Harvesting Black Swans

If you are worried that you are feeling a little too positive about the world, Nassim Taleb's book, The Black Swan, is a good way to bring you back down to earth.

Wednesday, August 21st 2019, 7:00AM  3 Comments

3 Comments

by Castle Point Funds Management

Taleb has dedicated his professional career to exploring risks that lie outside of "normal" expectations. It has obviously taken some personal toll, "Every morning the world appears to me more random than it did the day before, and humans seem to be even more fooled by it than they were the previous day. It is becoming unbearable." he writes.

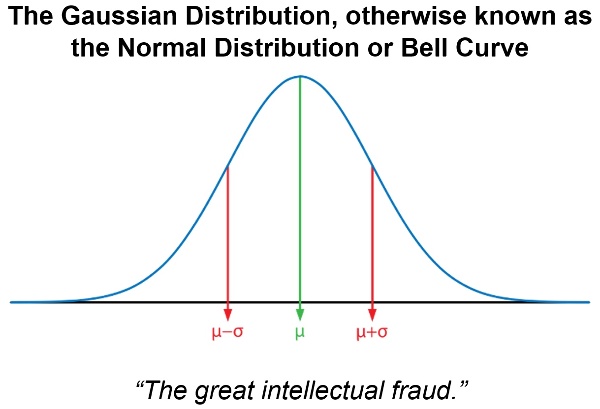

The cause for his discomfort is the occurrence of far more extreme events, Black Swans, than we might expect if the distribution of events fits within the Gaussian bell curve. This curve was first used to describe probability distributions in the natural world and is now a fundamental pillar of modern investment theory.

The standard approach to investing assumes that return distributions can be accurately described by the bell curve. Black Swans are assumed to be extremely rare events that are not worth worrying about. The problem with this approach in investing is that these events happen more often than they should, and when they do, they can be catastrophic. Taleb recommends that you turn the approach to risk on its head and consider Black Swan risk first. His answer is to barbell risk, keeping most of your investments as safe as possible and putting a small proportion into very risky investments, investments that are highly leveraged to positive Black Swans.

Positive Black Swans are events that are unexpected but have large positive impacts, such as the by-chance discovery of penicillin. Some companies are more exposed to positive Blacks Swans than others. A small technology company versus a large, regulated energy generator for example.

In our opinion, harvesting Black Swans is a more productive investment approach than trying to forecast future earnings. Look for companies that have the industry placement and corporate culture that increases the probably of them benefitting from unforeseen but positive future events. When you hold a company like that you have essentially been given a bunch of free options on unforeseen but positive future strategic decisions. This is the main reason why we invest in mid-cap growers.

Value companies are also a good place for Black Swan harvesting. This is because sentiment is already so poor that positive surprises can have a far greater positive impact on the share price than negative surprises.

By "farming" these companies (holding a portfolio of them) the occasional poor performer will be more than compensated by the positive outcomes.

While Black Swans cannot be predicted, we should accept that they are out there in higher quantities than conventional investment theory tells us. And we should be prepared for them, both the bad and the good.

Disclaimer: The above commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest. All material presented is believed to be reliable, but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point Funds may or may not have investments in any of the securities mentioned.

Product disclosure statements, issued by Castle Point Funds Management Limited, can be found at www.castlepointfunds.com/investor-documents

| « Lower and lower domestic interest rates | Taking the carbon out of KiwiSaver » |

Special Offers

Comments from our readers

So isn't trying to predict the next Black Swan as futile as forecasting the next random number in a random number series.

If a Black Swan could be predicted, then surely it couldn't be an unknown,

Sign In to add your comment

| Printable version | Email to a friend |