Lowdown on NZ primary sector investment

There are more complexities to investing in the primary sector than you might imagine.

Tuesday, November 19th 2019, 8:00AM

by Castle Point Funds Management

In a previous life I once tried to explain to a horrified client of an Australian fund why the fund didn't own many mining companies when the market there was booming.

The person looked at me aghast and asked how the fund could not own companies that were the lifeblood of the Australian economy. My answer was that just because the industry was an important contributor to a country it didn't necessarily make the companies in the industry good investments.

We subsequently lost that account. The investment consultant who managed the account confided in me afterwards that I would have been more convincing if I had used bigger words.

The same question might be posed about the primary sector in New Zealand.

In April 2018 the S&P/NZX Primary Sector Index was launched by the New Zealand Exchange (NZX), replacing the S&P/NZX Farmers Weekly indices. Companies in the index include those operating in the agriculture (red meat and wool, dairy farming and horticulture), fishing, forestry and viticulture sectors.

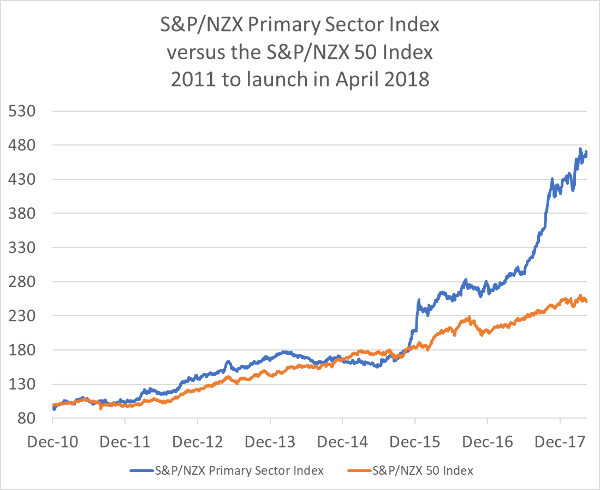

The NZX announcement at launch noted that the index "underpins the New Zealand Exchange’s strategy to support the growth of companies whose success is aligned to our country’s natural advantage". Analysis by the NZX showed that from 2011 to launch, the S&P/NZX Primary Sector Index increased 327%, compared to the S&P/NZX 50 Index which was up 153%.

Source: Bloomberg

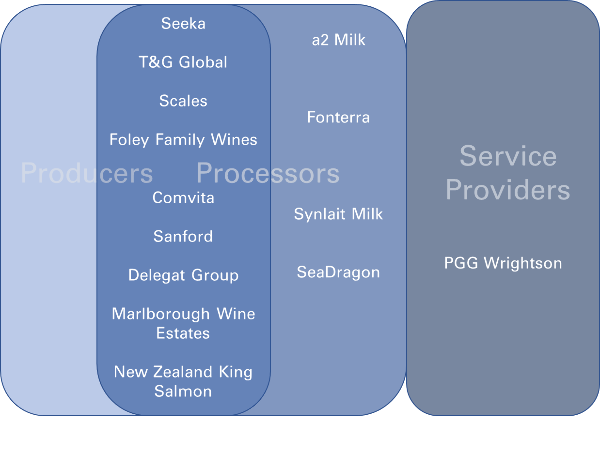

There are currently 14 companies in the index. It’s a diverse bunch. They can generally be split into the following categories: producer, processor, or service provider. Some are a combination of the three.

The overwhelming majority by number, and more so by size, are predominantly processors. The producers of primary sector commodities are New Zealand's farmers and beekeepers. You can get some apples, grapes, fish and a bit of honey. At the time of launch, the companies in the index generated 6% of New Zealand’s Gross Domestic Product.

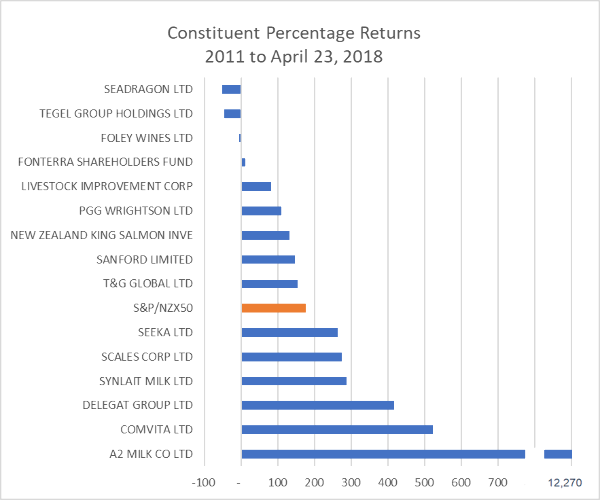

Up until launch many of the companies performed strongly. The standout of course was a2 Milk, returning a whopping 12,270%.

Source: Bloomberg

However, in our opinion, companies in this sector don’t generally make good long-term investments. Processors don't generally make good long-term investments if the end-product is still a commodity. This is because no real barrier to entry exists.

If the end-product is not differentiated, the processor is just a factory with some machinery in it, which is generally easily duplicated. This can result in very brutal capacity cycles. When processing capacity is tight, the processor can command high prices and earn strong returns, but high returns attract more investment and capacity is increased, generally overshooting demand and resulting in price competition and terrible returns for a time. Over a full cycle, returns tend to be poor.

Fonterra is a particularly tricky investment. When you invest in Fonterra you don't get exposure to milk. Apart from some inventory, the farmers own the milk, so milk price increases are not necessarily good for Fonterra. You also don't get shares. You get units in a trust that owns shares and you have no voting rights.

To make things more complicated, cash is divided out between shareholders and farmer suppliers using a complicated formula that can and has been tampered with.

You also need to consider some risks that are specific to agricultural commodities. Some suffer from severe cycles. If there are limited barriers to entry, producers increase capacity or switch to producing commodities that have delivered high returns, often oversupplying the market and decimating prices. There is also the risk of disease and bad weather events.

In our opinion, these risks are often forgotten by investors and management in good times, resulting in the accumulation of too much debt which often threatens survival in tougher times. Costa Group in Australia is a good current example of this.

Service providers often don’t get off lightly either. Service providers must bear an amplified effect during downturns in end-customer demand due to inventory run-down and cost cutting by the producers and processors.

In our opinion, any primary sector investment needs to be very seriously considered. A lot of attention needs to be placed on the balance sheet, potential industry cyclicality, and exposure to risk associated with weather and disease.

Dominant and innovative processors can make fantastic investments, as a2 Milk has proved to be, but the end-product needs to be sustainably differentiated or they will suffer the same cyclical problems as the producers.

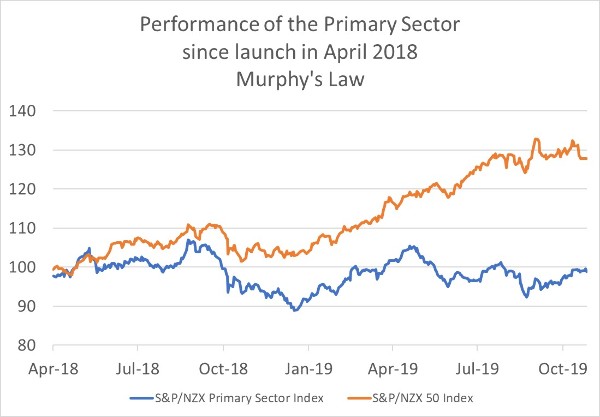

Source: Bloomberg

Disclaimer: The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest. All material presented is believed to be reliable, but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point Funds may or may not have investments in any of the securities mentioned.

Product disclosure statements, issued by Castle Point Funds Management Limited, can be found at www.castlepointfunds.com/investor-documents

| « Risks reduced but not removed | Low emissions, higher value, report suggests » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |