Thousands yet to apply for full FAP licences

More than 200 full financial advice provider (FAP) licences have now been approved by the Financial Markets Authority (FMA) with around 80% of advisers yet to apply.

Monday, December 20th 2021, 5:59AM  9 Comments

9 Comments

by Matthew Martin

John Botica.

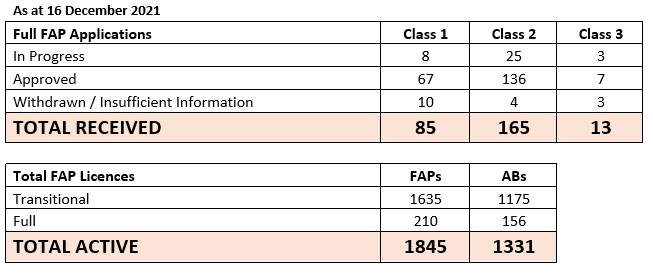

According to the latest statistics, the FMA has approved 210 full FAP licences (see table below) since the new licencing regime came into force on March 15, 2021.

Of those licences, 67 were for Class 1 (sole advisers), 136 were for Class 2 (more than one adviser, plus authorised bodies) and 7 Class 3 licences (multiple advisers, authorised bodies and nominated representatives).

This is more than double the 80 full licences approved by the FMA as of September 21, 2021, and there are still 1635 transitional FAP licence holders and 1175 authorised bodies yet to apply for a full licence.

A further 17 applications have been either withdrawn or sent back to applicants for more information.

The FMA's director of market engagement John Botica says with more than 80% of providers still to transition to a full licence there is much more work ahead.

For many in the financial advice sector, the next milestone will be preparing to submit a full licence application by the target date of September 30, 2022 (for Class 1 and 2 licences).

Botica says many lessons have been learned in the first nine months of the new regime and he acknowledges the efforts of the industry "...who stepped up to welcome the new era of licensing against some pretty tough odds".

"We want New Zealanders to trust the financial advice sector, we want to promote advisers as true professionals and to encourage more people to engage in their financial futures.

"In our mid-year report, we noted that a few full licence applicants had rushed in at the gate, reading the application guide and then pasting our sample answers into the online application form.

"They did not pass Go and were sent back to the start.

"More recently, we’re pleased to say the quality of most applications has improved as you focus on just telling it like it is, documenting how you run your businesses – and care for your clients – in your own words because you know your business best."

| « Ignite Advisers look to the future | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

They are 10, 4 and 3 short respectively for Class 1, Class 2 and Class 3.

Are these latter numbers applications declined?

Also I am not surprised the number of applications is so low - the full licence window was 24 months, since shortened to 18 months to allow FMA time to process the laggards. We are barely 1/2 way through that 18 months.

Under this Government New Zealand has seen the number of back office bureaucrats employed explode by a massive 30 percent. Meanwhile at our public hospitals nurses and doctors are currently understaffed, underpaid and when the opportunity presents they are now heading across the Tasman.

New Zealander consumers want to be protected when they access independent financial advice but they also see as a priority our front line public servants been paid and resourced properly.

Respectfully the increasing army of back office bureaucrats sitting in their glass towers are serving no one but themselves.

Sadly both the designers and the bureaucracy thinks they are going to make this utopia with Advisers focus on client best interest and conducting business with an halo on their head

Dreaming

So much experience has departed already and a lot more to depart in the future

Of course, there’s a butterfly effect with every decision. It seems inevitable to me that this enhanced licensing will cause advisers to leave, creating a shortfall. When combined with the retreat of larger financial institutions, the ‘victims’ will be the huge volume of consumers who won’t have access to financial advice. A quick survey of NZ demographics confirms that the volume of consumers who will be seeking financial advice will far exceed those who are able to provide it. Great for industry survivors / not so great for ‘mum & dad average’. But then, I’m sure that this has been considered by MBIE…

Do we have thousands of advisers who are registered as transitional who never intended to transition. Is the advice industry going to morph into institutional groups. Just asking

The FMA would only need to regulate the group itself, not the mass of individual advisers and nominated reps that make up our industry, I also think that under one Group FAP license the layers are so watered down (Group FAP, nominated reps, then sole advisers ) the risks to the consumer have to be higher for sure.

Plus if group Fap licenses were the dominant force in the industry I think there would be a lot more behind the scene deals going on for override commissions, back hand group payments for group insurance and kiwi saver deals, loan commission payments going straight to groups for second tier lending products etc., advisers would not own their data bases or clients , groups fees will have no ceiling to what can be charged and there would be less disclosure about all of this to the consumer, sounds a little bit like how things are being run now

As we know insurance companies already deal directly with insurance advisers as they don't require advisers to belong to a group. These advisers can now also access the override payments which formerly only their group pocketed. Many insurance advisers who currently belong to a group are now waking up to how much additional money they have been missing out on all these years. This extra commission via the override payment can be used now towards helping with their compliance and administration as a FAP license holder which is part of rationale of why Partners Life elected to pay the override (FAPO) now to the FAP holder itself who is actually giving the advice to the client.

The banks may be a bit more reluctant to deal directly with mortgage advisers (with the dealer groups currently using repayment of clawbacks as a big carrot to banks) but ultimately a class 1 or 2 FAP license holder is under the exact same level of scrutiny and disclosure now by the FMA as a class 3 FAP license holder with a couple of hundred members. As a bank I know who I would be more comfortable dealing with in terms of risk especially with Class 1 & 2 FAP license holders typically been the experienced advisers who have a superior level of application quality and drawdown ratio.

ANZ been the biggest lender in the country has already on record as stating it will deal directly with a FAP license holder be it class 1, 2 or 3. A class 1 or 2 FAP license holder forced to belong to a class 3 FAP license holder just to deal with the banks would be ridiculous and make a complete mockery of the whole point of licensing.

Sign In to add your comment

| Printable version | Email to a friend |

Not like we all had much else going on, eh...

Contrary to FMA belief, my next major milestone will be survival of 2022. I barely achieved that last year and this year.

*edited*