A better quarter in store?

After a challenging September, and subdued start to October, are markets still in for a seasonally stronger final quarter of 2023? Inflation has fallen sharply in the US and Europe, while there may also be some locally driven tailwinds for the kiwi market.

Thursday, October 5th 2023, 9:29AM

by Devon Funds

It was a challenging month for markets as investors fretted about the ‘higher for longer’ message from many central bankers. The RBNZ had the month off meeting-wise, but the Federal Reserve, Bank of England, Reserve Bank of Australia, Bank of Canada and Bank of Switzerland were amongst those that left rates alone but warned that they might need to stay there for some time. The European Central Bank meanwhile opted to put through a 10th consecutive rate hike.

Against this backdrop, bond yields rose across the globe, led by the 10-year US Treasury, which hit the highest level since 2007. Concerns over the stickiness of inflation were not helped by a surging oil price which hit US$95 a barrel at one point, gaining more than 30% since June.

Global stock markets weakened as a result. The S&P500 declined 4.8% during the month and by 3.7% over the quarter. The Nasdaq Composite was off 5.8% in September and lost 4.1% for the quarter (but is still up 27% year to date). The NZX50 eased 2.2% during the month, for a 5.2% decline over the quarter. The ASX200 was down 2.8% in September but was down a lessor 2.2% for the quarter.

Bond yields have remained a headwind to sentiment in the early days of this month, but have inflation numbers on both sides of the Atlantic perhaps brought some cause for optimism that “higher for longer” may not be a fait accompli? Late last week inflation in the Eurozone fell to its lowest level in nearly two years. US inflation also came in lower than expected, providing some comfort for central bank officials considering whether they have reached the end of the rate tightening road.

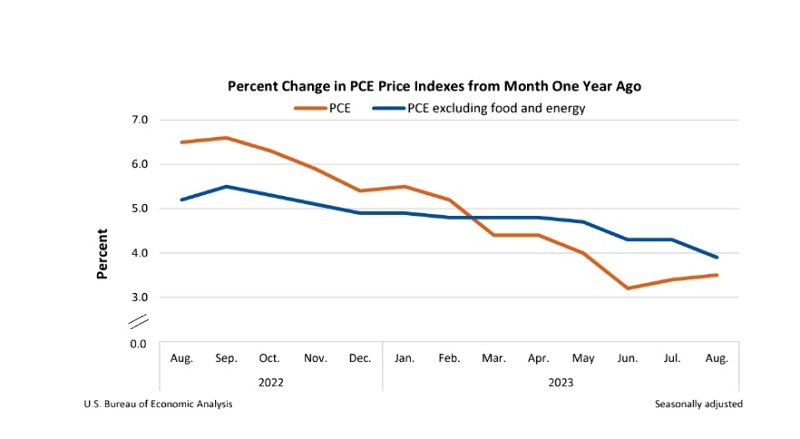

The Fed appears to remain in data-dependent mode and the central bank’s favoured measure of inflation barely budged in August, rising 0.1% during the month. On an annual basis, the core (excluding food and energy) Personal Consumption Expenditure Index rose 3.9%, down from 4.3% the previous month. Headline inflation ticked up to 3.5%, which was to be expected given the gains in petrol prices.

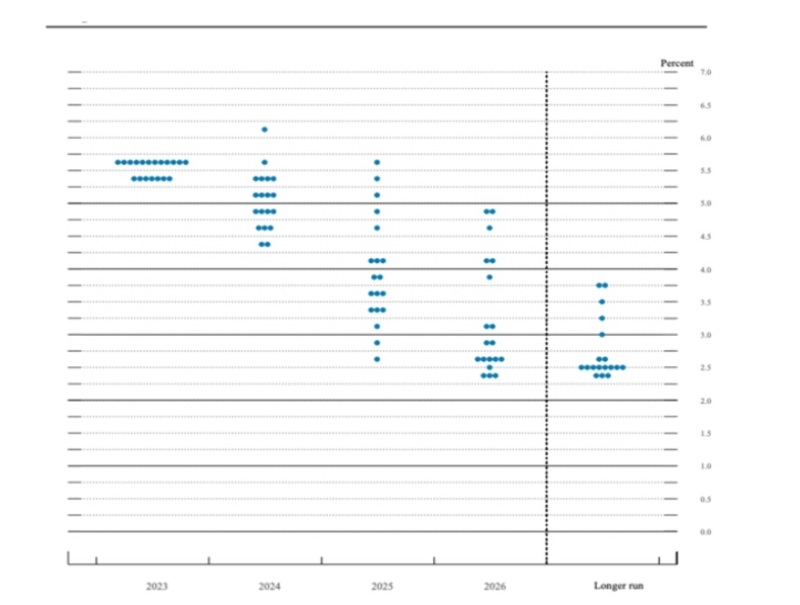

Fed Chair Jerome Powell said at the last meeting that he was encouraged by the progress on inflation but needed to see more. He may well now have this. It is clear though that there is some divergence about where various members see rates going – see the Fed “dot plot” below. For 2024, some officials see the Fed Funds Rate closing out the year at 4.6%, while others see it staying as high as 5.4%.

The Fed Dot plot

Source: The Federal Reserve

The inflation picture in Europe is also making for better reading. Consumer prices on the Continent rose 4.3% annually in September, below expectations of 4.5% and August’s rate of 5.2%. The last time inflation was lower was in October 2021. EU inflation peaked at 10.6% last year. On a monthly basis Euro inflation rose 0.3% while core CPI rose just 0.2%. This has all added to the notion that the ECB is done with rate hikes, with the economy somewhat fragile. Germany, the growth engine, is forecast to be the only major European economy to contract this year.

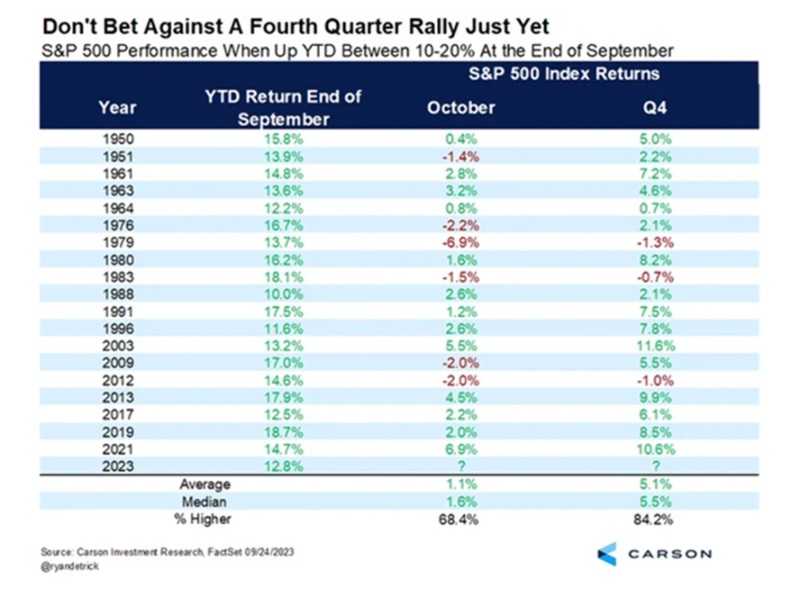

The good news around inflation comes as markets enter a new month. September is traditionally seasonally weak, and while October has seen some seismic events in the past (the 1929 crash and Black Monday in 1987), it has largely been a good month for markets and is known as “The Bear Killer”.

There is reason for optimism around the final quarter of the year as well. When the S&P 500 is up year-to-date between 10-20% at the end of September, the fourth quarter has been higher 84% of the time. The benchmark was up 13% year to date at the end of September.

Investors can also take some reassurance that the budget standoff in the world’s largest economy has been resolved (at least for now). The last-minute spending bill presents a 45-day window for the House and Senate to finish their funding legislation. Time will tell if this is more a case of kicking the can down the road.

It is potentially also helpful that the outlook is improving for the US corporate sector. FactSet has noted that the decline in third quarter earnings for S&P500 companies has halved from that forecast a few months ago to a modest 0.2%. FactSet sees eight of the 11 main sectors in the S&P 500 posting higher year-over-year third quarter earnings, led by the communication services and consumer discretionary sectors. Looking further ahead, fourth quarter S&P 500 earnings are expected to expand by 8.2% from last year, and 12.2% in all of 2024, up from just 1.1% growth in calendar 2023.

Meanwhile there were signs that investors do have an appetite for risk, providing the environment is conducive. Chip company ARM’s IPO (at a US$55b valuation) was 10x oversubscribed, and got off to a good start, as did online delivery company Instacart. Investor enthusiasm has however declined as concerns over rising bond yields took over, with both stocks trading lower since. The more old-fashioned Birkenstock, valued at US$9b, is the next to list.

Signs of stability in China, the second largest economy in the world, may also have come at the right time. The latest Purchasing Managers’ Index data showed factory activity edging into expansion mode, rising from to 50.2 in September from 49.7 in August. This is the first expansion in six months and suggests stimulus measures may be working.

The latter would be positive for New Zealand, and also for Australia, for whom China is their largest trading partner. The key iron ore sector will be encouraged that prices for the steel-making ingredient have risen to around US$120 a tonne. Rising bond yields though have also taken their toll on the Australia stock market. Yields on 10-year and 30-year Treasuries rose to the highest since 2011 and 2007 respectively.

The RBA meanwhile this week kept the cash rate at 4.1% for the fourth meeting in a row, and the first with new Governor, Michelle Bullock, at the helm. The RBA sees CPI inflation continuing to track lower and back within the 2-3% range by 2025, but like many central banks, continues to maintain optionality with respect to further rate tightening given a host of uncertainties at play. These include the outlook for China, but also the persistence of services sector inflation, the outlook for household consumption, and the lagged impact of monetary policy tightening.

And so to New Zealand, where the market also retreated during the month, but not as steeply as the indices in the US or across the Tasman.

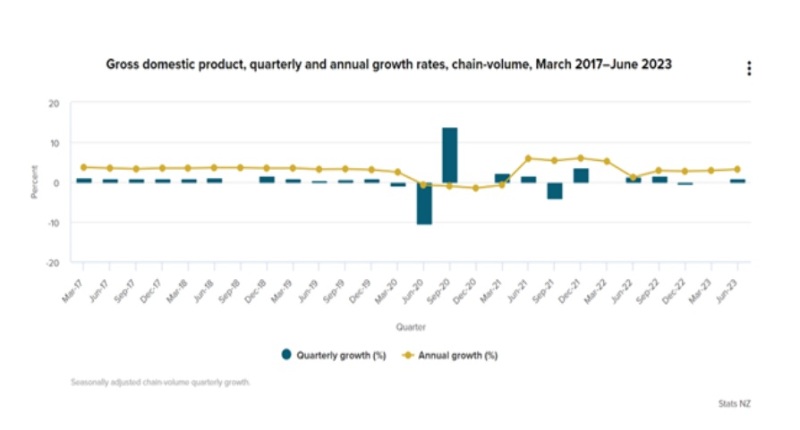

The kiwi economy is clearly facing some challenges, even as it was confirmed that we emerged from technical recession during the month (in fact per revised figures the economy was never actually in one at all). GDP expanded a more than expected 0.9% in the three months ended June and rose 3.2% over the year.

The primary sector has been weak and was a detractor from growth. A change in the fortunes of the key dairy industry may however be coming at just the right time. Milk prices have risen at the last three dairy auctions (for a total rise of 12%), and the impending arrival of the El Nino weather pattern (with warmer and drier conditions) and its impact on pastures has the potential to restrict supply further, creating upward pricing pressures for our key export commodity.

The Pre-Election Economic and Fiscal Update also suggested some bumps in the road for the New Zealand economy in the next few years (regardless of who wins the election). On the positive side, no recession is forecast, with high migration a mitigating factor. The not so good news is that tax revenues have fallen ($2.9b below forecasts), and the return of the operating balance to surplus has been pushed out one year to 2026/7. Bond issuance as a result is on the rise.

The economy has clearly softened, and while the Treasury forecasts see inflation being ‘stickier’ than expected, it is coming down (despite higher energy prices and a weak exchange rate). The RBNZ has also acknowledged this in leaving the OCR on hold at 5.5%, noting that “interest rates are constraining economic activity and reducing inflationary pressure as required.”

The central bank kept rates at a restrictive level but has also noted the medium-term risks to the economy. Business confidence is still relatively tepid, and although a shortage of labour is less of a worry (per the latest NZIER quarterly survey), there remain concerns over the demand side. Consumers are clearly feeling pressured, and are wearing cost of living increases, including much higher borrowing costs – 40% of all outstanding mortgages are rolling off low interest rates in the coming months. Arrears rates, while still at historic lows, are ticking up.

So, what about the impact of the election on the stock market?

The election outcome is certainly likely to have an impact on the market. A change to a National or National/ACT coalition would likely be seen as positive by investors. National governments have traditionally been seen as business-friendly, and sentiment surveys suggest most businesses are in favour of a change to a right-leaning government. Greater business confidence and increasing levels of investment could be a tailwind for the economy. On the contrary, there could well be widespread disappointment amongst businesses if the status quo is maintained. That said, the headwinds facing the economy are not likely to disappear overnight with a change of government. Global factors will also remain an important driver of market sentiment as well.

Historically, looking back at the last 65 years, analysis from Forsyth Barr shows that the NZ share market has delivered positive returns (+1.5%) over the three months following an election where National wins. Correspondingly, when Labour wins, returns have been negative, averaging around -3.0%. National governments have also presided over returns for the NZX50 Index of around +8% per annum, whereas those for Labour have been a quarter of that.

To give some perspective though, on average the market has been stronger heading into an election when Labour has been in power, more so than when National has been at the helm (the market has been weak this time around). While something of a chance outcome (certainly for global events), Labour governments have also occasionally coincided with some major periods of volatility including the 1987 stock market crash, the dot-com bubble, and the onset of the Global Financial Crisis.

But still, there is little question that National governments are seen as more market friendly.

On policy, many of Labour and National’s policies are aligned (there won’t be any major changes to the tax system for instance), and many of the goals are the same, but there are clear differences in how they want to get there. To ease the cost-of-living crisis, Labour is looking to remove GST on fresh and frozen vegetables, while National is looking to adjust where the tax bracket for PAYE tax kicks in. Time will tell which is more effective at easing the plight of consumers and boosting consumer confidence - a key driver of the economy.

There are certainly some differences as they relate to potential sector impacts. National reintroducing interest expense deductibility and bringing the bright-line test back to two years could be positive for the residential property market (which is already seeing some green shoots with the NZ Housing Index rising 0.9% month on month in August), and therefore arguably the retirement sector.

On commercial and industrial property, the parties are similarly positioned. The agricultural sector stands to benefit from National pushing out the timeframe for farm-level emissions pricing to 2030, and a general reduction in regulation.

In the electricity sector, National wants to speed up the consents process on renewable projects but is also removing the ban on new offshore oil and gas exploration. Whether Tiwai stays or goes is ultimately the wild card for the sector, and it will be interesting to see if a change of government is a factor in negotiations.

In the gaming sector, Sky City would likely benefit from National’s proposed regulation of the online casino market.

Overall, there are potentially going to be some significant market impacts should we see a change of government, and equally so if the status quo is maintained.

The bigger story though may well be the global one, and whether October and the final quarter sides with history and performs in a positive fashion. Either way uncertainty still abounds, providing an astute environment for active stock pickers.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Acceleration of innovation now spells danger for investors | Diversification - Markowitz’s greatest gift » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |