adviser in Taupo had nothing to do with the collapse of a general insurer, that had been trading insolvent (on the RB’s watch!), and was having trouble with construction insurance, which was issued in France.

Speaking of “conduct” and “culture”: Let’s look at the conduct of the RBNZ who relied on the assurances of CBL’s auditors who concealed the insurer’s difficulties and insolvency for years, and then when the RB suspected there was trouble, made investigations under strict non-disclosure rules which kept shareholders in the dark. On 14 November Rob Stock wrote on Stuff quoting Toby Feinnes (RB head of prudential supervision) saying “There have been some questions already on whether we should have done things differently," Fiennes acknowledged. "The main question that's been raised... by shareholders is whether we should have revealed to the sharemarket that we were investigating from August last year," he said.

Seems our RB has a culture of “light handed” (lazy) regulation. Relying on unreliable auditors. And has no aversion to butt-covering conduct at shareholders expense, hiding their concerns and allowing shares to be traded long after becoming concerned (when they finally realised that CBL was actually insolvent).

Kiwisavers lost about $750 million. And over $135 million of shares were traded after August 2017 (when the RB finally became concerned, but hid it) and the company’s collapse in in February this year.

Brian Gaynor has much to say on this here https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12161376

And a response from the CBL directors is here https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12167441

Moving on. On P39 we have “Insurance advisors have an important role in helping buyers select insurance products that meet their needs. However, the high level of commissions and other incentives that life insurers pay to advisors can create conduct risk.”

Evidence please. Really. Because I am absolutely sick and tired of this myopic view that advisers are ‘switching’ or ‘replacing’ or ‘any-word-other-than-churn’-ing policies.

Furthermore, Assertions such as “because policyholders may not be matched with the best policies” seriously wind me up. Define “best”. Go on. And please, dear regulator, tell me how you got to the conclusion that you know what is “best” for the poor helpless incapable consumer – that they can’t work out either for themselves, or by working with an adviser who you said plays “an important role in helping buyers select insurance products that meet their needs”. Do regulators play a more important role?

One more thing: The report claims “Bancassurers” and “mature traditional businesses” had higher profits than “insurers that distributed through advisers.”

This quote comes from page 37. Now this is confusing AF. The table and comments deal with profit margins and expense ratios covering “88 percent of the industry by premium”. So not everyone who plays in the life sandpit.

We have “Bancassurers”, “mature traditional businesses” and “insurers that distribute through advisers”. That’s three types. And the former two “tend to have higher profits” than the third. Puzzling. Of course no breakdown of which specific companies are more profitable is available, but I would love to know how many ‘mature traditional businesses’ both do not distribute through either a bank or advisers, and are not in the 12% of the market that is outside the report’s reach.

None of this makes sense, and it seems the conclusions drawn from the data are not actually available in the data.

IE, are they made up?

The comments seem to imply that high commissions are a problem, drawing a distinction between the well-behaved and properly-run bancassurance, and the less profitable others. “Bancassurers have expense ratios in line with international averages. Expense ratios for other types of life insurer are significantly higher.” AHA!

Except, the expense ratios are non-commission expenses (see the very very fine print).

Ah.

So the true comparison is the more profitable bancassurance has lower non-commission expenses.

Like, claims?

Full circle. The problem is what again? Oh yeah. Advisers are paid too much.

Because, um… They just are. OK?

Because We said so.

Yup, because they said so, without justification or facts, from an opinion with no understanding of the industry.

I liked the point, higher profits through less claims. Explained because bancassurance and direct products are often substandard and as a result pay less claims.

A case of shareholder drivers and not client drivers, 80’s thinking from RB on this

Sign In to add your comment

| Printable version | Email to a friend |

And, as usual, no empirical evidence provided to show that consumers suffer adverse outcomes as a result of the remuneration structure.

In other words, tired old chestnuts trotted out in "me too" fashion as some sort of definitive revelation - without a shred of evidence, research, or proper investigation.

The author clearly has no idea how a life insurance premium is constructed or the role that reinsurance plays in funding retail distribution.

Even in these brief extracts, note the deployment of "could". "might", "can" and "may" - nothing more than surmise. hypothesis, and conjecture.