Advisers can take on the climate change challenge

Financial advisers have a crucial role in helping their clients and the companies they invest in avoid climate risk after a disappointing result at the recent COP26 Climate Summit.

Tuesday, November 23rd 2021, 7:07AM

by Matthew Martin

Climate risk is real and is too often ignored by companies and fund managers says Mindful Money founder and chief executive, Barry Coates.

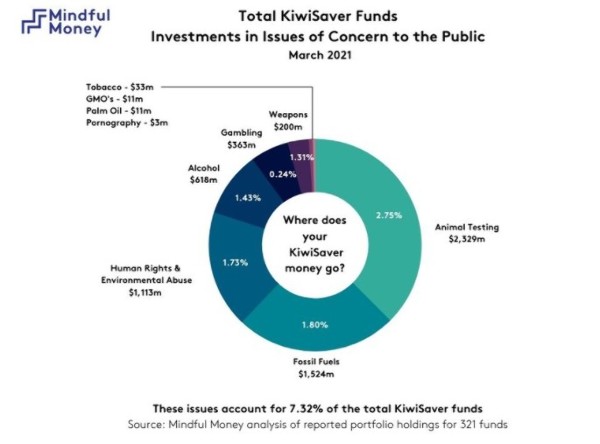

"It is clear that most fund managers have yet to adequately manage their fossil fuel exposures.

"The transformation in markets to shift towards a net-zero economy in New Zealand and internationally has barely started, as became painfully obvious during the COP26 Climate Summit.

"The most severe disruptions from climate change have yet to come."

He says many advisors are still developing their responsible investing approaches and have not yet taken the step of explicitly avoiding climate risk.

"Now the mantle passes to citizens and markets to decarbonise our economy. A straightforward way to avoid climate risk is to exclude fossil fuels from portfolios.

"This recognises that the business models of fossil fuel companies are built around coal, oil or gas, and the vast majority of companies will find it difficult, if not impossible to make the transition to clean energy."

He says there are alternatives to simple divestment – some funds engage with companies to encourage them to transition more quickly to fossil fuels.

"But the reality is that there are only a few companies that have made a real commitment to change. Most investors want to avoid fossil fuels, so the most straightforward response for financial advisors is to divest from the sector as a whole."

Coates has some solutions for advisers who are concerned about climate change.

"A starting point for financial advisers is knowing what clients want from their portfolios. Most are likely to echo the views of most Kiwis in wanting to reduce their personal climate footprint."

He says another way is by communicating the importance of investment for an individual by calculating their investment impact.

Mindful Money analysis shows that the average global diversified portfolio has 3.4 tonnes of carbon dioxide equivalent emissions in their portfolio (other emissions from their energy use, transport, consumption etc total around 7.7 tonnes).

"Once they know this information, it is likely that a large proportion of Kiwis would want to reduce those emissions, particularly if it also reduced their portfolio risk."

Financial advisers can also research future plans and policies for investment funds.

"For example, they can look at the funds that are planning to make deep emissions reductions.

"The good news is the advisers and funds that are doing so are attracting clients and enabling them to earn good returns, often higher than comparable funds while reducing systemic risk.

"Mindful Money is committed to ramping up climate finance and keen to work with financial advisers that share this aim."

He says KiwiSaver and retail investment funds with a policy to exclude fossil fuel production are now readily available in New Zealand, for example, fossil-free KiwiSaver funds have risen from 2% in 2019 to 19% right now.

| « The cost of retirement increases - again | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |