Three risks we are thinking about for 2024

Touch wood, but 2023 has probably turned out better than many expected. At the end of 2022, there was a strong consensus that a recession was on the cards in the world’s largest economy, the US, and that inflation will prove extremely hard to rein in.

Friday, December 22nd 2023, 6:59AM

by Harbour Asset Management

While the inflation genie is not completely back in the bottle, the trend has been positive. The prevailing dour sentiment at the end of 2022 saw many Wall Street strategists have negative return expectations for the S&P 500 and, believe it or not, sentiment towards technology stocks was extremely low, though that was before many of us had heard about Chat GPT.

Reality was quite different. AI contributed towards a boon year for technology stocks, the much-feared recession failed to eventuate, and investor sentiment improved as a result, causing earnings multiples to expand. Proof again that the greatest risks and opportunities in markets arise from consensus views, which ultimately prove incorrect and spur repricing; 2023 was proof of that.

Today, the consensus paints a less bearish view. Scanning external research and fund manager surveys tells us that:

- Year-end price targets for US equity indices are pointing to high single-digit returns for equities.

- Investors are generally overweight “big tech” stocks.

- Investor positioning is bearish towards China.

- The base case for the US economy is for a soft landing (i.e. inflation comes down without central banks having to inflict severe economic damage).

- Investors expect bonds to outperform equities in 2024.

- Yield curves for most developed markets point to rate cuts in 2024, but with policy remaining above current estimates of neutral.

So, what are the upside and downside risks to the consensus and where do we think the opportunities lie in 2024?

1. A much better backdrop for bond returns (redux)

We had a strong view that bonds offer strong risk/reward coming into 2023, we think coming into 2024 things still stack up. Back then, we had the view that 2023 should be a better year for bond returns owing to higher running yields, inflation moderating and demand softening. While bonds have delivered positive returns this year, with the Bloomberg NZBond Composite 0 year+ Index up almost 5% and the Bloomberg Global Aggregate NZD Hedged Index up around 3% to the end of November, we think the story has much further to run in 2024, particularly in New Zealand where we are seeing signs of monetary policy working and ample room for further pricing in of rate cuts. Globally, the driver could be a move away from the consensus “soft landing” narrative that is currently persisting. One thing we believe is the attractiveness of running yields of 5.1% for the Bloomberg NZBond Composite 0 year+ Index and 5.2% for the Bloomberg Global Aggregate NZD Hedged Index. Importantly, bonds are at yields where they have plenty of room to rally if a non-inflationary macroeconomic shock were to occur.

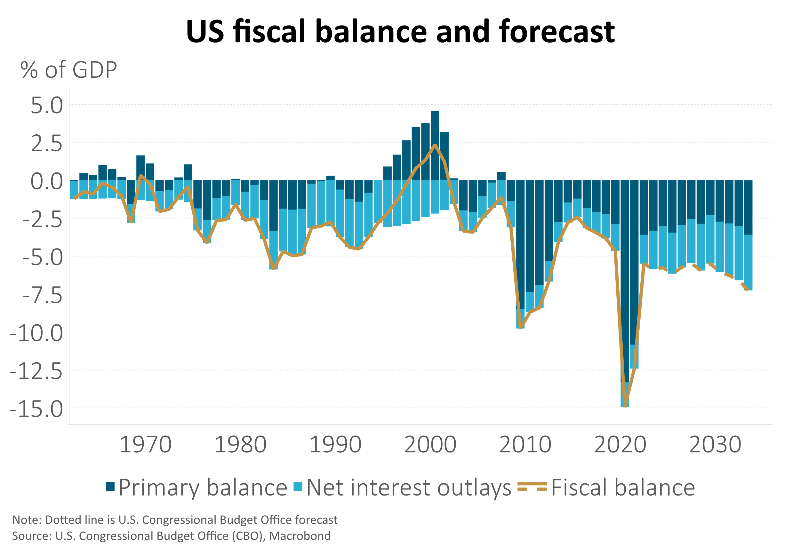

The large pipeline of bond issuance, however, may cause some volatility. In New Zealand, the Government needs to raise almost NZ$40bn in 2024 via the bond market, more than four times the pre-COVID annual average. In the US, the independent US Congressional Budget Office forecasts the US Government to run increasingly large fiscal deficits for the next decade, taking debt to 120% of GDP, from 100% currently. Increasing net interest outlays are a key contributor, along with larger-than-sustainable primary deficits. The worrying thing for markets is that this outlook for US fiscal deterioration sits in the context of below-average term premia and quantitative tightening from global central banks. As such, many analysts don’t think these challenging dynamics are fully reflected in current yields.

2. Company earnings don’t meet their lofty expectations

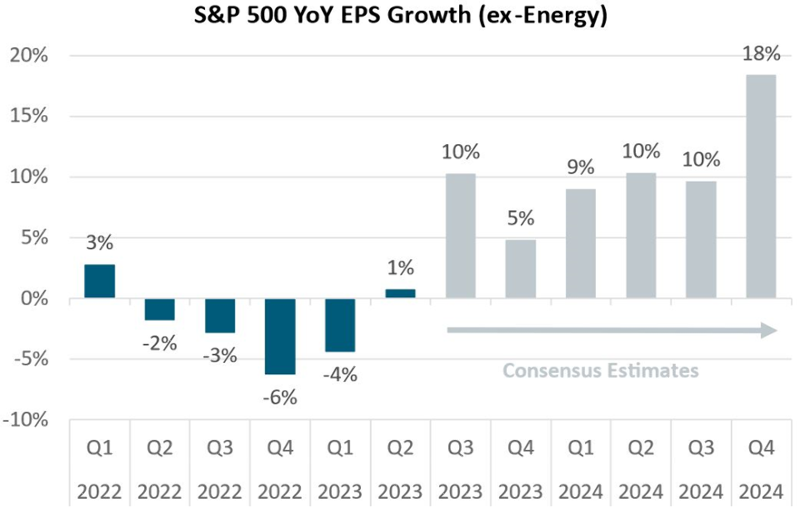

As pointed out by one of our global research providers, there is an inconsistency in the US fixed income market anticipating at least four 0.25% interest rate cuts in 2024, while at the same time the consensus of equity analyst forecasts has S&P 500 profits rising 10%. At face value, it seems unlikely that both market expectations could be right. Rarely would sharp cuts in the Federal Reserve’s Fed Funds rate of 1% or more be correlated with a double digit rise in corporate earnings.

Which of these market expectations is more likely? Typically, once the Federal Reserve starts easing policy, it is unlikely that they cut only once or twice. They generally cut because the economy enters a recession, or because something breaks (often a bank or two). On the other hand, if economic growth and earnings do deliver, and, like recent quarters, beat expectations, it would be hard to see a decent reason for the Fed to cut rates, especially four or five times.

Is there a middle road? Perhaps, with a stretch of imagination, some combination of productivity gains from generative AI and the positive workforce implications of GLP-1 drugs like Ozempic will provide both a leap in corporate earnings and a disinflationary force for good.

Source: Harbour, Bloomberg

3. AI adoption continues to create disruption (but some of that could be priced)

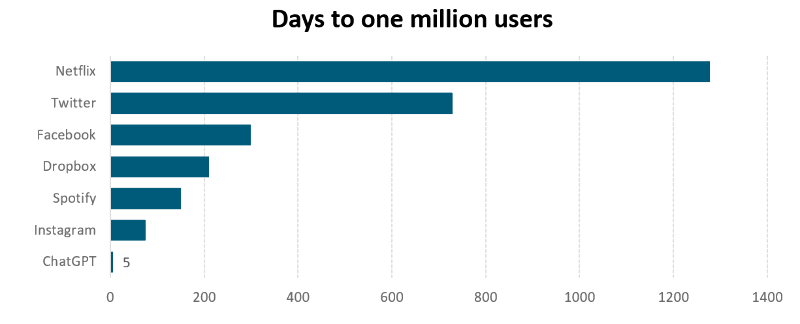

It took Netflix more than three years, Facebook ten months and Spotify five months, but for ChatGPT the path to 1 million users took just five days. And this was just the start. NVIDIA announced year-on-year earnings growth of over 1200% in Q3 with AI being a key driver. The share prices of many others benefitted, from the “magnificent seven” to data centres. Is AI a flash in the pan or could the growth continue into 2024? One thing that is likely to be a key driver is the roll out of Microsoft’s Copilot. While a version of Copilot was released in November 2023, it is said that many advanced capabilities will not be rolled out until 2024. Further, the roll-out has been restricted to companies that can purchase a minimum of 300 seats, limiting its adoption to larger businesses that can afford the minimum US$108,000 per annum commitment. The release of this into a slowing economy could have large productivity and employment implications.

While the more widespread adoption of AI could go ahead in leaps and bounds, the implication for AI-exposed stocks could be more muted in 2024. Why? Earnings growth expectations have been significantly upgraded for 2024 and beyond, creating a higher bar for upside surprises. Despite this, we expect AI to be an enduring theme in markets.

Source: https://www.statista.com/chart/29174/time-to-one-million-users/

Chris Di Leva is a director and portfolio manager at Harbour Asset Management; Hamish Pepper is director and fixed income & currency strategist at Harbour Asset Management. This content is not intended as financial advice.

Important disclaimer information

| « Animal spirits - global stock markets have closed out their best month in several years, but can the rally continue? | Coming into land in 2024 » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |