Death rates and the impact of the End of Life Choice Act

With the passage of the End of Life Choice Act and the referendum result a form of assisted dying is available in New Zealand.

Monday, June 28th 2021, 10:29AM

by Russell Hutchinson

What will the impact be on death rates? I asked my data scientist, Ed Foster, to explore the experience of other countries to help us model the possible impacts.

Canada’s C-14 Bill is comparable to the proposed end of life Bill in most aspects but with one key difference - in Canada death must be “reasonably foreseeable” rather than within the specific timeframe of six months required by our draft law.

This difference would probably result in Canada having somewhat higher figures than that of New Zealand.

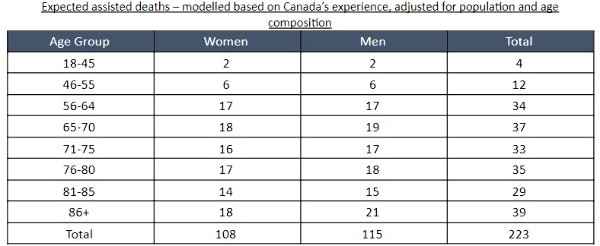

Applying a standardised death rate for age and gender the following yearly deaths can be predicted.

These estimates should be taken in context. For example, in the year to June 30, 2020, there were 33,990 deaths.

But even so, these expected deaths are not really ‘additional’ as they should be in effect bringing forward death by a few months, not creating extra deaths.

So, on balance we think it is unlikely that the passing and implementation of the bill would greatly affect either the number of deaths or the number of life insurance pay-outs.

The key to this assumption is that medical assistance in death would only apply to cases of terminal illness (six months or less) and not for those who are in chronic pain/discomfort, as per the current law.

Although it is also, perhaps, possible to anticipate that in a subsequent law change the scope of the bill could be broadened in the future to include non-terminal conditions as has been done in other countries such as the Netherlands.

It is also possible that the way the law is administered could be widened.

The classification of deaths will probably be impacted by a reduction in the number of instances recorded as suicide.

The passing of the law may likely enable some people to end their life in a less traumatic way.

It is conservatively estimated that 5 to 8% of all suicides in New Zealand between 1950 and 2000 were by people with terminal or irremediable illness.

Based on the evidence from other countries or states that have adopted some form of assisted dying, it can be expected that the number of people electing for the procedure would increase over time.

In the interest of open journalism, if you would like a copy of the reference data used for the above estimate, including source data from Canada, it is available.

Just send an email to Matthew Martin at Good Returns and he can put you in touch with me - matthew@tarawera.co.nz.

| « The tale of two claims - The media's perception of insurance | Financial stress – more common than you might think » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |