Solid borrowers, not the vulnerable, hurt most by CCCFA – report

New data shows the Credit Contracts and Consumer Finance Act (CCCFA) has actually harmed financially sound borrowers the most.

Thursday, March 3rd 2022, 9:23AM  4 Comments

4 Comments

by Eric Frykberg

This finding appears to fly in the face of the intent of the law which was to protect vulnerable people from taking on debt they can't repay.

The information comes in a new report by the credit agency, Centrix, which said the best borrrowers suffered worst under the new rules.

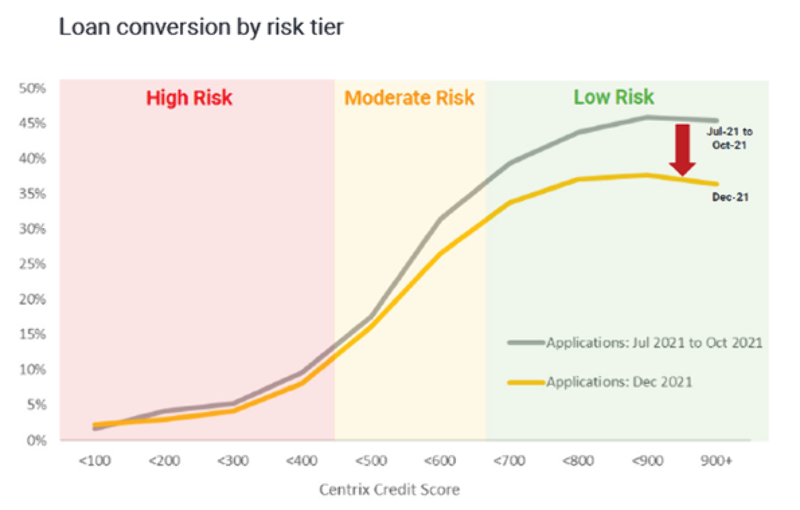

“Research indicates that low-risk applications were the most affected by the CCCFA,” Centrix wrote.

“Loan conversion rates have dropped markedly for those with a credit score above 700, which is generally considered to be good.

“But our data shows there has been little impact on those with a credit score of below 500.”

Centrix suggested a reason for this: borrowers below 500 were already being turned down anyway, long before the CCCFA rules were applied.

Centrix's managing director Keith McLaughlin said that showed the old system was already working, and the new rules blocked loans to people who did not need that sort of protection.

“There used to be one hurdle to get over and that was your credit risk, and if you had a good credit score, you would get that box ticked …. and you would be approved for a loan.

“Now they have introduced the affordability scale which is a second hurdle....and that is what is catching some borrowers out.”

McLaughlin said low-risk borrowers had greater access to money and more discretionary spending, and so had the means to get themselves out of any financial jam that might occur.

Brokers and bankers in the past would know this and would know of a borrower's good credit history and make a judgement accordingly.

But the new affordability scale had to be applied rigidly.

“The CCCFA is capturing the people it is not supposed to capture and the ones it is supposed to capture were being caught under credit risk criteria anyway.

“Where there used to be a lot of discretion, brokers would say, that if you take out this mortgage we know you would cut back on some of that discretionary spending, and therefore we are OK with this.

“They would say, you have had three loans in the past and you have met all your obligations and we have never had a problem with you.

“So there used to be an element of discretion, whereas under the CCCFA, you look at the income and then the expenditure and if there is not a surplus, you cannot issue the loan.”

Other aspects of the Centrix report are more positive. They show fewer people are having difficulty paying their mortgages. The percentage of mortgages in arrears has fallen from to 1% from 1.2% a year ago and 1.5% a year before that. There were, however, difficulties with some other classes of lending

Centrix also went on to combine the impact of the CCCFA, with the cost of borrowing and other factors.

“Higher interest rates and changes to the CCCFA, alongside tighter LVR restrictions, are all combining to slow the housing market,” Centrix wrote.

“The value of new residential mortgage loans fell 21% when compared with January 2021. This is nearly $1 billion in reduced lending.”

In further information, Centrix said just one third of all mortgage applications led to an approval,

| « Goppy's gone | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

Who would have thunk!

And well said, Tang.

I guess this is what happens when you get unqualified people making the rules!

Wake up Minister Clark! You have clearly got these CCCFA changes horribly wrong for borrowers.

an uneducated father went camping with his highly educated son. they pitch the tent and went to sleep. in the middle of the night, the father nudged his son, and say "look up, what do you see?". his learned son replied, "stars".

father then asked, "what does that tell you?". his son replied, "astronomically, it means that there are billions of stars that made up the galaxies ..." before he could continue, his father slapped him a few times in the face, and screamed at him, "that means someone has stolen our tent".

refer to "amused" comment, having deep knowledge about the moons and the stars but the inability to see the problem in front of your very eye, is a far more serious problem than the regulations the CCCFA.

Sign In to add your comment

| Printable version | Email to a friend |