Tricky turbulent transition

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed income and equity markets.

Wednesday, May 11th 2022, 10:12AM

by Harbour Asset Management

Key points

- The MSCI All Country World (global shares) Index fell -7.0% in NZD-hedged terms in April and, with the New Zealand dollar weakening in the past month, the same Index fell -1.4% in unhedged terms.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month down -1.9%, whilst the Australian equity market (S&P ASX 200) fell -0.9% in AUD terms (+0.5% in NZD terms).

- Bond markets continued to come under pressure over the month, with yields continuing to rise as investors priced in more rate hikes from central banks as they battle to tame inflation. As a result, the Bloomberg NZ Bond Composite 0+Yr Index fell -1.95% over the month.

Key developments

Global equity markets were weak over the month. We saw volatile daily swings in returns as high inflation data points triggered expectations of an acceleration in central bank interest rate hikes and further increases in long term bond yields, while earnings results for stocks in the US were mixed. The combination of severe lockdowns in Chinese cities to control COVID, the prospect of a prolonged war in Ukraine and rising costs, including higher interest rates, fuelled fears of a slowdown in economic growth.

Equity and bond markets remained volatile as investors continued to be pushed around by the narrative of higher long-term interest rates. Inflation prints, whilst largely in line with market expectations, are well above where central banks are comfortable. Central banks delivered on interest rate increases with the Reserve Bank of New Zealand (RBNZ) providing a 0.50% increase in the official cash rate (OCR) in the month; however, this was accompanied by dovish (less aggressive) commentary paring back the market’s enthusiasm for extrapolating rate rises. The RBNZ wasn’t alone with the US Federal Reserve (the Fed) and other central banks also increasing official interest rates over the month.

In the New Zealand bond market, market liquidity has deteriorated, pushing yields higher than economists really believe the RBNZ will go in this cycle. Signs of weakness in activity, which will reduce demand-driven inflation, are not yet sufficient to stabilise prices.

In Australia, resource stocks gave back some of their recent outperformance with China’s lockdowns to contain COVID contributing to expectations of slower economic activity weighing on commodity prices. Technology stocks were generally weaker as they responded to higher interest rates and, in some cases, weak trading updates.

Consumer staples and healthcare outperformed reflecting their defensive characteristics, with an extra boost from merger and acquisition (M&A) activity. During the month we saw companies provide quarterly updates with general themes of increased costs, difficulty in finding and retaining labour, supply disruptions and the lingering effects of COVID disruptions.

What to watch

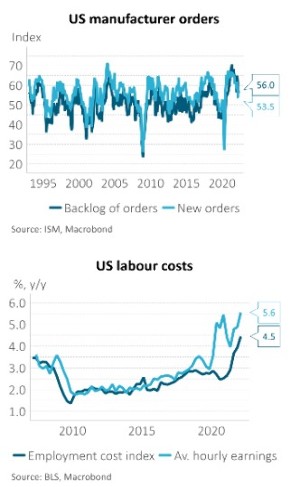

Drivers of inflation: economists look at the drivers of inflation split by two categories – supply-side, and demand-side. Easy monetary policy from central banks has meant that consumers have had higher spending power and thus driven inflation from the demand-side. With monetary policy beginning to tighten, we would expect to see household disposable income reduce and thus ease pressure on inflation from the demand-side. On the supply-side however, we are seeing the combined effect of COVID lockdowns in China and the Russia/Ukraine war having knock-on effects to global supply chains, as well as tight labour markets pushing up wage inflation, and this is maintaining the upward pressure on inflation from the supply-side.

Market outlook and positioning

Stock markets globally continue to make the tricky, turbulent, transition to a lower growth, higher inflation environment. We expect the tussle to continue with a hawkish central bank (with risk of faster increases in official rates), Chinese lockdowns and an extended Ukraine war (including a reset of European energy supply), pitted against the potential for better earnings results from the coming reporting period and increasing M&A activity.

The speed of the withdrawal of accommodative monetary policy by central banks, with front-end loading of rate hikes, is contributing to the rise in equity market volatility. It is also exposing valuation bubbles in some assets (including parts of the technology sector and some residential housing markets). Some inflation data points are showing signs of peaking; when combined with a rapid slowdown in global economic activity, this may provide some room for central banks to slow the pace of rate hikes later in calendar year 2022. We would expect growth stocks to do better in an environment of slower rate hikes.

Recent earnings forecast revisions have been mixed, with some forecasts revised lower reflecting higher input costs. The pending reporting season for the March period may provide transparency around this risk, but also has the potential to see stocks continue to beat conservative earnings forecasts with better-than-expected revenue and operating margins. There is risk to returns for cyclical companies as economic activity slows and for companies that are not able to pass on higher input costs to customers.

While we expect capital market volatility to continue as central banks execute an accelerated transition to new settings, we note investor sentiment has moved quickly from being very optimistic to being very pessimistic. This pessimism may provide a boost to stock market returns if central bank settings or earnings forecasts prove to be ‘less worse’.

Within equity growth portfolios, we continue to focus on sectors that can do relatively well through the transition, particularly with pricing power. Selected stocks in the healthcare sector offer a good balance between relatively high, stable growth and reasonable valuation, driven by demand from aging demographics and technology change. Where supported by productivity enhancements, healthcare earnings are relatively inflation protected. Resources companies also have pricing power driven by supply-side disruptions. Increased Chinese government infrastructure spending, offsetting COVID lockdown weakness and positioning for future sustainability objectives, may also support accelerated demand for commodities.

Within fixed interest portfolios, we see a market that is pricing in an aggressive hiking path from the RBNZ, such that the OCR reaches 4.3% by November 2023. We do not expect rates to be hiked this far and accordingly are long duration in the 0- – 3-year sector that is exposed to the monetary policy outcomes. For longer maturities, we are more cautious, seeing scope for US 10-year bond yields to rise beyond 3.25%, which would most probably take longer rates in New Zealand higher. We retain a holding in inflation-indexed bonds and have edged towards a higher credit weighting as credit spreads have become more appealing.

Within the Active Growth Fund, our portfolio has been relatively conservatively positioned. We continue to favour Australasian equities over global equities, so our equity exposure is skewed towards opportunities in these markets. We believe New Zealand shares, which have priced an aggressive tightening cycle into valuations, have room for upside if some of this pricing begins to be unwound. However, this does make us more mindful when allocating to New Zealand cyclical and discretionary companies. At the end of the month, we added a small position to the T8 Energy Vision Fund. This follows months of researching strategies exposed to themes of electrification and the energy transition. We believe that higher energy prices will, over the medium term, accelerate electrification and the march towards renewables by lowering the barriers to entry (by making alternative forms of energy more compelling cost-wise). Since Russia’s invasion of Ukraine, we have also seen huge investment into renewables projects as well as green hydrogen. This strategy provides the Fund with exposure to what we believe will be a dominant theme over the next decade.

Within the Income Fund, we have continued to be cautious with regards to equity weighting, with a strong bias towards Australasian equities that have stable, income-generating characteristics. Amongst the equity weightings is an investment in the Harbour Long/Short Fund, which has less market exposure, and larger exposure to security selection opportunities. The fixed income component is closely aligned to the strategy in our other fixed interest portfolios. The broad theme expressed across strategy is based on caution regarding expected asset class returns in an environment of high inflation and tightening monetary policy. Markets have repriced considerably in the process so far, but until inflation shows signs of peaking, risks will remain.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

Important disclaimer information

| « Why timing the market is a fool’s game | Allbirds, from darling to disaster » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |