Life insurance covers up but claims down through pandemic

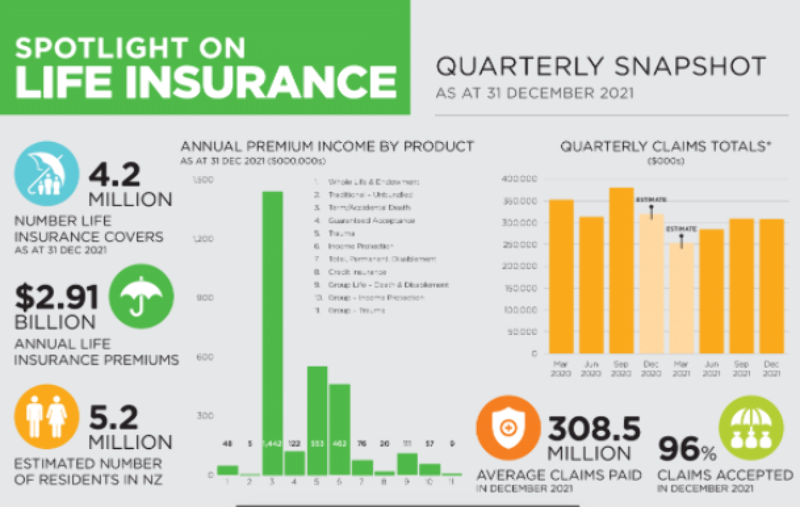

Latest data released by the Financial Services Council showed life insurance covers increased over 2021 and by the end of December 2021 had increased by 92,000 to $4.2 million worth of life insurance cover for Kiwis.

Wednesday, March 9th 2022, 9:53AM

Richard Klipin, Chief Executive Officer of the Financial Services Council, said “As we saw in the FSC health insurance data released last month, Covid-19 looks to be having a similar impact on families looking to protect their financial wellbeing and better manage their risk with insurance products through these uncertain times.”

The figures show a notable increase in group life, income and trauma covers. Nick Stanhope, co-chair of the FSC Life Forum, said “Of interest is the growth in group insurance cover. This is a similar trend we have seen in other data, where employers are looking to dodge the ‘Great Resignation’ trend across the world and mitigate recruitment issues caused by New Zealand’s tight labour market, by offering added incentives to retain their teams.”

Claims were a different story from March 2020 up until the end of 2021, where statistics show a gradual decline in the numbers. Partly this was down to Covid-19 creating deferrals and delayed diagnosis but also a change in how the FSC reports it’s numbers.

In Quarter 4 2020, figures reported for health insurance claims and cover were split from Life Insurance. The data snapshot shows that the Life sector paid out $308 million in claims in the last quarter of 2021 and that 96% of life insurance claims made over the same period were paid. At the beginning of the pandemic around $350 million were being paid out quarterly.

Partners Life said “In our experience over the past two years, we have seen a deferral in the lodgement of claims during periods of lockdown or higher alert levels, rather than a decrease overall. As New Zealand begins to open back up and move through the current traffic light settings, access to general healthcare will increase and with it we’ll start to see the number of claims pick up steadily with a sustained level of claims overall.”

Naomi Ballantyne, co-chair of the FSC Life Forum, said “Life insurance is designed to be there when unexpected events happen, and with 96% of all claims paid in the last quarter of 2021 by FSC members, it demonstrates the industry’s commitment to support customers in some of the most difficult and challenging life situations.

Richard Klipin, Chief Executive Officer of the Financial Services Council concluded “As we continue to move through the latest Omicron surge, it is encouraging to see that more New Zealanders are thinking about their financial resilience and wellbeing.”

| « The latest on Fidelity's ratings | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |