FMA steps up enforcement of AML breaches

Warnings delivered by the FMA for non-compliance with New Zealand’s anti-money laundering and countering the financing of terrorism rules have almost doubled in the three years to June 30.

Thursday, September 30th 2021, 10:48AM

by Matthew Martin

James Greig.

According to a report - AML/CFT Monitoring Insights - released by the Financial Markets Authority (FMA) today, the regulator has escalated its enforcement approach to non-compliance with AML/CFT rules saying some entities are not taking the law seriously enough.

The report covers the regulator’s monitoring of the AML/CFT Act over the past three years from July 1, 2018, to June 30, 2021, and found that the FMA issued three public warnings, brought its first High Court proceedings under the Act and 27 formal, private warnings were issued.

The FMA’s previous monitoring report covering the period from July 1, 2016, to June 30, 2018, where the regulator issued one public warning and 17 formal, private warnings.

The FMA is one of three supervisors under the AML/CFT Act, along with the Reserve Bank of New Zealand and Department of Internal Affairs, and supervises around 750 reporting entities under the Act, two-thirds of which define themselves as financial advice providers.

In the three-year period, the FMA conducted 60 monitoring reviews on firms, identifying 363 issues requiring remedial action.

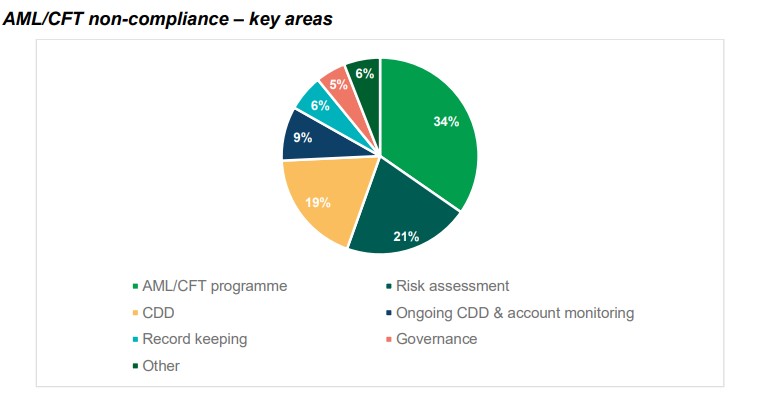

The most common areas of concern were inadequate and outdated AML/CFT programmes and entity self-risk assessments, as well as insufficient customer due diligence by entities (see chart below).

FMA director of supervision James Greig says New Zealand’s AML/CFT regime has been in place for eight years and businesses have had plenty of time to comply with the regulations.

"Accordingly, we have now less tolerance for companies not meeting their obligations, which is reflected in an increased number of enforcement actions.

"Disappointingly, we found numerous instances of businesses not meeting basic requirements, particularly around having a robust AML/CFT programme."

Grieg says the FMA has spent considerable time educating the industry on what’s expected, including targeted training for compliance officers on how to monitor accounts and transactions, and file suspicious activity reports.

"This appears to have had an impact, with large increases in volumes of suspicious activity reports being filed by firms.”

Suspicious activity reports submitted by FMA-reporting entities to the Police Financial Intelligence Unit (FIU) have risen significantly over the past three years – from 170 in 2018/19 to 257 in 2019/20 and 493 in 2020/21.

The Act requires reporting entities to have self-risk assessments and AML/CFT compliance programmes audited every two years (now every three years, with effect from July 9, 2021) or at any other time at the request of their AML/CFT supervisor.

“We have noted several instances where firms failed to have their AML/CFT audits completed, or they were late," says Greig.

"There were also failures to remediate audit findings, which could indicate a lack of priority or willingness to comply. In some instances, senior management failed to monitor the progress of remediation work."

Looking forward, Greig says the FMA intends to continue monitoring firms processes, with more in-depth assessments of how they add new customers, as well as their monitoring of accounts and transactions, and reporting of suspicious activity to the FIU.

The regulator will assess how much entities relied on guidance issued in response to Covid-19 limiting their abilities to onboard new customers and perform account monitoring and will test if entities applied the guidance correctly.

| « Manager salts up its fund menu | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |