Financial stress – more common than you might think

Recently we have examined the question of vulnerable customers and the Human Rights Commission report on vulnerable people has been central to our thinking.

Tuesday, July 13th 2021, 10:01AM

by Russell Hutchinson

Reasons to suspect a person is vulnerable – such as age, disability, or chronic illness – also suggest they are probably not owners of current insurance policies unless they’re on claim.

But financial stress is a leading cause of "vulnerability" – it creates fear and places a strain on relationships.

Vulnerability is on the rise due to layoffs and reduced work in sectors most affected by the Covid-19-induced economic situation.

How many of your clients could be under financial stress?

This is important as, referring to the Human Rights Commission report (link below) if you combine financial stress with another factor – such as a claimable event like a cancer diagnosis – then you have a vulnerable client who needs extra care.

To think about this, we can refer to data on in-work poverty.

Research conducted by AUT’s New Zealand Work Research Institute and commissioned by the Human Rights Commission found that more than 50,000 working households live in poverty across the country.

The research found the overall in-work poverty rate was 7% before housing costs.

This rate varies greatly across several demographic dimensions – for example, it rises to 12.3% for single-parent households, and 19.9% for two or more family households where only one adult is working.

The lowest in-work poverty rate is observed for households comprising a couple without children (4.8%), followed by a couple with child(ren) (6.3%) and single adults (6.4%).

Higher rates exist for single-parent (12.3%) and multi-family households (9.6%).

Perhaps what is surprising is the prevalence of financial stress in what we might ordinarily think of as higher-income households.

A family earning a little over $150,000 a year could be under significant stress if more than 40% of their income is going on housing – which can easily happen with a stretch to a bigger home followed by, say, a pilot being grounded by Covid.

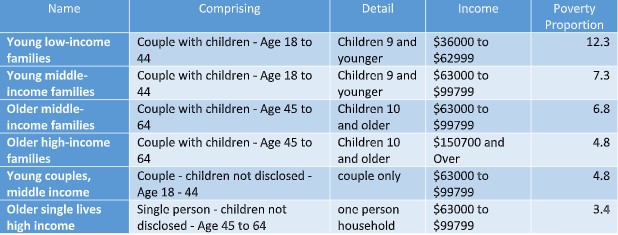

That situation exists for about one in twenty such households. To make life easier, we calculated the in-work poverty ratio for the most common household types:

Watch out for financial stress in clients, especially when combined with other factors, and act accordingly.

Provide options and support when needed. Having some standard resources such as links on your annual review letters could help some clients manage their stress rather than simply cancelling their cover.

Sources:

https://www.hrc.co.nz/news/more-50000-working-households-new-zealand-live-poverty/

Full report https://www.hrc.co.nz/files/8215/7462/2882/In-Work_Poverty_Report_2019.pdf

| « Death rates and the impact of the End of Life Choice Act | How overpaying claims leads to product innovation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |