Diversification - Markowitz’s greatest gift

It was a sad day for the world of Economics and Finance when it was announced in June that Harry Markowitz had passed.

Monday, October 9th 2023, 6:11AM

by Mint Asset Management

By Marek Krzeczkowski - Portfolio Manager and Ryan Falls - Senior Analyst

Hailed as the ‘Father of modern portfolio theory’, Markowitz won the Nobel Prize in 1990 in Economic Sciences for his invaluable contribution to the field. Arguably his greatest gift to the world was his commodification of an age-old adage into the world of investment – ‘don’t put all your eggs in one basket’ a.k.a. diversification.

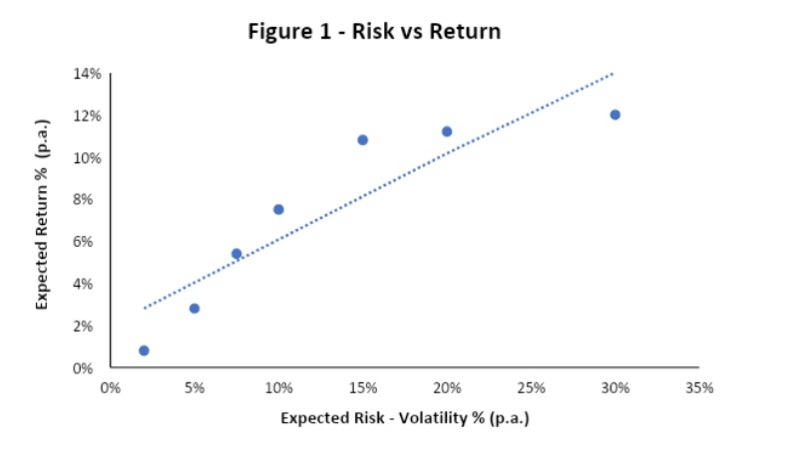

First and foremost, one of the tenants which Mr Markowitz’s investment framework¹ relies on is that the expected return for any asset is directly proportional to the level of expected risk. In simple terms this means, higher risk means higher return and vice versa, as shown in Figure 1. So, to maximise the return that you expect to get, that naturally would mean you maximise the amount of risk you can take (up until the point you are comfortable with). However, as Mr Markowitz goes on to show - there are more efficient ways to achieve the same level of return for a lower level of risk.

Not putting all your eggs in one basket is a saying that most people grasp, but how does it translate to investment? Keeping with my culinary theme from the first paragraph; imagine the world of investment opportunities as a well-stocked dinner buffet. You set out with the intention of maximising the amount of tasty food you can eat, but when you first set your eyes on the Pepperoni pizza all your best intentions go out the window because you already know it’s your favourite food, so you pile your plate high.

However, what if the pizza at this buffet is soggy, or the pepperoni is burnt, or the cheese is too stringy? More importantly, what if one of your dining companions gets something better like the Fried Noodles or the Pulled Pork²? This is where Mr Markowitz’s diversification lessons could prove invaluable. If you were a ‘diversified diner’ you would choose multiple smaller portions of many plates. Why? Because in that way you are minimising the possibility of a bad meal. By having exposure to many different meals, you reduce the risk of any one meal being total garbage, and thus your entire meal being terrible. Using our example again, if we chose one slice of Pizza, some noodles, and a spoonful of pulled pork – and the pizza turns out to be rubbish, we still have the chance of enjoying the meal overall, compared to the misery of the all-pizza example.

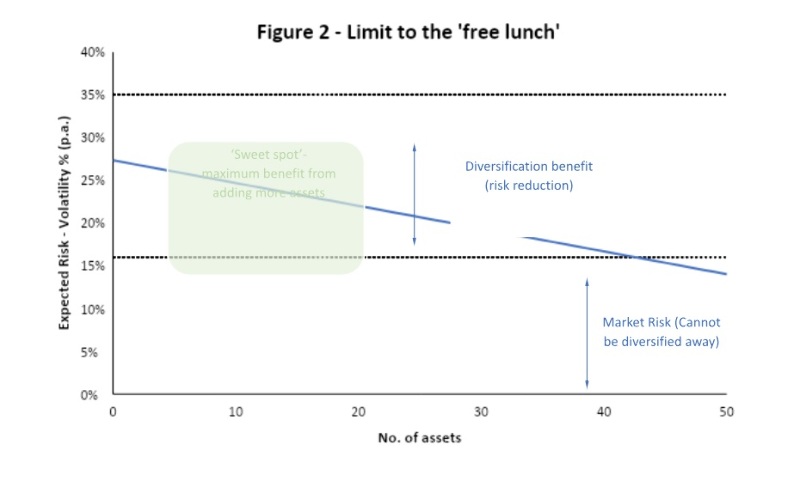

And thus, therein lies Markowitz’s greatest gift, if we spread our portfolio across different assets (and different types of assets) therefore we will reduce the risk of our overall portfolio. By decreasing risk and maintaining the return, we increase the efficiency of our portfolio – you increase the amount of return per unit of risk. Does this mean then an investor should invest a tiny sliver of their portfolio across thousands of individual investments? No, not necessarily. Sadly, for us, there is a limit to this ‘free lunch’ for reducing risk.

Figure 2 above shows how after a certain point of adding assets the reduction in risk from adding each additional new asset becomes negligible. To that end, achieving a more efficient portfolio can be done by simply having c10-20 different assets³.

The final piece of the pie is correlation. This is the measure of how much one asset moves in line with another asset. An obvious example in real life – temperature on any given day will be highly correlated with how many hours of sunshine there are, however we would not expect temperatures to be highly correlated with the return on the S&P500 that day. For diversification to be effective, it is crucial to consider correlation. We need to incorporate assets that have low (or negative) correlation with our portfolio. If we don’t, we simply won’t see any material diversification benefit through a reduction in our risk. Circling back to our favourite food buffet, it would be like us changing our full plate of pepperoni pizza with a mix of Pepperoni, Margherita and Hawaiian pizza. We aren’t exactly reducing the risk of having a bad meal when we choose very similar items, the same applies to investment risk.

Typically, investors will use a mix of growth (equities) and income (bonds) assets as part of their overall portfolio, with these two asset classes being negatively correlated historically – providing investors a diversification benefit. However, what do you do in a year when that relationship breaks down as we had in 2022? Both equities and bonds sold off⁴, and investors were left holding losses in both asset classes, the historical negative correlation between the two broke down and they both moved in tandem. The answer is to consider truly diversified and low correlated assets to add to the portfolio; assets which are exposed to completely different risk factors than traditional corporate balance sheets (to which both bonds and equities are exposed). Assets in this category are known as “Alternatives” and include investments like Private Equity, Real Estate, Infrastructure and Hedge Fund strategies. The beauty of Alternatives is that they are exposed to quite different risks relative to traditional bonds or equities, and (should) move independently of the wider market movements.

One bad year is not the death knell for a diversified portfolio of equities and bonds (like a classic 60/40 portfolio), however what it does it prompts investors to contemplate: ‘Are equities and bonds the sole tools at my disposal to optimise diversification and portfolio efficiency?’ The short and clear answer is no. There is a wealth of alternative assets out there which can be added to your existing portfolio to improve resilience in downturns, increase portfolio efficiency⁵ and ultimately earn an attractive risk adjusted return. The key considerations for investors remain however, choosing the right alternatives, determining appropriate mix and understanding the risk behind each strategy. For investors without the detailed expertise in this field, a managed solution of multiple alternatives strategies managed in a risk conscious way could be a suitable option. We have Harry Markowitz to thank for pioneering the concept of diversification, investors just need to ensure they truly are diversifying their assets in all markets, in order to see the fruitions of his teaching.

¹ Portfolio Selection, Harry Markowitz - The Journal of Finance, Vol. 7, No. 1. (Mar., 1952),

² Sadly Mr Markowitz did not cover ‘food envy’ as part of his academic research

³ This assumes the assets added to the portfolio are not perfectly correlated with the existing assets

⁴ -16.3%, Bloomberg Global Agg Local TR (Bonds), -17.6% S&P Global BMI (Equity) NZD Hedged

⁵ We define portfolio efficiency as return per unit risk

Disclaimer: Marek Krzeczkowski is Portfolio Manager and Ryan Falls is a Senior Analyst at Mint Asset Management Limited. The above article is intended to provide information and does not purport to give investment advice. Past performance is not a reliable indicator of future performance.

Mint Asset Management is the issuer of the Mint Asset Management Funds. Download a copy of the product disclosure statement here.

Mint Asset Management is an independent investment management business based in Auckland, New Zealand. Mint Asset Management is the issuer of the Mint Asset Management Funds. Download a copy of the product disclosure statement at mintasset.co.nz

| « A better quarter in store? | Insync uncovers flaws in passive versus active debate » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |