When a rising tide no longer lifts all boats

Stock market volatility in April has given investors further cause to believe that the recent rotation from growth to value has further to play out.

Friday, April 29th 2022, 11:21AM

by Greg Smith

While most markets were softer, ‘growthier’ sectors came under much more pressure. The tech laden Nasdaq Composite in the US fell over 13%, dragging the broader S&P500 benchmark down nearly 10% for the month. In contrast, the broader and older economy-dominated NZX50 and ASX200 were only down 1.9% and 1% respectively.

Recent market dynamics, amidst elevated levels of inflation and the onset of a global rate tightening phase, have also raised questions around the merits of “passive” versus “active” investing strategies. This has always been the subject of much debate, with both approaches clearly having pros and cons. Passive investing strategies have arguably suited many investors well during the bull market, but equally active strategies often start to display their credentials in a scenario where “a rising tide no longer lifts all boats.”

Passive investing is a strategy which typically tracks a market-weighted index. The concept is not new, with index funds first introduced in the 1970s, but has exploded with the development of exchange-traded funds (ETFs) in the 1990s. Active strategies by contrast look to outperform the market by buying and selling shares that are seen as undervalued or overvalued respectively.

Proponents of passive investing strategies argue that funds that simply track an index have lower running costs and are cheaper. Their general claim is also that active managers are generally not able to consistently beat the market. This is a simplistic view, and one that ignores some fairly basic points.

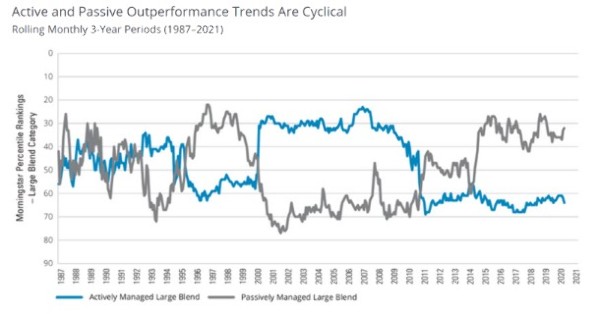

The first is that while passive strategies have outperformed active strategies over certain periods, the opposite has also often been true. Both strategies have “ebbed and flowed” over the past 30 years as the chart below shows. The chart compares the rolling monthly 3-year performance percentile rankings for active managers with that of passive managers ranked within the Morningstar Large Blend category (23% of the entire US mutual funds market) for the S&P500.

Source: Morningstar/Hartford funds

As can be seen, above active strategies outperformed for a sustained period during the mid-90’s and then also from the start of the new millennia until just after the GFC. And while the tide has turned of late, passive strategies have largely been on top since the GFC.

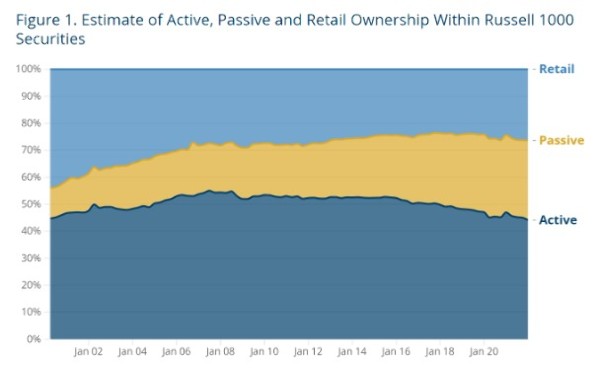

There has been a proliferation of ETFs since the GFC, but this has largely coincided with a bull market over the past decade (punctuated by a relatively brief pandemic-induced correction in March 2020). The ETF industry has yet to face a stern test in terms of an elongated period of volatility. Passive strategies by their nature can’t protect investors from periods of volatility, in the asset class benchmarks that they are designed to replicate. We can see this historically with active strategies substantially outperforming during the 27 market corrections in the US over the past 34 years.

Source: Man Institute

Setting aside the issue of relative outperformance for a moment, there are also a number of deeper questions that need to be considered with passive strategies, both from a quantitative and qualitative perspective.

First the foremost, there is no ‘price discovery’ with passive investing. These strategies run counter-intuitively to the notion of fundamental analysis. In a completely passive world, all markets would be flow driven. Companies that are good or bad would attract the capital, simply because they are present in an index. This situation at its most severe is largely destructive for stock markets, and a bad outcome all round.

Financial markets exist to help efficiently allocate capital. The relationship between a company’s fundamentals and its share price does matter, and active investing is essential in this regard. Passive investing strategies meanwhile largely track indices that are market capitalisation-weighted. The larger the market cap, the larger a company’s weighting in the index. Studies have shown that this will mean that portfolios that look to replicate the underlying index will often systematically overweight overpriced stocks and underweight cheap stocks.

Bigger is not always best, and at some point, this can come home to roost. We have already seen this play out in spades with the super-cap tech stocks, or ‘FAANGS.’ These have been over-owned, and at one point during the pandemic made up a quarter of the S&P500. They could do no wrong - we have since seen that they can. Netflix and Meta Platforms (formerly Facebook) are down 40% and 60% respectively year to date. Amazon lost 14% in one day last week, the biggest fall since 2006.

We can also turn to the curiosities and impacts of index following in the NZX50. Z Energy (a stock which has been held within several of the Devon funds) is leaving the index due to a takeover by Ampol. The energy retailer’s place in the index has been taken by The Warehouse Group. Shares in WHS have rallied 5% since its inclusion. Is the Warehouse suddenly 5% more valuable than it was a week ago, given no other material pieces of news-flow?

Another example relates to large moves in two of New Zealand’s biggest companies (Meridian, and Contact Energy in recent years), owing to their inclusion in the S&P500 Clean Energy Index. Both stocks surged in December 2020 with their inclusion in the benchmark, and then the next year saw significant volatility as the index builder changed the design of the portfolio to include many more stocks.

Nothing fundamentally changed with either business (or the industry), and prices moved to this extent largely because they had been included (or reweighted) within the index. This situation makes little sense - the stock market at its essence should be “a voyage of price discovery.”

Passive investing effectively removes the art of fundamental analysis and the prospect of ‘beating the market’ through astute analysis. Passive investors are quite literally “going with the flow.” The trend is sometimes your friend, but only until it grounds to a halt. A major downfall of passive investing is that you are at the mercy of total market risk, which is only fine if the market is moving in a direction which suits you.

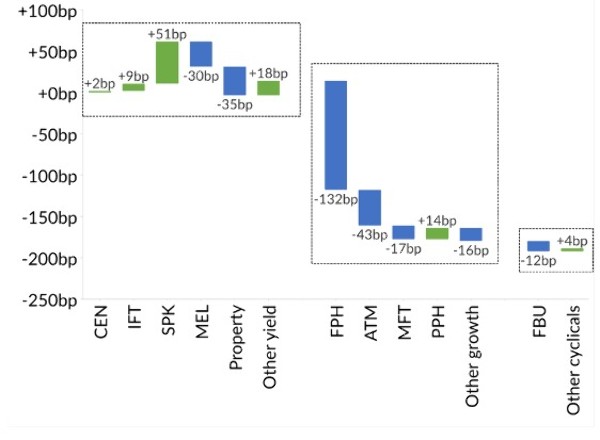

At first glance, the costs of active management may be slightly higher, but there are also implicit costs to consider. Again, another recent example can be seen in looking at the performance of the NZX50 last month. The benchmark lost 1.9% in April but was weighed substantially by falls in Fisher and Paykel Healthcare (FPH) and A2 Milk (ATM). Both stocks fell around 15% during the month.

An investor who avoided both names but owned the rest of the index would have returned -0.14%. The Devon investment team have largely avoided FPH (or in some cases maintained an underweight position), based on prior analysis around the impact of declining hospitalisation rates. Further, the Devon funds have been substantially underweight ATM on concerns around the impacts of declining birth rates and increasing competition in the key Chinese market. Passively following the index was effectively much more expensive from a performance point of view.

NZX50 – one-month thematic contribution in April 2022

Source: Forsyth Barr

The notion that good research and astute stock picking can be rewarded seems logical. Successfully seeking out unloved stocks is not something that a passive investor aspires to. However, again the benefits can also be marked, particularly when the market closes the discount to the underlying intrinsic value of a stock. The latter can also be externally-driven, as we saw with the takeover approach for Ramsay Healthcare by a consortium led by KKR last month. The Devon funds were well positioned in Ramsay which rose around 25% last month.

Active strategies are also “active” in a much broader sense. Active fund managers such as Devon look to actively engage with companies to help deliver optimal outcomes from Environmental, Social and Governance (ESG) perspectives. We seek to “do well by doing good”, and engage with portfolio companies to achieve improved outcomes as it relates to the interests of all stakeholders. Passive investing typically cannot play a role in this dynamic, nor channel funds away from non-ESG-compliant businesses while rewarding those that are proactive and progressive. Passive investing also largely challenges the notion that better returns can be achieved if the businesses that we invest into are good corporate citizens who look after the interests of all stakeholders and operate in a sustainable manner.

Historically, over time, good active managers have outperformed their underlying indexes. Further, in our view the cost argument is debatable. As Devon MD Slade Robertson has noted previously, “Active investors are by definition much more nimble, and can adapt to a world where change is happening at an extraordinary rate and the implications of these disruptive forces can create major challenges for all investors. In such an environment surely those that understand the relationship between fundamentals and price stand a better chance”.

The benefits of an active (value-driven) investment style are showing out in the performance of the Devon funds. Return figures from Morningstar to 30 April have all the Devon funds in or around the top industry quartile (for the funds covered by Morningstar) over three, six and twelve-month periods. The Devon Alpha and Trans-Tasman funds occupied the first and second spots respectively in April.

There is an old saying that goes when the tide goes out, “you can see who is swimming naked.” The question going forward may be to whether a receding market tide is what re-exposes the wider defects of a passive investing style.

About Devon: Devon Funds Management is an independent investment management business that specialises in building investment portfolios for our clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has recently launched two new international strategies with a heavy ESG tilt.

For more information please visit www.devonfunds.co.nz

Greg Smith is Head of Retail at Devon Funds.

| « Why timing the market is a fool’s game | Tricky turbulent transition » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |