Plans to buy shares swing upwards

Consumers are planning to reduce spending in the next three months, but stocks is one area where buying intentions are on the rise.

Thursday, April 6th 2023, 2:45PM

by Andrea Malcolm

Respondents to a monthly survey by independent economist Tony Alexander shows a slight easing in the level of pessimism consumers feel towards spending going forward – but only back to levels of two months ago.

A net 27 per cent of the 438 respondents in the April survey report plans to cut spending in the next three to six months – an improvement from the net 37 per cent negative of March but still well below the average reading of a net 4 per cent positive spending intentions.

But four areas where people plan to spend more are groceries (unavoidable due to rising costs), international travel, domestic travel and shares. Strong cutbacks remain planned for eating out, furniture and appliances.

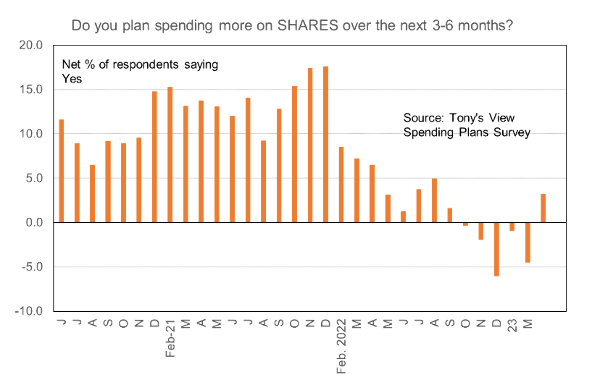

Share buying intentions have turned positive for the first time since September last year, according to the survey.

“I think the results partly reflect on the resilience of the share markets in the face of recent events such as Silicon Valley Bank collapsing, Signature Bank and Credit Suisse. When these things happened four weeks ago, obviously the markets weakened a bit and people were concerned but they were sorted out really quickly,” says Alexander.

“Secondly, and this is a continuation of taking the guide from US markets, the view for US monetary policy has changed. US wholesale interest rates have fallen quite a bit in the past four weeks and so that naturally leads people to look at other assets.

“So I personally think a lot of us are driven by the events in the United States and the resilience of the sheer market rather than any particular view on monetary policy in New Zealand, or the New Zealand economy.”

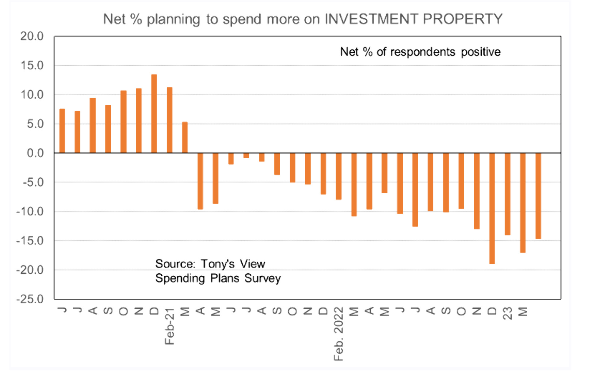

Meanwhile property investors remain stuck with a net 14.6 per cent of respondents planning reduced investment property spending.

Alexander says the reticence on property investment is likely to be an element in the renewed interest in the stock markets.

A net –3.7 per cent of respondents indicated plans to reduce spending on a house to live in which was an improvement on –7.8 per cent reading for March and the least negative result since October last year. But it is still negative and suggestive of housing market weakness.

Alexander says the results for property investment are the second weakest reading on record and confirms one of his key points about the housing market - that first home buyers are returning but investors are as inactive as ever.

“That's what the government has been wanting for a long time. They have actively disincentivised people from buying existing residential property with the tax regime favouring getting something built.

“It's consistent with the other readings I get from surveys on real estate and mortgage advisers that the residential property investors are just standing right back from the markets.”

The most unusual development for this month has been a resurgence in plans to travel overseas – something which acts as a drag on other areas of spending and is not generally what economists would expect to see with householders so pessimistic about the future, says Alexander.

| « Kiwis risk missing out with limited benchmarks | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |