Covid-related KiwiSaver switches less likely with an adviser

Young people dominated the high level of KiwiSaver fund switching during the height of Covid-19 market volatility last year but were less likely to switch if they were with a non-bank provider, KiwiSaver provider data shows.

Thursday, June 17th 2021, 6:53AM  3 Comments

3 Comments

by Matthew Martin

Gillian Boyes.

Research commissioned by the Financial Markets Authority (FMA) has revealed KiwiSaver members aged 26-35 made five times more fund switches than usual, while overall fund switching was three times higher than the normal volume.

Fund switching data of 1.5 million KiwiSaver members from seven KiwiSaver providers – representing around half of all KiwiSaver accounts - from February to April 2020 was compared to the same period in 2019.

The report found 58,356 of the sample KiwiSaver members made 88,112 switches, meaning some made multiple switches.

These switching members represented 3.9% of the total sample - 2.7 times higher than the same group in 2019.

The report contains several future considerations for providers, including highlighting the risks of switching funds, improving the measurement of investor communication effectiveness, utilising prompts to have members pause before completing a switch, and following up with anyone who switched to ensure they were comfortable with their decision and the long term consequences.

Other key findings from the report revealed:

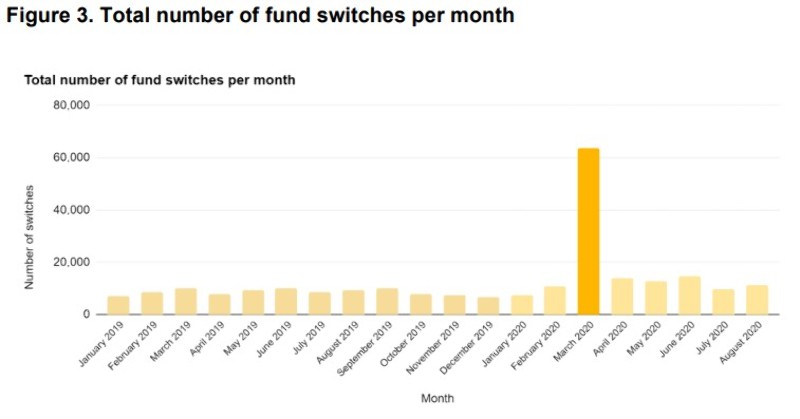

- March 2020 was the peak switching month, with seven times the 2019 average monthly volume.

- On March 22, 2020 there were 6,156 switches – the equivalent of around 20 days’ worth of switches in 2019.

- 70.5% of switches were to lower risk funds, 11% to equivalent risk funds and 18.5% to higher risk funds.

- Members aged 26 to 35 constituted 23% of all sample members, yet made 30.8% of all lower-risk fund switches.

- Banks saw a disproportionate increase in switching compared to other KiwiSaver providers.

The FMA commissioned the research to understand the extent of and reasons for fund switching behaviour during the high level of market volatility, through a behavioural science lens.

FMA investor capability manager Gillian Boyes says the report has focused predominantly on the behaviour of younger KiwiSavers because this is where most of the switching occurred.

“Using behavioural science, we can observe a bias among younger people to take action when they see their balances drop.

"Younger people with a bank KiwiSaver provider often see their balance alongside day-to-day accounts. The research found this may be influencing younger people to see their KiwiSaver as both accessible and transactional like a bank account.

"This was supported with a small number of case studies we interviewed – all three said they switched funds after seeing their balance drop and they found the process straightforward,” Boyes says.

“Action bias means people felt the need to ‘do something to gain a sense of control over their falling balance, other factors provoking this activity were emotionally charged public conversations about KiwiSaver at the time, a herd mentality, and a desire to mitigate short-term losses.

"A panic decision to switch because of shorter-term events can have long term consequences.”

Boyes says it was concerning that only 9.1% of people who switched to a lower risk fund from February to April 2020 "boomeranged" back to a high growth fund by August.

This meant a large portion of those who left growth funds would now be in a low-risk fund that may not align with their savings goals, especially if they were a long way from retirement.

The report also highlighted the fact that customers of banks and those without access to financial advisers were more likely to switch.

Younger people with non-bank KiwiSaver providers made 36.9 per cent of fund switches in 2019, while making up just 7.5 per cent of the sample for this age group.

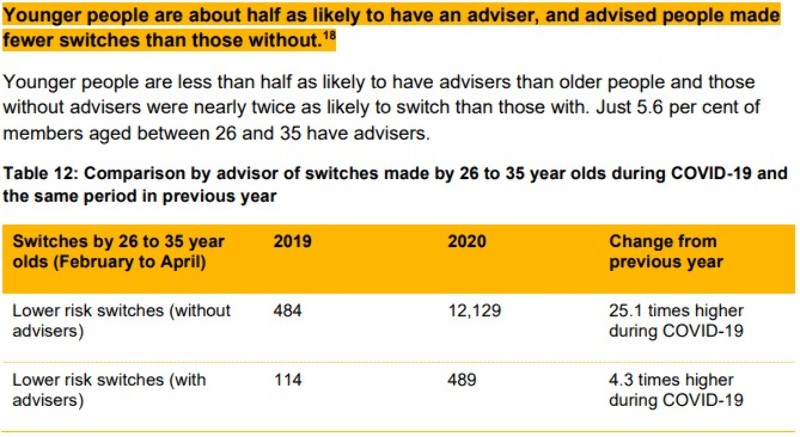

Younger people are about half as likely to have an adviser and advised people made fewer switches than those without, but just 5.6 per cent of members aged between 26 and 35 have advisers.

"Advisers play an important role and can use behavioural concepts to support investors’ decisions.

"It is worth noting that most advised members are also non-bank members," the report states.

"Providers that offer advised funds could get investors initiating a fund switch to speak to an adviser before completing. The advisor could encourage the member to reflect and highlight potential downside risks."

| « Micro-investing platforms - the future is now | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

People will still be people and act without asking. Mum and dad investor will still buy high and sell low regardless of what they are told... Part of the reason I'm happy with risk...

I had a prospect call yesterday talking about KS for their daughter while joining the workforce.

They were with a non-bank advised KS provider themselves and they had switched provider (another non-nbank provider) because someone (not an adviser) had criticised their providers' returns.

Talking to them they had no idea how KiwiSaver worked, how funds worked, who had their money, and a bunch of basic stuff that people in KiwiSaver are supposed to know (especially if they had actively taken KiwiSaver and then moved it)

Yes, take the wins, and this is an expected one, but we have a long way to go yet.

Sign In to add your comment

| Printable version | Email to a friend |