Allbirds, from darling to disaster

In this article we have a look at why Allbirds listing has been such a wild ride.

Friday, May 20th 2022, 9:15AM  1 Comment

1 Comment

by Stephen Bennie

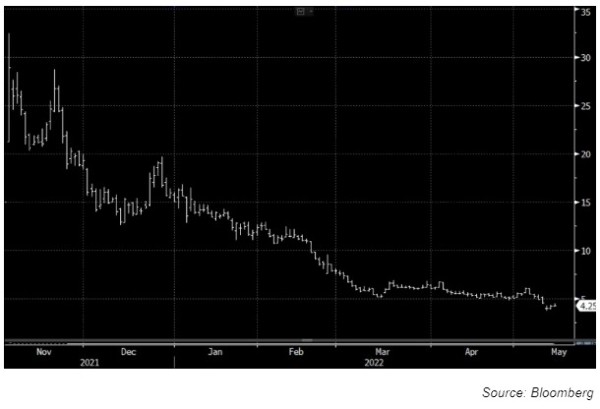

Back in the 13th century when the enormous flightless moas still roamed across New Zealand, there were virtually no native mammals in the land. New Zealand was all birds. This was the inspiration for the name that Tim Brown and Joey Zwillinger gave the business they founded in 2014; Allbirds. Their business was listed on the New York Stock exchange on 3rd November 2021. While this was only 6 months ago, it will seem as distant as the 13th century to Allbirds shareholders who have seen the share price drop 87% since that first day of trading. What on earth has gone wrong?

Chart showing Allbirds drop 87% since its IPO in November last year

Back in 2014 Brown, the just retired All White soccer player, teamed up with engineer Zwillinger to make sustainable leisure footwear from Merino wool. In full disclosure, I thought Brown was a great soccer player and the wool shoes a fantastic idea, and I bought my wife a pair as a birthday present shortly after they brought the shoes to market in 2017. She loved them and people commented on how smart they were, more pairs were in due course purchased. This would fall into the classic advice from legendary investor Peter Lynch who sagely advised, if you love the product perhaps you should own shares in that company. However, the price you pay always matters.

Allbirds original wool runner

So, we have a great, new sustainable product and a massively scalable, capital light business model. Happy days. Through 2017 to 2020 the business had a splendid “J” curve of rapid growth as it went big in the USA. Such was the tremendous progress of the Allbirds brand that it was now valued at US$1.7 billion and in September 2020 was able to raise US$100 million from top rated growth investors such as Baillie Gifford, T. Rowe Price, and Franklin Templeton. And then a full listing on the NYSE in 2021 where Allbirds raised a further US$300 million at US$15 a share, with the business valued at US$2.1 billion. On that first day of trading in November, the shares jumped 91% to close just under US$29, with plenty of shares exchanged during the day at over US$30. Allbirds was now valued at US$4.1 billion. What could possibly go wrong? Sadly lots.

First, the market environment has soured dramatically since November and it has soured most for expensive growth stocks that have yet to turn a profit. Allbirds would fall into that category having yet to card an annual profit.

Second, on-line retailers, such as Allbirds, are facing increased marketing costs. With the Amazon privacy setting change last year the information that is used to create digital profiling has become scarcer and consequently more sought after. Digital advertising campaigns have become more expensive and less effective, this was at the heart of Facebook’s massive downgrade that saw US$200 billion wiped of its market capitalisation in one day.

Third, on-line retailers, such as Allbirds, are having to pay couriers more to ship their product to customers. And often taking longer to do so due to logistics bottlenecks.

Fourth, due to rampant inflationary pressures retailers, such as Allbirds, are having to pay more for the manufacture of their products.

All these factors negatively impact gross margin and unless all these increased costs can be fully passed onto customers by making the shoes more expensive, the business is less valuable.

Fifth, signs that the effects of rising costs of living is starting to impact consumer sentiment and impacting discretionary spending. Last week downgrades by leading American retailers Walmart and Target further confirmed this trend.

Six, Allbirds has profit warned twice this year so far as a result of these factors, the share market gets extra grumpy with new listings that issue profit warnings in their first year. Never mind two in the first six months.

Seven, success has led to increased competition with several copycat products coming to market. Allbirds clean look means that they can be more easily copied than Adidas or Nike.

Picture of an Allbirds knock off

All of that and then some led to the 87% drop in share price from that first day of trading. That leaves Allbirds currently valued at US$630 million and US$240 million of that is cash in hand from the IPO. Now they will spend that cash, they have an aggressive store roll out planned, rising inventories and store fit outs will drain that cash in due course. But the good news is that will not have to go to the share market for further cash for quite some time, if at all.

Allbirds ambitious store roll out plans

Allbirds have spoken about how they could open a large number of new stores and the chart above underlines the scale of that ambition, they want to match Lululemon. Warby Parker is a fancy optician that started out as on-line only and then did a successful physical store roll out. If Allbirds can follow in their, or even better, Lululemon’s footsteps and successfully open hundreds of stores then they will have created a highly profitable business. There is an enormous amount of execution required from the team at Allbirds to achieve that but at the current share price, the risks around that execution may now be more appropriately priced, than when it traded over 600% higher 6 months ago.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

Stock photos can be found here: https://castlepoint.sharepoint.com/:f:/s/Consultant/EsyXv-TcMlpDn8nDLVXk8tsBWBOMAeERgXPKwmjt8aVzeA?e=BJbuYg

More information can be found at: http://www.castlepointfunds.com

| « Tricky turbulent transition | Mixed messages – What still elevated levels of M&A activity may be telling us that the stock market is not » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |